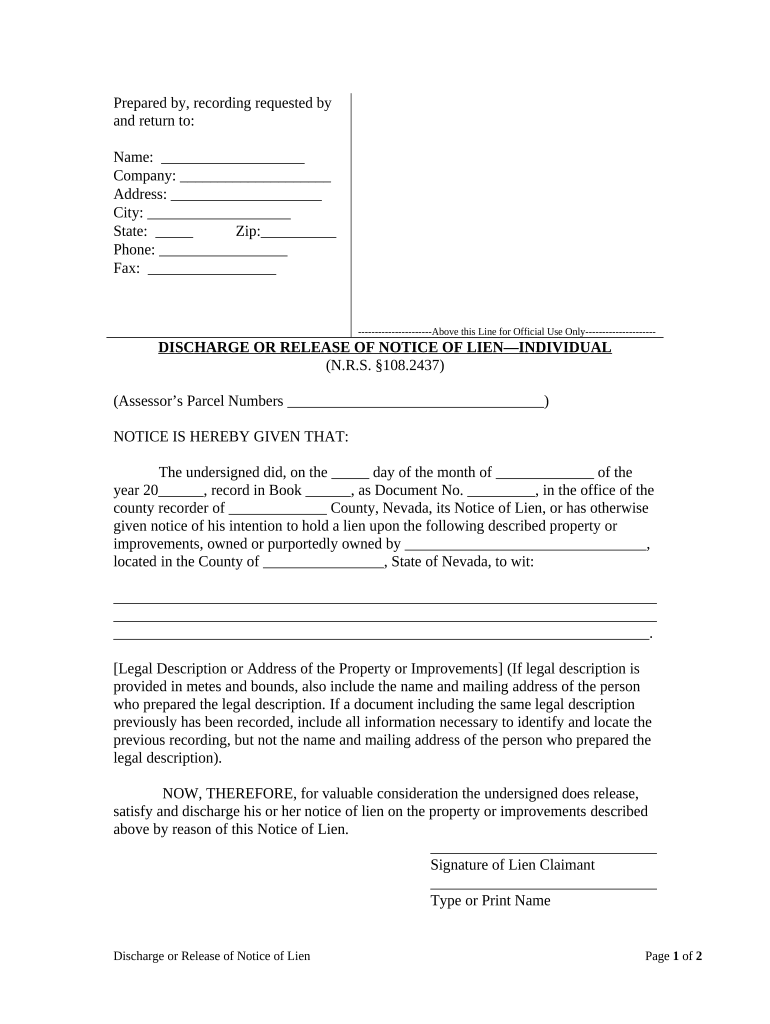

Nevada Lien Form

What is the Nevada Lien?

The Nevada lien is a legal claim against property that ensures the payment of a debt or obligation. It can arise from various situations, such as unpaid taxes, loans, or contractor services. When a lien is placed on a property, it prevents the owner from selling or transferring the property until the debt is settled. Understanding the nature of the lien is crucial for property owners and creditors alike, as it impacts financial transactions and property rights.

Steps to Complete the Nevada Lien

Completing a Nevada lien involves several key steps to ensure it is legally binding and properly filed. Here is a general outline of the process:

- Gather necessary information about the property and the debtor.

- Complete the Nevada discharge form accurately, ensuring all details are correct.

- Obtain the required signatures from all parties involved.

- File the completed form with the appropriate county recorder’s office.

- Pay any applicable filing fees to finalize the process.

Legal Use of the Nevada Lien

The legal use of a Nevada lien is governed by state laws, which outline the circumstances under which a lien can be placed. It is essential for creditors to follow the legal procedures to avoid disputes. A lien must be properly documented and filed to be enforceable. Additionally, understanding the rights and responsibilities associated with a lien can help parties navigate potential conflicts and ensure compliance with local regulations.

Required Documents

To file a Nevada lien, certain documents are necessary. These typically include:

- The completed Nevada discharge form.

- Proof of the underlying debt or obligation.

- Identification of the property subject to the lien.

- Any additional documentation required by the county recorder’s office.

Having these documents ready can streamline the filing process and help prevent delays.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for ensuring the enforceability of a Nevada lien. Generally, liens must be filed within a specific timeframe from the date the debt arises. Failure to file within this period may result in the loss of the right to claim the lien. It is advisable to consult local regulations for precise deadlines and any updates that may affect the filing process.

Who Issues the Form

The Nevada discharge form is typically issued by the county recorder’s office where the property is located. This office is responsible for maintaining public records, including liens. Property owners and creditors should contact their local recorder’s office to obtain the correct form and any specific instructions for filing.

Quick guide on how to complete nevada lien 497320626

Complete Nevada Lien effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Nevada Lien on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Nevada Lien with ease

- Locate Nevada Lien and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Nevada Lien and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada discharge and how does it relate to eSignatures?

A Nevada discharge refers to the formal release of a financial obligation or legal responsibility in the state of Nevada. With airSlate SignNow, you can quickly and securely eSign documents related to Nevada discharge processes, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for handling Nevada discharge documents?

The pricing for airSlate SignNow varies based on your business needs and the features required. We offer several plans designed to fit various budgets, allowing you to manage Nevada discharge documents without breaking the bank. Check our pricing page for detailed options.

-

What features does airSlate SignNow offer for Nevada discharge workflows?

airSlate SignNow offers a range of features to streamline Nevada discharge workflows, including customizable templates, team collaboration tools, and secure cloud storage. These functionalities ensure a smooth process for managing important documents, making it easier to handle Nevada discharges.

-

Can I integrate airSlate SignNow with other software for Nevada discharge management?

Yes, airSlate SignNow offers integrations with various software tools commonly used for document management and eSigning. This capability allows you to seamlessly incorporate Nevada discharge document handling into your existing workflows, enhancing productivity.

-

What are the benefits of using airSlate SignNow for Nevada discharge documents?

Using airSlate SignNow for handling Nevada discharge documents offers several benefits, such as faster turnaround times, enhanced security, and improved document tracking. By adopting our eSigning solution, you can simplify the discharge process while ensuring legal compliance.

-

Is airSlate SignNow legally binding for Nevada discharge documents?

Absolutely! Documents signed through airSlate SignNow are legally binding and comply with the electronic signature laws in Nevada and other jurisdictions. This ensures that your Nevada discharge documents are valid and enforceable.

-

How secure is airSlate SignNow for handling sensitive Nevada discharge documents?

airSlate SignNow prioritizes security, utilizing encryption protocols and advanced authentication measures to protect sensitive Nevada discharge documents. Your information is safeguarded throughout the eSigning process, giving you peace of mind.

Get more for Nevada Lien

- Beazley school of nursing form

- Nc dealer manual form

- Employee profile sheet form

- 461 visa form

- Emotional and social competency inventory form

- St jude trike a thon family participant donation form fy24 st jude trike a thon family participant donation form fy24

- Distinta richiesta firma digitale visura form

- Form 8872 rev november internal revenue service

Find out other Nevada Lien

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now