Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Nebraska Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

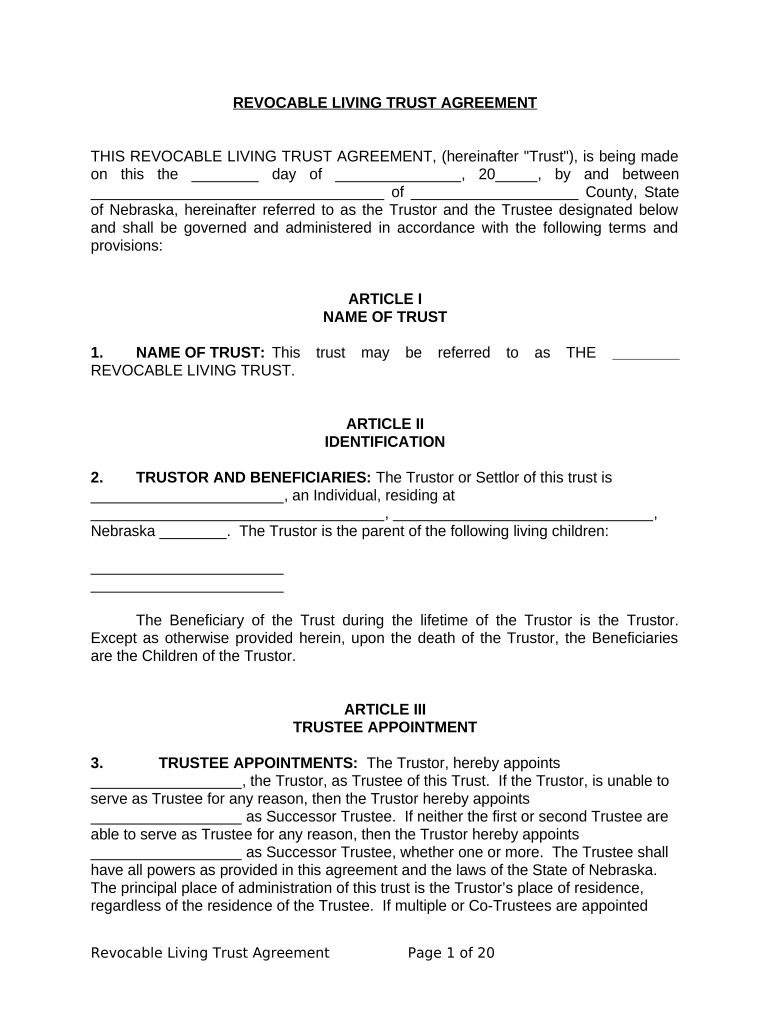

A living trust for individuals who are single, divorced, or widowed with children in Nebraska is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, making the transfer of assets smoother and more efficient for beneficiaries. The trustor, or creator of the trust, can retain control over the assets while alive, and upon their passing, the assets are transferred to the designated beneficiaries without the need for court intervention.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

Using a living trust involves several steps. First, the individual must decide which assets to place in the trust. This can include real estate, bank accounts, investments, and personal property. Next, the trust document needs to be drafted, outlining the terms of the trust, including the trustee's powers and the beneficiaries. Once the document is executed, the assets should be transferred into the trust's name. It is essential to keep the trust updated, especially after significant life events such as marriage, divorce, or the birth of a child.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

Completing a living trust involves a series of systematic steps:

- Determine the assets to include in the trust.

- Choose a reliable trustee who will manage the trust.

- Draft the trust document, ensuring it meets Nebraska laws.

- Sign the document in the presence of a notary public.

- Transfer ownership of the selected assets to the trust.

- Review and update the trust as necessary over time.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

The legal use of a living trust in Nebraska is governed by state law, which allows individuals to create trusts for various purposes, including estate planning. The trust must be established with clear terms and must comply with Nebraska's legal requirements. This includes having the trust document properly executed and ensuring that the assets are correctly titled in the name of the trust. Legal advice may be beneficial to ensure compliance and to address any specific circumstances related to the trustor's situation.

Key elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

Key elements of a living trust include:

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities designated to receive the trust assets.

- Trust property: The assets placed into the trust.

- Trust terms: The rules governing how the trust operates and how assets are distributed.

- Revocability: Whether the trust can be altered or revoked by the trustor during their lifetime.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

Nebraska has specific rules regarding the creation and administration of living trusts. These include requirements for the trust document to be in writing, the necessity for the trustor to have legal capacity, and the need for the trust to be funded with assets. Additionally, Nebraska law provides guidelines for the management of the trust assets and the responsibilities of the trustee. It is advisable to consult with a legal professional familiar with Nebraska trust law to ensure compliance and proper execution.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children nebraska

Prepare Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska on any platform utilizing airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska with ease

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It helps avoid probate and can be easily modified as your life circumstances change.

-

Why should I consider a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

Opting for a Living Trust allows you to retain control over your assets while providing clear directions for your beneficiaries. It can simplify the distribution of your estate, reduce costs, and ensure that your children are taken care of according to your wishes.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska differ from a will?

Unlike a will, which goes through probate and can be contested, a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska bypasses probate, providing faster access to your assets for your beneficiaries. Additionally, it offers privacy since it doesn't become a public record.

-

What are the costs associated with creating a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

The costs can vary depending on whether you use a lawyer or an online service. airSlate SignNow offers cost-effective solutions to create your Living Trust, ensuring you get the proper documentation without excessive legal fees.

-

Can I update my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

Yes, one of the benefits of a Living Trust is that you can update it as your life changes. Whether you get married, have more children, or experience other life events, you can easily amend your Living Trust to reflect your current wishes.

-

Is it necessary to have an attorney when creating a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

While it is beneficial to have legal guidance, it is not required. Many individuals successfully create their Living Trust using online services like airSlate SignNow, which provide user-friendly tools and resources for creating legally binding documents without a lawyer.

-

What assets can I include in my Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children in Nebraska?

You can include various assets in your Living Trust, such as your home, bank accounts, investments, and personal property. By designating these assets within your Living Trust, you ensure they are distributed according to your wishes in Nebraska.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

- Commerce cd150 form

- Multilingual standard form

- Wv form cst 250

- Form for declaration for registration by the students under west

- D userdata trueforms sites 125126 jlevine 633930104205312500 0 far vac 9 pdf form created instanet forms

- School ruby sue clifton middle school form

- Drop erhvervspraktik uu k benhavn uu kk form

- Walk dog walker form contract template

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Nebraska

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors