Non Foreign Affidavit under IRC 1445 New York Form

What is the Non Foreign Affidavit Under IRC 1445 New York

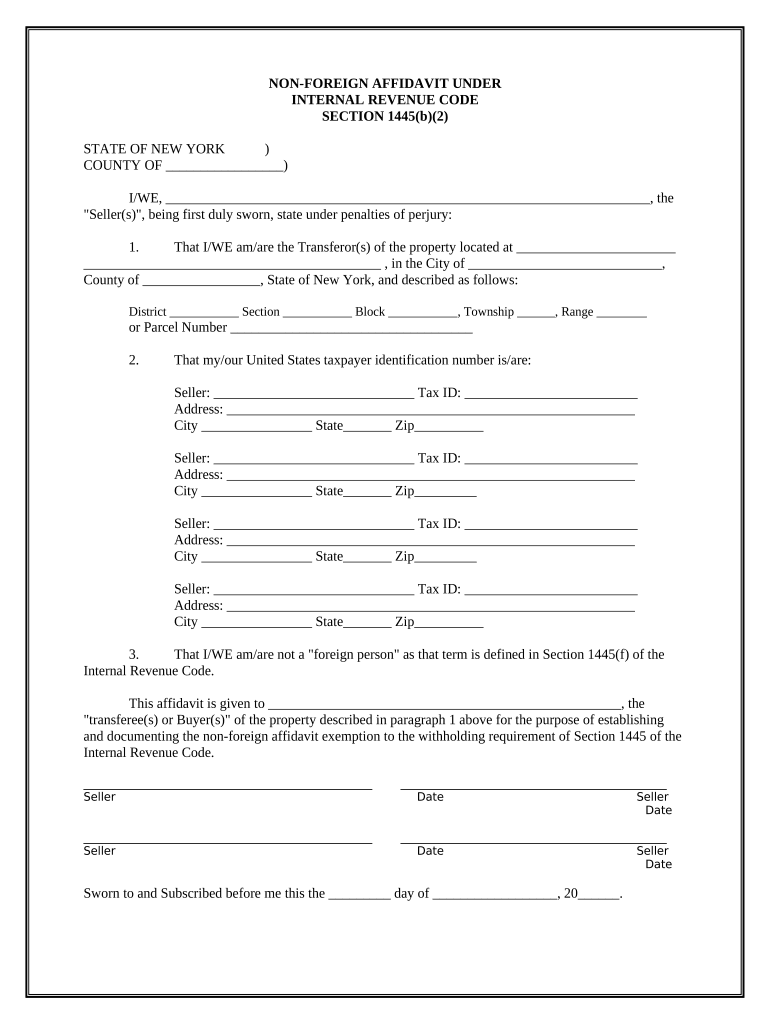

The Non Foreign Affidavit Under IRC 1445 is a legal document used in New York to certify that a seller of real property is not a foreign person, as defined by the Internal Revenue Code. This affidavit is essential for buyers to avoid withholding tax obligations related to the sale of real estate. By completing this document, sellers affirm their status as U.S. citizens or residents, thereby ensuring compliance with tax regulations. The affidavit serves as a safeguard for both parties involved in the transaction, facilitating a smooth transfer of property ownership.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 New York

Completing the Non Foreign Affidavit involves several straightforward steps:

- Gather necessary information, including the seller's full legal name, address, and taxpayer identification number.

- Fill out the affidavit form, ensuring all fields are accurately completed.

- Sign the document in the presence of a notary public to validate the affidavit.

- Provide the completed affidavit to the buyer or their representative as part of the closing process.

Following these steps ensures that the affidavit is properly executed and recognized by relevant authorities.

Key Elements of the Non Foreign Affidavit Under IRC 1445 New York

Several critical components must be included in the Non Foreign Affidavit to ensure its validity:

- Seller's Information: Full name, address, and taxpayer identification number.

- Certification Statement: A declaration confirming the seller's non-foreign status.

- Signature: The seller's signature, which must be notarized.

- Date: The date the affidavit is signed.

These elements are vital for the affidavit to be legally binding and accepted during real estate transactions.

How to Use the Non Foreign Affidavit Under IRC 1445 New York

The Non Foreign Affidavit is primarily used during real estate transactions to inform the buyer and relevant tax authorities of the seller's status. When the seller submits this affidavit, it serves as a declaration that they are not subject to withholding tax under IRC 1445. This document is typically presented at the closing of the sale, ensuring that all parties are aware of the seller's tax obligations. Proper use of this affidavit can prevent unnecessary complications and facilitate a smoother transaction process.

Legal Use of the Non Foreign Affidavit Under IRC 1445 New York

The Non Foreign Affidavit is legally binding when executed correctly. It must comply with the specific requirements set forth in the Internal Revenue Code. Failure to provide this affidavit when required can lead to withholding tax obligations for the buyer. Therefore, it is crucial for both buyers and sellers to understand the legal implications of this document. Utilizing a reliable electronic signature service can enhance the legitimacy of the affidavit, ensuring compliance with eSignature laws.

Required Documents for the Non Foreign Affidavit Under IRC 1445 New York

To complete the Non Foreign Affidavit, the following documents are typically required:

- A valid form of identification for the seller, such as a driver's license or passport.

- Taxpayer identification number, which may be a Social Security number or Employer Identification Number.

- Any additional documentation that may support the seller's claim of non-foreign status, if applicable.

Having these documents ready can streamline the process of completing the affidavit and ensure compliance with all necessary legal requirements.

Quick guide on how to complete non foreign affidavit under irc 1445 new york

Complete Non Foreign Affidavit Under IRC 1445 New York effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers a fantastic eco-conscious substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents promptly without interruptions. Handle Non Foreign Affidavit Under IRC 1445 New York on any device with airSlate SignNow Android or iOS applications and enhance any document-driven task right now.

How to modify and electronically sign Non Foreign Affidavit Under IRC 1445 New York without hassle

- Find Non Foreign Affidavit Under IRC 1445 New York and click on Get Form to commence.

- Take advantage of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device of your choice. Edit and electronically sign Non Foreign Affidavit Under IRC 1445 New York and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 New York?

A Non Foreign Affidavit Under IRC 1445 New York is a document that certifies a seller's foreign status for tax withholding purposes. This affidavit helps clarify the tax responsibilities of property transactions in New York, ensuring compliance with the IRS regulations. By utilizing this affidavit, sellers can avoid unnecessary withholding on the sale of their property.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 New York?

airSlate SignNow provides an efficient platform to create, send, and eSign your Non Foreign Affidavit Under IRC 1445 New York with ease. Our user-friendly interface allows you to manage all your documents electronically, streamlining the process and reducing paperwork. This simplifies compliance with tax regulations while enhancing your productivity.

-

What are the pricing options for using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 New York?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our cost-effective solution ensures that you can easily manage the Non Foreign Affidavit Under IRC 1445 New York without breaking the bank. You can choose from various subscription models to find the right fit for your needs.

-

What features does airSlate SignNow offer for handling Non Foreign Affidavit Under IRC 1445 New York?

With airSlate SignNow, you get comprehensive features such as customizable templates for Non Foreign Affidavit Under IRC 1445 New York, secure signing options, and real-time tracking. Our platform also allows collaboration among multiple users, ensuring that all parties involved can review and sign documents effortlessly. Experience increased efficiency and reduced turnaround times with our advanced tools.

-

Are there any integrations available with airSlate SignNow for Non Foreign Affidavit Under IRC 1445 New York?

Yes, airSlate SignNow integrates seamlessly with a variety of applications to enhance your workflow when managing Non Foreign Affidavit Under IRC 1445 New York. Whether you use CRMs, cloud storage, or accounting software, our integrations ensure that your data flows smoothly between systems. This compatibility minimizes errors and accelerates your document handling process.

-

How secure is the airSlate SignNow platform for eSigning Non Foreign Affidavit Under IRC 1445 New York?

Security is a top priority for airSlate SignNow, and our platform is designed to protect your documents, including Non Foreign Affidavit Under IRC 1445 New York. We employ industry-standard encryption to safeguard your data, ensuring that only authorized users can access your documents. Trust us to keep your sensitive information safe and secure throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for Non Foreign Affidavit Under IRC 1445 New York?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your Non Foreign Affidavit Under IRC 1445 New York documents on the go. Our mobile app provides all the features you need for eSigning and document management, ensuring that you can stay productive no matter where you are. Download our app and experience the freedom of mobile document handling.

Get more for Non Foreign Affidavit Under IRC 1445 New York

- Get and esign instructions for form m 6 hawaii estate tax

- Form m 4852 substitute for form w 2 wage and tax

- Tax certification statement 256349472 form

- Massachusetts department of revenue form 84 application

- Www templateroller comtemplate2315762form cu 7 ampquotvirginia consumers use tax return for individuals

- Www cityofchesapeake netassetsformsmilitary spouse residency affidavit for tax exemption

- City of chesapeake virginia commissioner of revenue form

- Form vm 2 virginia vending machine dealers sales tax

Find out other Non Foreign Affidavit Under IRC 1445 New York

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter