Irs Omb No 0938 1190 Fillable Form

Understanding the IRS OMB No. 0 Fillable Form

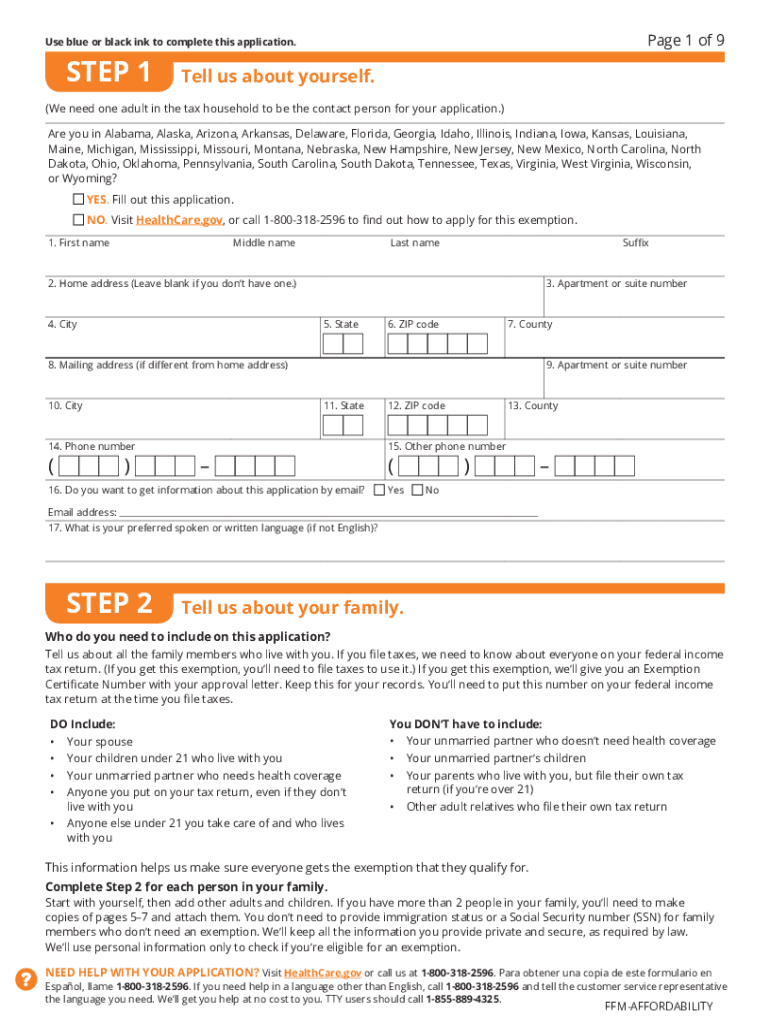

The IRS OMB No. 0 fillable form is a crucial document for individuals seeking an application exemption. This form is primarily used to report certain information related to health coverage and exemptions under the Affordable Care Act (ACA). Understanding the purpose and requirements of this form is essential for ensuring compliance with federal regulations.

Steps to Complete the IRS OMB No. 0 Fillable Form

Completing the IRS OMB No. 0 fillable form involves several clear steps:

- Gather necessary information, including personal identification details and any relevant health coverage data.

- Access the fillable form online, ensuring you have a compatible PDF viewer.

- Fill in the required fields accurately, paying close attention to any instructions provided on the form.

- Review your entries for accuracy and completeness before submission.

- Submit the form electronically or print it for mailing, depending on your preference or requirement.

Eligibility Criteria for the IRS OMB No. 0 Fillable Form

To qualify for an application exemption using the IRS OMB No. 0 fillable form, individuals must meet specific eligibility criteria. Generally, these criteria include:

- Not having access to affordable health coverage.

- Experiencing certain life events, such as a change in household size or income.

- Meeting specific income thresholds as defined by the ACA.

Legal Use of the IRS OMB No. 0 Fillable Form

The legal use of the IRS OMB No. 0 fillable form is governed by federal regulations. It is essential that individuals complete this form accurately to avoid penalties. The form serves as a declaration of exemption status and must be submitted to the IRS as part of compliance with the ACA.

Form Submission Methods for the IRS OMB No. 0 Fillable Form

Individuals can submit the IRS OMB No. 0 fillable form through various methods:

- Electronically via the IRS website, which is often the fastest option.

- By mail, ensuring that the form is sent to the correct IRS address for processing.

- In-person at designated IRS offices, if assistance is needed.

Required Documents for the IRS OMB No. 0 Fillable Form

When completing the IRS OMB No. 0 fillable form, certain documents may be required to support your application for exemption. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of any health coverage you have or had during the year.

- Any notices or letters received from health insurance providers regarding coverage options.

Quick guide on how to complete application exemption form

The optimal approach to locate and endorse Irs Omb No 0938 1190 Fillable

On the scale of an entire organization, ineffective workflows around document authorization can consume a signNow amount of working hours. Signing documents like Irs Omb No 0938 1190 Fillable is a standard aspect of operations in any organization, which is why the efficiency of each agreement's lifecycle signNowly impacts the company's overall effectiveness. With airSlate SignNow, endorsing your Irs Omb No 0938 1190 Fillable can be as simple and rapid as possible. This platform provides you with the latest edition of nearly any form. Moreover, you can endorse it instantly without needing to install external applications on your computer or producing hard copies.

How to obtain and endorse your Irs Omb No 0938 1190 Fillable

- Explore our collection by category or use the search function to find the form you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and include any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Irs Omb No 0938 1190 Fillable.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to manage your paperwork efficiently. You can locate, complete, modify, and even send your Irs Omb No 0938 1190 Fillable all in one tab without complications. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How much does it cost to start a 501(c)3 in NYC?

According to the Department of State, Division of Corporations, State Records, and UCC for New York, you must pay the statutory filing fee of $75 (as of July 2017) along with a small fee to check name availability.Filling out your non-profit forms accurately is very, very important. Ultimately, what you put in your documents may affect whether you are (or will remain) tax-exempt. Now, with that being said, your state documents aren’t the only documents you must complete. You must also fill out an Application for Recognition of Exemption with the IRS. Some non-profits are eligible to fill out a streamlined version, but you should talk with an attorney or tax professional to determine which one you should complete.You may also be required to obtain certain permits or licenses in New York (at either the city or the state level). This depends on what your non-profit will do or sell in order to raise money. Without the right permits or licenses, your non-profit could be shut down.You also need to write bylaws and appoint directors to the non-profit. Directors are important and should be chosen with care. They make important business and financial decisions for your non-profit. They will also officially adopt the bylaws at the first board meeting. The bylaws explain how the non-profit will be ran.Because non-profits must remain in compliance with state and federal law, it’s a good idea to first speak with an attorney and maybe even consider allowing the attorney to fill out the documents. It’s really worth the price since the tax-exempt status of the non-profit can be affected by a mistake. If you’d like to speak with an experienced attorney, check out LawTrades. Our legal marketplace has helped connect many entrepreneurs with experienced, non-profit attorneys to get them up and running. Hope you give us a try!

-

What requirements are there for building a startup?

There are no requirements to actually building a startup.Every startup will have its own special way that it will start up and its own bespoke path to the road for success. That being said, there are guidelines that most startups follow in order to increase their chances of success. Let me share them with you.LegalMaking sure that a startup begins on the right legal footing is crucial for success. You will want to make sure that the startup is registered, has the right structure and all the proper legal documents and certifications.You would be surprised by the number of startups that don’t have all of the followings! If you aren’t legally covered from the beginning, it can cause serious trouble for your startup in the future.For example, imagine you are running a Fintech startup.You might be unaware of all the regulations that your startup must abide by.Hence, you might be accidentally be violating one or more of them if you don’t have the proper supervision or license.A regulatory body like the Financial Conduct Authority (FCA) might find out about this and either give you a hefty fine or even ask for your business to shut down due to its illegal nature.Either way, your startup has just been dealt a massive blow that will be almost impossible to come back from.TeamEvery startup needs to be started with the best possible team to run and have a vision of the future for it.Then from there, they will need to hire the best possible talent that they can.Why? Because having the best people working for your startup will help it scale for the future.That is why companies like Google, Facebook, Amazon, Apple and etc spend so much money and time on hiring the best people out there for the job. When raising funds, investors will want to see why your team is the best team for the job.That is why having the best talent is so important. It will show investors and the world that your team has what it takes to take this idea into the future.In the startup world, no matter how amazing your idea is, if you don’t have the right team to execute it, it will fail.IdeaWhich brings us to the idea itself. At the end of the day, the idea itself will be fundamental to building your startup and its success.This means that you have to be 100% convinced that what you will be working on has the potential to actually change the world or industry.You will have to do a crazy amount of research on your industry, competitors, current trends, future trends, the market, consumer research and so on and so on.The fundamental question you should be able to answer is whether or not the pain point you are trying to solve really exists and if your product would be the best one to solve it.Then from there, you will have to be able to take the next step in the journey which is to actually start the business.Starting a company is not easy and it will require a lot of blood, sweat, tears and sacrifices but, speaking from experience it is completely worth it!I recommend you read as many books as you can from past founders (like Tools of Titans, The Hard Thing About Hard Things and etc), blogs, videos, podcasts and etc as you can to gain as much knowledge as you can before jumping in.At the end of the day, your ability to learn (because no one knows everything, no matter how many times they have done it) and grow will be fundamental to your success with your startup and with life!I hope this has helped you and if you have any legal questions or need legal assistance for your startup, feel free to contact me or visit our website. We offer a FREE Startup Legal Consultation, check it out!

-

What is the general process involved with getting a B-1 visa? Is it necessary to fill out an application form and go through the interview process?

It would depend where you are from. Canadians are visa exempt meaning they just apply for entry at the border otherwise you will have to apply for a visa. You may find reviewing the following article helpful: How to secure a U.S. visitor visa.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How does an organization gain legal status as a religion in the US?

Organize as a trust, corporation, or association..Fill out and submit IRS form Form 1023, Application for Recognition of Exemption.with a check for $400.File the similar State form for exemption from real estate and sales tax.

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the application exemption form

How to make an eSignature for your Application Exemption Form online

How to make an eSignature for the Application Exemption Form in Chrome

How to make an eSignature for signing the Application Exemption Form in Gmail

How to generate an electronic signature for the Application Exemption Form straight from your mobile device

How to create an eSignature for the Application Exemption Form on iOS

How to create an eSignature for the Application Exemption Form on Android devices

People also ask

-

What is application exemption online and how does it work?

Application exemption online refers to the process of submitting requests for exemptions through a digital platform. With airSlate SignNow, businesses can easily send and eSign documents related to these exemptions, streamlining the overall process and ensuring compliance.

-

How can airSlate SignNow help with application exemption online?

airSlate SignNow simplifies the application exemption online process by allowing users to create, send, and sign documents seamlessly. Our platform provides templates and tools that make it easy to manage exemptions efficiently, reducing paperwork and saving time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses. Our pricing options are designed to fit different budgets, providing value for businesses looking to manage their application exemption online needs affordably.

-

Is airSlate SignNow easy to integrate with other applications?

Absolutely! airSlate SignNow smoothly integrates with various other applications, enhancing your workflow. This compatibility allows you to manage your application exemption online alongside other business processes for greater efficiency.

-

What features does airSlate SignNow provide for managing application exemptions?

Our platform includes features such as customizable templates, automated reminders, and audit trails, all tailored for managing application exemptions online. These tools ensure that all requests are tracked and handled promptly, providing a reliable solution.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your application exemption online from anywhere. Our mobile-friendly design ensures that you can send and eSign documents on the go, keeping your business operations smooth.

-

What benefits come with using airSlate SignNow for application exemption online?

Using airSlate SignNow for application exemption online offers numerous benefits, including improved speed, reduced errors, and enhanced compliance. Our user-friendly interface and versatile features make document management a breeze, helping your business thrive.

Get more for Irs Omb No 0938 1190 Fillable

- Illinois property agreement form

- Agreement between parties living together but remaining unmarried with regard to sale of residence illinois form

- Illinois owner llc form

- Illinois claim form 497306039

- Quitclaim deed from husband and wife to an individual illinois form

- Illinois deed to form

- Illinois foreclosure form

- Architect mechanics lien notice and claim corporation or llc illinois form

Find out other Irs Omb No 0938 1190 Fillable

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure