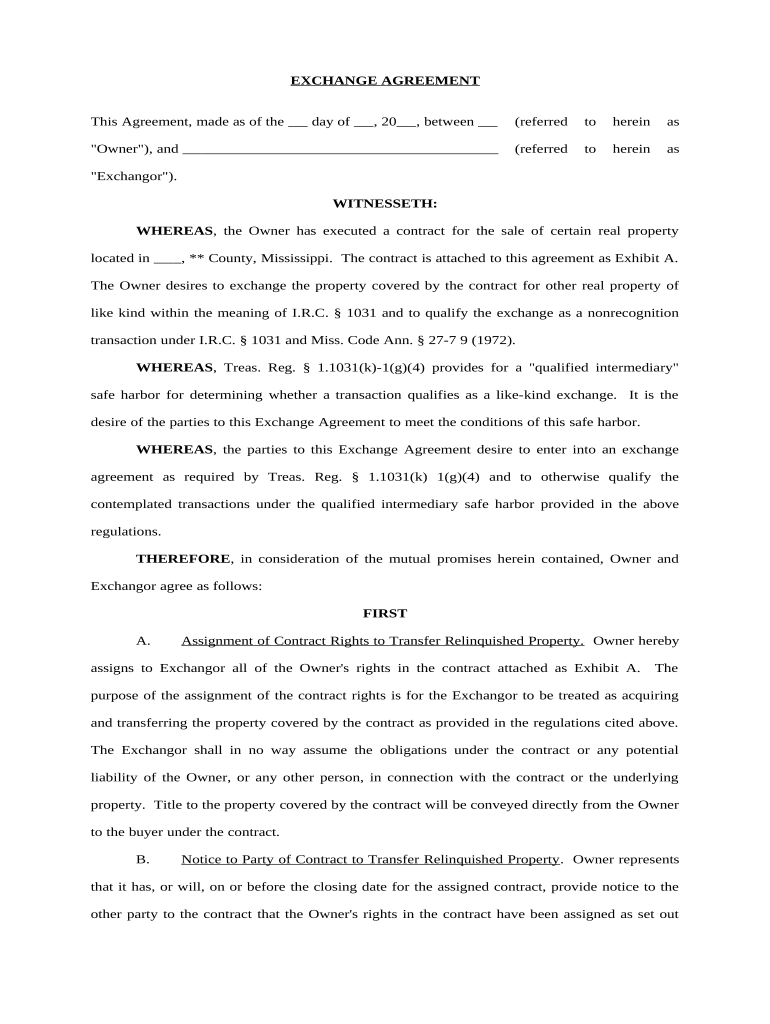

Tax Exchange Agreement Mississippi Form

What is the Tax Exchange Agreement Mississippi

The Tax Exchange Agreement in Mississippi is a formal arrangement that allows taxpayers to defer capital gains taxes when exchanging certain types of property. This agreement is particularly relevant for real estate transactions, where property owners can swap their properties without incurring immediate tax liabilities. By adhering to specific guidelines, taxpayers can benefit from tax deferral, enabling them to reinvest their gains into new properties.

Key elements of the Tax Exchange Agreement Mississippi

Several key elements define the Tax Exchange Agreement in Mississippi. These include:

- Property Type: The agreement typically applies to like-kind properties, meaning both properties must be of the same nature or character.

- Identification Period: Taxpayers must identify potential replacement properties within 45 days of the exchange.

- Exchange Period: The replacement property must be received within 180 days of the sale of the original property.

- Documentation: Proper documentation is essential to validate the exchange and ensure compliance with IRS regulations.

Steps to complete the Tax Exchange Agreement Mississippi

Completing the Tax Exchange Agreement involves several important steps:

- Determine Eligibility: Ensure that the properties involved meet the like-kind requirement.

- Engage a Qualified Intermediary: A qualified intermediary is necessary to facilitate the exchange and hold the proceeds.

- Identify Replacement Properties: Within 45 days, identify potential replacement properties that meet the criteria.

- Complete the Exchange: Finalize the transaction within 180 days, ensuring all documentation is accurate and complete.

Legal use of the Tax Exchange Agreement Mississippi

The legal use of the Tax Exchange Agreement in Mississippi is governed by both state and federal tax laws. It is crucial for taxpayers to understand the legal framework surrounding these agreements to avoid penalties. Compliance with IRS guidelines, including the proper identification of properties and adherence to timelines, is essential for the exchange to be considered valid and for tax benefits to be realized.

Filing Deadlines / Important Dates

Timely filing is critical when dealing with the Tax Exchange Agreement. Key dates include:

- Identification Deadline: 45 days from the sale of the original property.

- Exchange Deadline: 180 days from the sale of the original property.

Missing these deadlines may result in the loss of tax deferral benefits, making adherence to these timelines vital for successful exchanges.

Examples of using the Tax Exchange Agreement Mississippi

Tax Exchange Agreements can be utilized in various scenarios, such as:

- Real estate investors exchanging rental properties to upgrade their portfolio.

- Business owners swapping commercial properties to better suit their operational needs.

- Individuals trading vacation homes to accommodate personal preferences without incurring immediate tax liabilities.

These examples illustrate the flexibility and advantages of using the Tax Exchange Agreement in Mississippi for effective tax planning.

Quick guide on how to complete tax free exchange agreement mississippi

Prepare Tax Exchange Agreement Mississippi effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to draft, modify, and eSign your documents promptly without delays. Manage Tax Exchange Agreement Mississippi on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Tax Exchange Agreement Mississippi with ease

- Find Tax Exchange Agreement Mississippi and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Finish button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Tax Exchange Agreement Mississippi and guarantee superb communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tax Exchange Agreement Mississippi?

A Tax Exchange Agreement Mississippi is a legal contract that helps businesses exchange tax credits, incentives, or other benefits to optimize their financial positions. This agreement ensures compliance with state regulations while maximizing potential tax savings, making it essential for businesses looking to leverage available tax benefits in Mississippi.

-

How can airSlate SignNow help with a Tax Exchange Agreement Mississippi?

airSlate SignNow streamlines the process of drafting, sending, and eSigning Tax Exchange Agreements Mississippi. With its user-friendly platform, you can ensure that all agreements are securely handled and legally compliant, simplifying the administrative burden for your business.

-

What features does airSlate SignNow offer for managing Tax Exchange Agreements Mississippi?

airSlate SignNow offers features including customizable templates, document tracking, and secure storage specifically designed for Tax Exchange Agreements Mississippi. These tools help businesses maintain organization and facilitate efficient management of their agreements throughout the signing process.

-

Is airSlate SignNow cost-effective for handling Tax Exchange Agreements Mississippi?

Yes, airSlate SignNow is a cost-effective solution for managing Tax Exchange Agreements Mississippi, as it eliminates the need for physical document storage and reduces the time spent on administrative tasks. Our pricing plans are designed to cater to businesses of all sizes, giving you an affordable way to handle important documentation.

-

Can I integrate airSlate SignNow with other software for Tax Exchange Agreements Mississippi?

Absolutely! airSlate SignNow offers a variety of integrations with popular software and platforms that can complement your management of Tax Exchange Agreements Mississippi. Integrating your workflow enhances efficiency and ensures a seamless experience for your team.

-

What are the benefits of digital signatures for Tax Exchange Agreements Mississippi?

Digital signatures provided by airSlate SignNow for Tax Exchange Agreements Mississippi are legally binding and enhance security, making it easier for all parties involved. This leads to faster processing times and reduces the chances of errors, ultimately benefiting your business's operational efficiency.

-

How secure is airSlate SignNow when handling Tax Exchange Agreements Mississippi?

airSlate SignNow prioritizes security with features like encryption and secure storage for all documents, including Tax Exchange Agreements Mississippi. Compliance with industry standards ensures your sensitive data is protected, allowing you to sign agreements with confidence.

Get more for Tax Exchange Agreement Mississippi

- Hud acknowledgement of receipt form

- Tax deduction locator amp irs trouble minimizer itemized deductions form

- Ca 26 0285 form

- Property tax form 50 181

- First report of injury pinnacol assurance form

- Eh public counter services form

- Sample almond pollination agreement project apis m form

- Team captain application form

Find out other Tax Exchange Agreement Mississippi

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now