Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November

Understanding the Individual Characteristics Form for the Work Opportunity Tax Credit

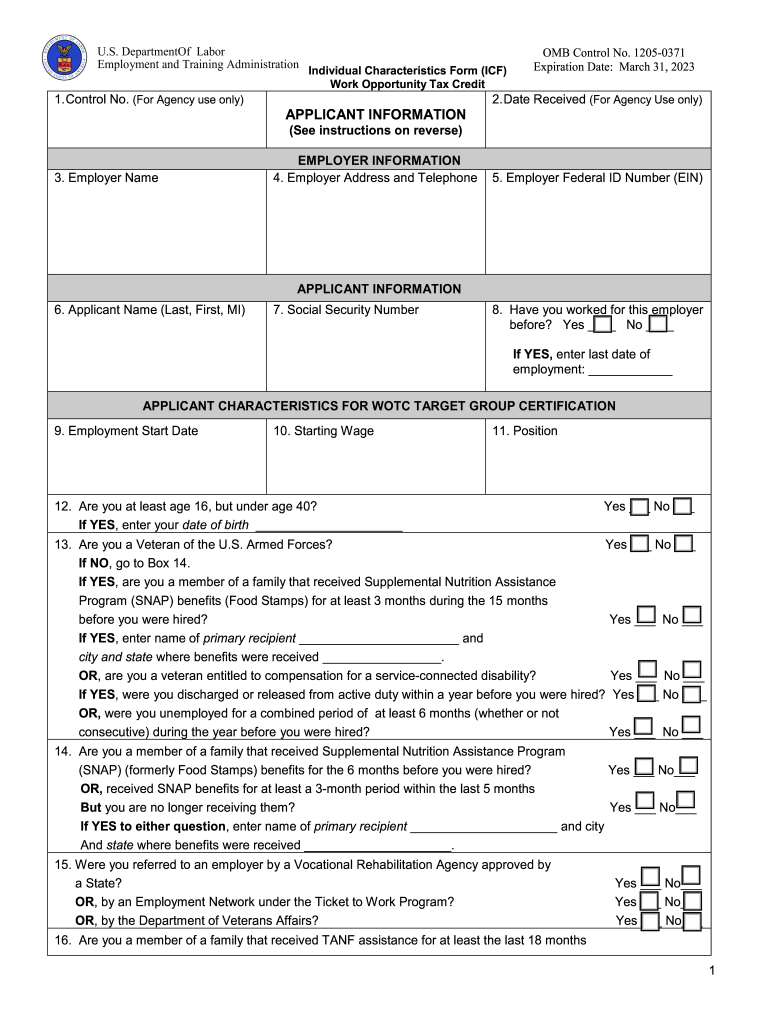

The Attachment 5A Individual Characteristics Form, commonly referred to as the ICF for the Work Opportunity Tax Credit (WOTC), is essential for employers seeking to claim tax credits for hiring individuals from specific target groups. This form collects vital information about the individual’s characteristics, which helps determine eligibility for the tax credit. It is crucial for employers to accurately complete this form to ensure compliance with IRS regulations and to maximize potential tax benefits.

Steps to Complete the Individual Characteristics Form

Completing the Attachment 5A Individual Characteristics Form involves several key steps:

- Gather necessary information about the individual, including their name, Social Security number, and other identifying details.

- Review the eligibility criteria for the Work Opportunity Tax Credit to ensure the individual qualifies.

- Fill out the form accurately, ensuring all sections are completed, including the individual characteristics that pertain to the target groups.

- Sign and date the form to validate the information provided.

- Submit the completed form as part of the WOTC application process.

Key Elements of the Individual Characteristics Form

The Attachment 5A Individual Characteristics Form includes several important elements that need careful attention:

- Personal Information: This section captures the individual's basic details, such as name and contact information.

- Eligibility Criteria: Specific characteristics that determine eligibility for the tax credit are outlined, such as veteran status or long-term unemployment.

- Signature Section: A signature is required to certify that the information provided is accurate and complete.

Legal Use of the Individual Characteristics Form

The Attachment 5A Individual Characteristics Form must be used in accordance with IRS guidelines to ensure its legal validity. Employers are responsible for maintaining compliance with federal regulations when submitting this form. The form must be completed truthfully, as any discrepancies or false information can lead to penalties or disqualification from receiving the tax credit.

Obtaining the Individual Characteristics Form

The Attachment 5A Individual Characteristics Form can be obtained directly from the IRS website or through state workforce agencies. It is essential to use the most current version of the form to ensure compliance with any updates in tax regulations. Employers should verify that they have the correct form before submission to avoid delays in processing their WOTC claims.

Examples of Using the Individual Characteristics Form

Employers may encounter various scenarios where the Attachment 5A Individual Characteristics Form is applicable:

- Hiring a veteran who has been unemployed for an extended period.

- Employing individuals receiving government assistance, such as SNAP or TANF.

- Bringing on board individuals with disabilities who meet specific criteria.

Quick guide on how to complete attachment 5a individual characteristics form icf work opportunity tax credit eta form 9061 rev november 2016

Effortlessly Prepare Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November on any platform with airSlate SignNow’s Android or iOS applications and enhance your document-centered workflow today.

How to Modify and eSign Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November with Ease

- Find Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, the hassle of manual form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the attachment 5a individual characteristics form icf work opportunity tax credit eta form 9061 rev november 2016

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What are the key characteristics of airSlate SignNow?

The key characteristics of airSlate SignNow include its user-friendly interface, robust security features, and seamless integration with other applications. These characteristics make it easy for businesses to manage their document signing processes efficiently. Additionally, airSlate SignNow's mobile compatibility ensures users can sign documents on the go, enhancing overall productivity.

-

How does airSlate SignNow's pricing structure reflect its characteristics?

airSlate SignNow offers a flexible pricing structure that aligns with its characteristics of being cost-effective and scalable. Customers can choose from various plans based on their organization's needs, allowing them to maximize the value derived from its comprehensive features. This pricing philosophy ensures that businesses of all sizes can leverage its capabilities without overspending.

-

What unique characteristics does airSlate SignNow offer for document security?

airSlate SignNow stands out with its strong document security characteristics, including advanced encryption and compliance with popular regulations like GDPR and HIPAA. These characteristics are designed to protect sensitive information and ensure that electronic signatures are legally binding. Users can feel confident that their document workflows are secure and reliable.

-

Can you explain the characteristics of airSlate SignNow's integration capabilities?

One of the defining characteristics of airSlate SignNow is its extensive integration capabilities with various third-party applications. This allows users to connect their existing workflows and tools seamlessly, enhancing overall efficiency. With numerous API options, businesses can customize their document signing processes to fit unique operational needs.

-

What are the collaborative characteristics of airSlate SignNow?

The collaborative characteristics of airSlate SignNow enable multiple users to engage in real-time document editing and signing. This feature is particularly beneficial for teams working remotely, as it promotes transparency and efficiency in the document workflow. By facilitating collaboration, airSlate SignNow ensures that all stakeholders can contribute effectively to the signing process.

-

How do the characteristics of airSlate SignNow improve user experience?

airSlate SignNow's characteristics, such as intuitive navigation and comprehensive customer support, signNowly improve user experience. These characteristics allow users to easily navigate the platform without extensive training. Additionally, responsive customer service ensures that users receive timely assistance, enhancing satisfaction and productivity.

-

What reporting characteristics does airSlate SignNow provide?

The reporting characteristics of airSlate SignNow include detailed analytics and insights into document activities, such as status tracking and signature timelines. These characteristics help businesses evaluate the efficiency of their signing processes and make informed decisions. By leveraging these insights, organizations can optimize their workflows and enhance operational effectiveness.

Get more for Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November

- Da form 1256 feb fillable

- Court of honor script template form

- Bmarriageb license application ktoo form

- School counseling group consent form

- Mined land reclamation idaho department of lands form

- Idaho department of lands application for reclamation plan form

- How to strengthen your nonprofits internal controls form

- Form 1718 michigan unemployment jobs ecityworks

Find out other Attachment 5A Individual Characteristics Form ICF Work Opportunity Tax Credit ETA Form 9061 Rev November

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast