Business Credit Application South Carolina Form

What is the Business Credit Application South Carolina

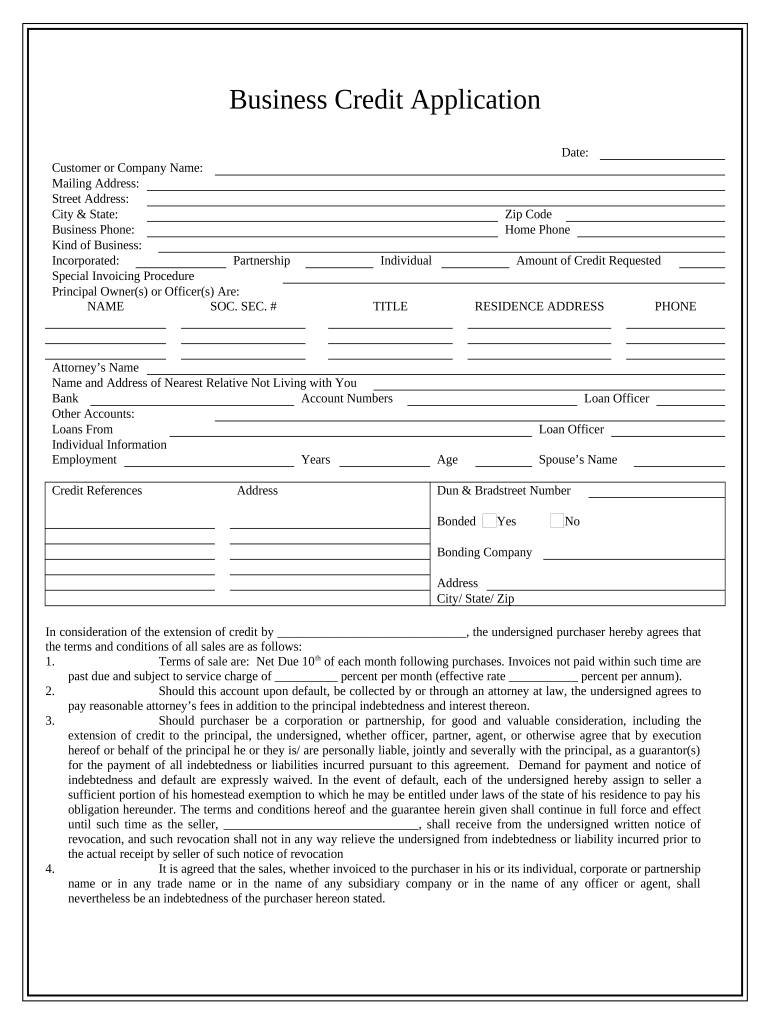

The Business Credit Application South Carolina is a formal document that allows businesses to apply for credit from financial institutions or suppliers. It typically collects essential information about the business, including its legal structure, financial history, and creditworthiness. This application serves as a critical tool for businesses seeking to establish or expand their credit lines, enabling them to manage cash flow and invest in growth opportunities.

Steps to complete the Business Credit Application South Carolina

Completing the Business Credit Application South Carolina involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your business, including:

- Business name and address

- Tax identification number

- Ownership details

- Financial statements

- Bank references

Next, fill out the application form carefully, ensuring all fields are completed. Review the document for any errors or omissions before submitting it. It is advisable to retain a copy of the completed application for your records.

Legal use of the Business Credit Application South Carolina

The Business Credit Application South Carolina is legally binding once signed by the authorized representatives of the business. To ensure its legality, the application must comply with relevant state and federal laws regarding credit applications. Utilizing a reliable eSignature solution can enhance the legitimacy of the application, as it provides a digital certificate and maintains compliance with the ESIGN Act and UETA.

Key elements of the Business Credit Application South Carolina

Several key elements are essential to include in the Business Credit Application South Carolina to ensure it meets the requirements of lenders and suppliers. These elements typically include:

- Business Information: Name, address, and contact details

- Ownership Structure: Details about the owners or partners

- Financial Information: Income statements, balance sheets, and cash flow statements

- Credit History: Information regarding past credit usage and repayment

- References: Banking and trade references to verify creditworthiness

Eligibility Criteria

To qualify for credit through the Business Credit Application South Carolina, businesses must meet specific eligibility criteria. Generally, these criteria may include:

- Established business operations with a minimum duration

- Positive credit history and financial stability

- Compliance with state and federal regulations

- Provision of accurate and complete information in the application

Application Process & Approval Time

The application process for the Business Credit Application South Carolina typically involves submitting the completed form along with supporting documents to the lender or supplier. Upon receipt, the institution will review the application, which may take anywhere from a few days to several weeks, depending on the complexity of the application and the lender's internal processes. Prompt communication and providing additional information when requested can help expedite the approval process.

Quick guide on how to complete business credit application south carolina

Complete Business Credit Application South Carolina easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Business Credit Application South Carolina on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Business Credit Application South Carolina effortlessly

- Locate Business Credit Application South Carolina and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to store your modifications.

- Select how you want to share your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Business Credit Application South Carolina and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application South Carolina?

A Business Credit Application South Carolina is a formal document that businesses submit to request credit from suppliers or lenders. This application helps assess the creditworthiness of the business, including financial history and other relevant information. Using airSlate SignNow streamlines this process by allowing you to send and eSign applications securely and quickly.

-

How can airSlate SignNow help with my Business Credit Application South Carolina?

airSlate SignNow helps simplify the Business Credit Application South Carolina by providing an easy-to-use platform for creating, sending, and eSigning the documents. This ensures that you can complete credit applications efficiently, reducing turnaround time. Our platform enhances document security and compliance, which is crucial for financial applications.

-

What are the costs associated with the Business Credit Application South Carolina?

The costs for using airSlate SignNow for your Business Credit Application South Carolina vary based on the plan you select. We offer competitive pricing tailored to business needs, ensuring you only pay for the features that will benefit you. Additionally, the reduced administrative time can lead to signNow savings in the long run.

-

Are there any specific features included in the Business Credit Application South Carolina process?

Yes, our platform includes several features that enhance the Business Credit Application South Carolina process, such as customizable templates, automatic reminders, and secure storage. You can easily track the status of your applications and receive instant notifications when they're completed. These features save time and improve efficiency.

-

How does eSigning work for a Business Credit Application South Carolina?

eSigning your Business Credit Application South Carolina with airSlate SignNow is simple and completely secure. Once your document is prepared, you can send it to the required parties electronically for their signatures. The process is compliant with legal standards, ensuring that your signed applications hold up in court.

-

Can I integrate airSlate SignNow with other software for handling Business Credit Applications South Carolina?

Absolutely! airSlate SignNow offers various integrations with popular software that can help you manage your Business Credit Application South Carolina more effectively. Whether it's CRM systems or accounting software, our platform enhances your workflow by connecting seamlessly with existing tools.

-

What are the benefits of using airSlate SignNow for Business Credit Applications in South Carolina?

Using airSlate SignNow for your Business Credit Application South Carolina allows for streamlined processes, increased efficiency, and enhanced security. The ease of sending and signing documents saves valuable time for your business, allowing you to focus on growth. Additionally, our platform is designed to meet various compliance requirements, giving you peace of mind.

Get more for Business Credit Application South Carolina

- Sba form 770 2008 2019

- Ny residential lease form

- Fax telecom impresa semplice form

- Annual report of guardian of the person form

- Disclosure request form city of barrie barrie

- Dr2444 colorado form

- Retroactive medicaid application michigan form

- Fsis form 9297 1 food safety and inspection service us fsis usda

Find out other Business Credit Application South Carolina

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement