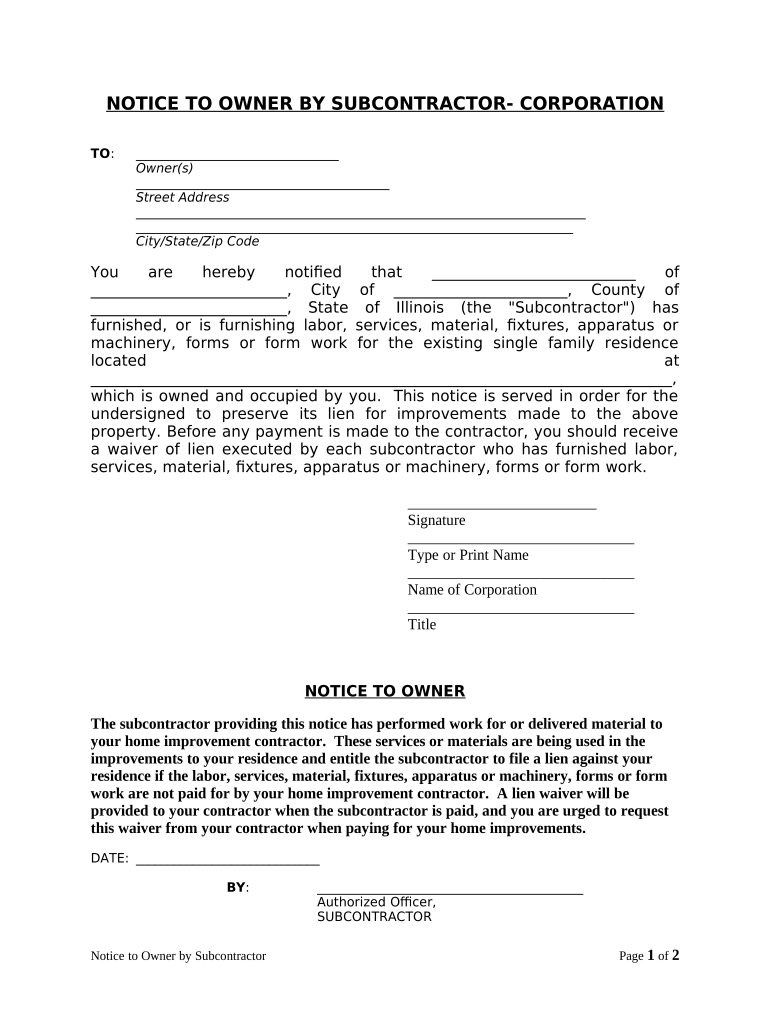

Illinois Owner Llc Form

What is the Illinois Owner LLC?

The Illinois Owner LLC is a specific business structure designed for individual entrepreneurs in Illinois. This form allows a single individual to establish a limited liability company, providing personal liability protection while maintaining operational flexibility. By forming an Illinois Owner LLC, business owners can separate their personal assets from their business liabilities, which is a crucial step in safeguarding personal wealth.

How to use the Illinois Owner LLC

Using the Illinois Owner LLC involves several steps that ensure compliance with state regulations. Once the LLC is formed, the owner can operate the business under the LLC name, enter into contracts, and manage finances separately from personal accounts. It is essential to maintain proper records and adhere to state filing requirements to preserve the liability protection offered by the LLC structure.

Steps to complete the Illinois Owner LLC

Completing the Illinois Owner LLC involves a series of steps:

- Choose a unique name for the LLC that complies with Illinois naming rules.

- File the Articles of Organization with the Illinois Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS, if needed.

- Draft an Operating Agreement to outline the management structure.

- Comply with any local business licenses or permits required for operation.

Legal use of the Illinois Owner LLC

The legal use of the Illinois Owner LLC includes conducting business activities, entering contracts, and protecting personal assets from business liabilities. It is important to follow state laws regarding business operations, including tax obligations and annual reporting requirements. Failure to comply with these regulations may jeopardize the legal protections afforded by the LLC status.

Required Documents

To establish an Illinois Owner LLC, several documents are necessary:

- Articles of Organization: This is the primary document filed with the state to create the LLC.

- Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures.

- Employer Identification Number (EIN): Required for tax purposes if the LLC has employees or multiple members.

Eligibility Criteria

To form an Illinois Owner LLC, the applicant must meet certain eligibility criteria. The individual must be at least eighteen years old and a resident of Illinois or a foreign entity authorized to conduct business in the state. Additionally, the chosen name for the LLC must be distinguishable from existing business entities registered in Illinois.

Quick guide on how to complete illinois owner llc

Complete Illinois Owner Llc effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Illinois Owner Llc on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Illinois Owner Llc without hassle

- Obtain Illinois Owner Llc and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Illinois Owner Llc and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois owner LLC?

An Illinois owner LLC is a limited liability company where a single individual or entity owns the business. This structure provides personal liability protection while allowing pass-through taxation. For entrepreneurs in Illinois, establishing an owner LLC can be a strategic choice to safeguard personal assets.

-

How do I form an Illinois owner LLC?

To form an Illinois owner LLC, you need to file Articles of Organization with the Illinois Secretary of State, along with a processing fee. After approval, you'll also want to create an operating agreement outlining how the LLC will operate. This process provides legal recognition and protects your personal assets.

-

What are the tax benefits of choosing an Illinois owner LLC?

An Illinois owner LLC offers signNow tax benefits, including pass-through taxation, where profits are only taxed once on your individual tax return. This avoids double taxation typically associated with corporations. Additionally, you may qualify for various business deductions to lower your taxable income.

-

What features does airSlate SignNow offer for an Illinois owner LLC?

airSlate SignNow provides a user-friendly platform for document signing and management which is particularly beneficial for an Illinois owner LLC. Key features include eSignature capabilities, templates, and document tracking. These tools help streamline operations and enhance professionalism in client interactions.

-

What is the pricing structure of airSlate SignNow for Illinois owner LLCs?

airSlate SignNow offers flexible pricing plans that are budget-friendly for Illinois owner LLCs. You can choose from a basic plan to advanced options, depending on your business needs. Each plan provides essential features that allow effective document management without breaking the bank.

-

Can airSlate SignNow integrate with other tools I use for my Illinois owner LLC?

Yes, airSlate SignNow integrates seamlessly with a variety of tools commonly used by Illinois owner LLCs, such as CRM systems and accounting software. This ensures a streamlined workflow and enhanced productivity. With these integrations, you can manage your documents more effectively within your existing processes.

-

What are the benefits of using eSignatures for my Illinois owner LLC?

Using eSignatures with airSlate SignNow offers many benefits for your Illinois owner LLC, such as increased efficiency and faster transaction times. Documents can be signed from anywhere, reducing delays associated with physical signatures. Additionally, eSignatures are legally binding and secure, ensuring compliance and peace of mind.

Get more for Illinois Owner Llc

Find out other Illinois Owner Llc

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple