Employees Paid Salary Form

What is the Employees Paid Salary

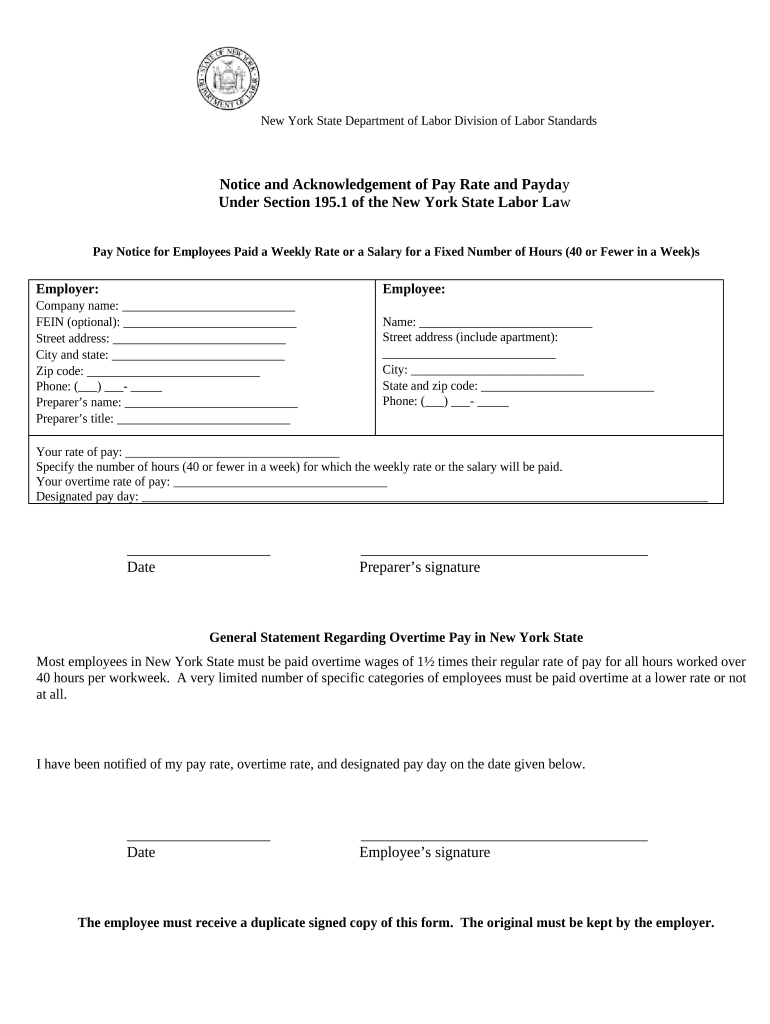

The employees paid salary refers to the compensation structure that employers in New York use to pay their employees. This salary is typically a fixed amount paid on a regular basis, such as weekly, bi-weekly, or monthly. Understanding this concept is crucial for both employers and employees, as it affects tax calculations, benefits eligibility, and overall financial planning.

Steps to Complete the Employees Paid Salary

Completing the employees paid salary involves several key steps. First, employers must determine the appropriate salary amount based on job roles, market rates, and company budgets. Next, they should ensure compliance with New York state laws regarding minimum wage and overtime pay. Once the salary is set, employers must document the payment terms in a clear pay rate form, which outlines the payment schedule, deductions, and any additional benefits. Finally, timely and accurate payroll processing is essential to ensure that employees receive their salaries as scheduled.

Legal Use of the Employees Paid Salary

The legal use of the employees paid salary is governed by various federal and state regulations. Employers must adhere to the Fair Labor Standards Act (FLSA) and New York labor laws, which dictate minimum wage requirements and overtime pay. Additionally, it is important for employers to maintain accurate records of salary payments and any changes to employment status, as these records may be needed for audits or disputes. Ensuring compliance with these legal standards helps protect both the employer and the employee.

State-Specific Rules for the Employees Paid Salary

In New York, specific rules apply to the employees paid salary that differ from other states. For instance, New York mandates that employees must receive their wages at least semi-monthly. Employers are also required to provide a pay notice form to employees, detailing their pay rate, pay frequency, and other relevant information. Additionally, certain industries may have unique regulations regarding salary structures, so it is essential for employers to stay informed about state-specific labor laws.

Required Documents

When establishing the employees paid salary, several documents are necessary to ensure compliance and proper record-keeping. Employers should maintain a pay rate form that outlines the agreed-upon salary, payment frequency, and any deductions. Additionally, tax forms such as the W-4, which indicates employee withholding allowances, must be collected. Keeping these documents organized and accessible is crucial for payroll processing and legal compliance.

Examples of Using the Employees Paid Salary

Examples of using the employees paid salary can vary widely depending on the industry and job roles. For instance, a software developer might have a fixed annual salary that is divided into bi-weekly payments, while a retail employee may receive an hourly wage that is calculated based on hours worked. Understanding these examples helps clarify how salaries are structured and how they relate to overall employee compensation and benefits.

Penalties for Non-Compliance

Employers who fail to comply with regulations regarding the employees paid salary may face significant penalties. These can include fines imposed by state labor departments, back pay owed to employees, and potential legal action from employees seeking compensation for unpaid wages. It is essential for employers to stay informed about compliance requirements to avoid these costly repercussions.

Quick guide on how to complete employees paid salary

Complete Employees Paid Salary effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without interruptions. Handle Employees Paid Salary on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Employees Paid Salary with ease

- Find Employees Paid Salary and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Employees Paid Salary to guarantee excellent communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the ny pay hours for using airSlate SignNow?

The ny pay hours for airSlate SignNow are designed to be flexible and user-friendly. You can access the platform 24/7, allowing you to manage your document signing needs at any time that suits your business schedule.

-

How does airSlate SignNow help in managing ny pay hours?

airSlate SignNow enhances your efficiency by streamlining the document signing process during your ny pay hours. This ensures that you can send, sign, and manage contracts quickly without missing essential deadlines.

-

Are there any costs associated with using airSlate SignNow during ny pay hours?

airSlate SignNow offers a range of pricing plans, allowing you to choose the best option that fits your needs during ny pay hours. Depending on your choice, you can enjoy various features, ensuring cost-effectiveness for your business operations.

-

What features are available for managing documents during ny pay hours?

With airSlate SignNow, you can take advantage of features like customizable templates, real-time tracking, and secure eSignatures during your ny pay hours. These tools help you streamline workflows and enhance collaboration with your team.

-

Can I integrate airSlate SignNow with other tools I use during ny pay hours?

Yes, airSlate SignNow offers seamless integration with various applications you may be using during your ny pay hours. This allows you to enhance your workflow and leverage existing tools more effectively.

-

What benefits does airSlate SignNow provide for businesses operating during ny pay hours?

airSlate SignNow provides signNow benefits such as increased efficiency and reduced turnaround time for document signing during your ny pay hours. This enables businesses to remain competitive and responsive to their clients’ needs.

-

Is airSlate SignNow suitable for small businesses concerned about ny pay hours?

Absolutely! airSlate SignNow is tailored to meet the needs of businesses of all sizes, including small companies. The platform's cost-effectiveness and ease of use make it particularly beneficial for small businesses managing operations within strict ny pay hours.

Get more for Employees Paid Salary

- Tax credits form

- Fbi bureau form

- Aldi job application pdf fill out the aldi application form for employment consideration at your local grocery store

- Residential lease for use in washington dc this form

- Cna florida board of nursing form

- Georgia cyber academy homeschool transcript form

- Bluecare plus hmo snpsm home health request fax form

- For applicationrenewalcancellation of work pass foreign worker form

Find out other Employees Paid Salary

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation