Reaffirmation Agreement Form

What is the Reaffirmation Agreement

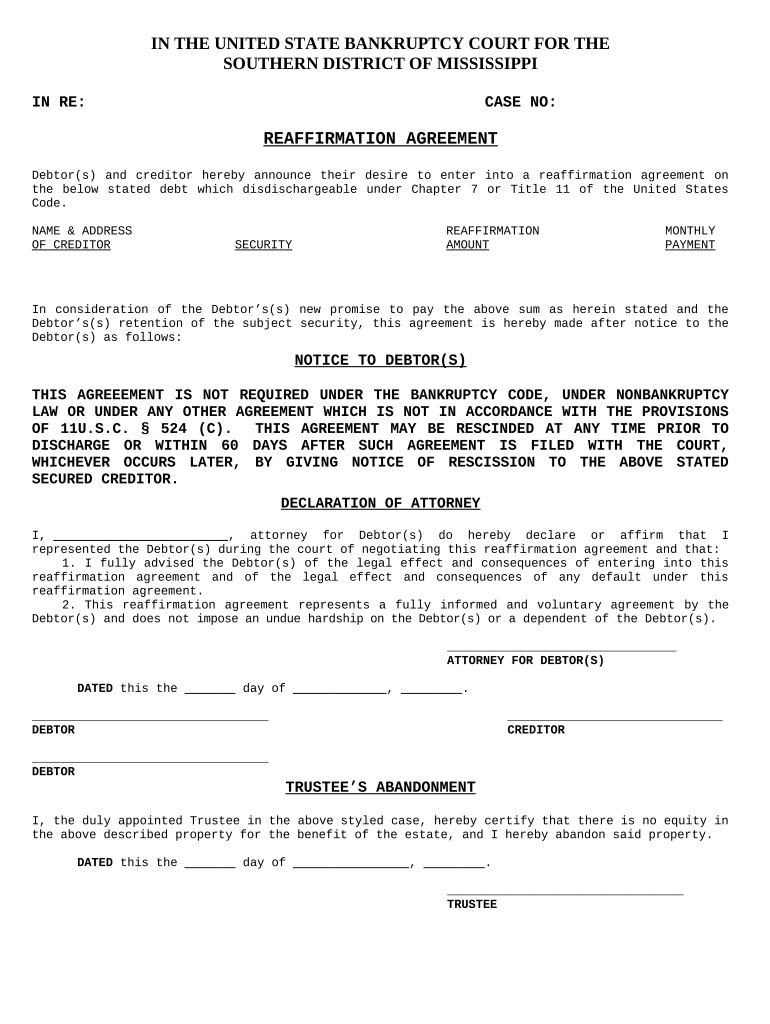

A reaffirmation agreement is a legal document that allows a debtor to reaffirm their obligation to pay a specific debt, typically in the context of bankruptcy. This agreement is particularly relevant for secured debts, such as mortgages or car loans, where the debtor wishes to retain the collateral while continuing to make payments. By signing this agreement, the debtor agrees to the terms of the debt, thereby waiving their right to discharge it in bankruptcy. This can help maintain ownership of the asset and improve the debtor's creditworthiness post-bankruptcy.

Key elements of the Reaffirmation Agreement

Several critical components define a reaffirmation agreement. These include:

- Debtor and Creditor Information: The names and addresses of both parties must be clearly stated.

- Details of the Debt: The agreement should specify the amount owed, the interest rate, and the payment schedule.

- Collateral Description: If applicable, the agreement must identify the asset securing the debt.

- Debtor's Acknowledgment: The debtor must acknowledge understanding the implications of reaffirming the debt.

- Signature Requirements: The agreement must be signed by both parties, often requiring the debtor's attorney's signature to confirm that the debtor understands the consequences.

Steps to complete the Reaffirmation Agreement

Completing a reaffirmation agreement involves several steps to ensure it is legally binding and meets all necessary requirements:

- Review the terms of the existing debt and determine if reaffirmation is beneficial.

- Consult with a bankruptcy attorney to understand the implications of reaffirming the debt.

- Obtain the reaffirmation agreement form from the creditor or legal resources.

- Fill out the form with accurate information regarding the debtor, creditor, and debt details.

- Sign the agreement, ensuring it is witnessed if required.

- File the signed agreement with the bankruptcy court, adhering to any deadlines.

Legal use of the Reaffirmation Agreement

The reaffirmation agreement must comply with specific legal standards to be enforceable. Under U.S. bankruptcy law, the debtor must demonstrate that reaffirming the debt is in their best interest and that they can afford to make the payments. The agreement must also be filed with the bankruptcy court, typically within a specified timeframe after the bankruptcy filing. Failure to adhere to these legal requirements can result in the reaffirmation being deemed invalid, leaving the debtor liable for dischargeable debts.

How to obtain the Reaffirmation Agreement

To obtain a reaffirmation agreement, the debtor can follow these steps:

- Contact the creditor directly to request the reaffirmation agreement form.

- Consult with a bankruptcy attorney for assistance in drafting or reviewing the agreement.

- Access legal resources online that provide templates or examples of reaffirmation agreements.

Examples of using the Reaffirmation Agreement

Reaffirmation agreements are commonly used in various scenarios, such as:

- A homeowner who files for bankruptcy but wishes to keep their home by reaffirming the mortgage.

- A car owner who wants to retain their vehicle during bankruptcy by reaffirming the auto loan.

- A debtor reaffirming a personal loan to maintain a good relationship with the lender and improve future credit prospects.

Quick guide on how to complete reaffirmation agreement

Effortlessly prepare Reaffirmation Agreement on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, edit, and eSign your documents without any hassles. Manage Reaffirmation Agreement on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Reaffirmation Agreement with ease

- Find Reaffirmation Agreement and click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Reaffirmation Agreement and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a reaffirmation agreement?

A reaffirmation agreement is a legal document that allows individuals to reaffirm their obligation to repay a debt despite filing for bankruptcy. This agreement can be beneficial for maintaining important assets, such as a home or vehicle, while ensuring compliance with the terms of the loan. With airSlate SignNow, you can easily create and eSign reaffirmation agreements securely and efficiently.

-

How does airSlate SignNow simplify the eSigning of reaffirmation agreements?

airSlate SignNow streamlines the process of eSigning reaffirmation agreements by providing a user-friendly interface where signers can complete documents from any device. The platform ensures fast turnaround times and enhances user experience with features like templates and secure cloud storage. This simplicity reduces hassles and speeds up the reaffirmation process.

-

Is there a cost associated with using airSlate SignNow for reaffirmation agreements?

Yes, airSlate SignNow offers a range of pricing plans to fit different business needs, including options for occasional users and larger enterprises. The pricing is competitive and provides great value for the features available, such as unlimited document sending and eSigning, making it a cost-effective solution for handling reaffirmation agreements.

-

What features does airSlate SignNow provide for managing reaffirmation agreements?

airSlate SignNow includes several key features for managing reaffirmation agreements, such as customizable templates, real-time status tracking, and automated reminders for signers. These features help ensure that all parties are kept informed and that agreements are completed efficiently. Additionally, you can easily integrate with other business tools to enhance workflow.

-

Can I integrate airSlate SignNow with other tools for reaffirmation agreements?

Absolutely! airSlate SignNow offers integrations with a variety of business tools, including CRM systems, accounting software, and cloud storage solutions. This connectivity allows for seamless handling of reaffirmation agreements within your existing workflows, increasing efficiency and ensuring that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for reaffirmation agreements?

Using airSlate SignNow for reaffirmation agreements provides several advantages, including increased speed and efficiency in document handling, enhanced security for sensitive information, and improved collaboration among parties involved. These benefits help ensure that your reaffirmation agreements are executed smoothly, allowing you to focus more on your core business activities.

-

How secure is airSlate SignNow when handling reaffirmation agreements?

Security is a top priority for airSlate SignNow. The platform uses industry-leading encryption and complies with various data protection regulations to ensure that all reaffirmation agreements and personal information are kept safe. You can trust that your documents are protected against unauthorized access at all times.

Get more for Reaffirmation Agreement

Find out other Reaffirmation Agreement

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form