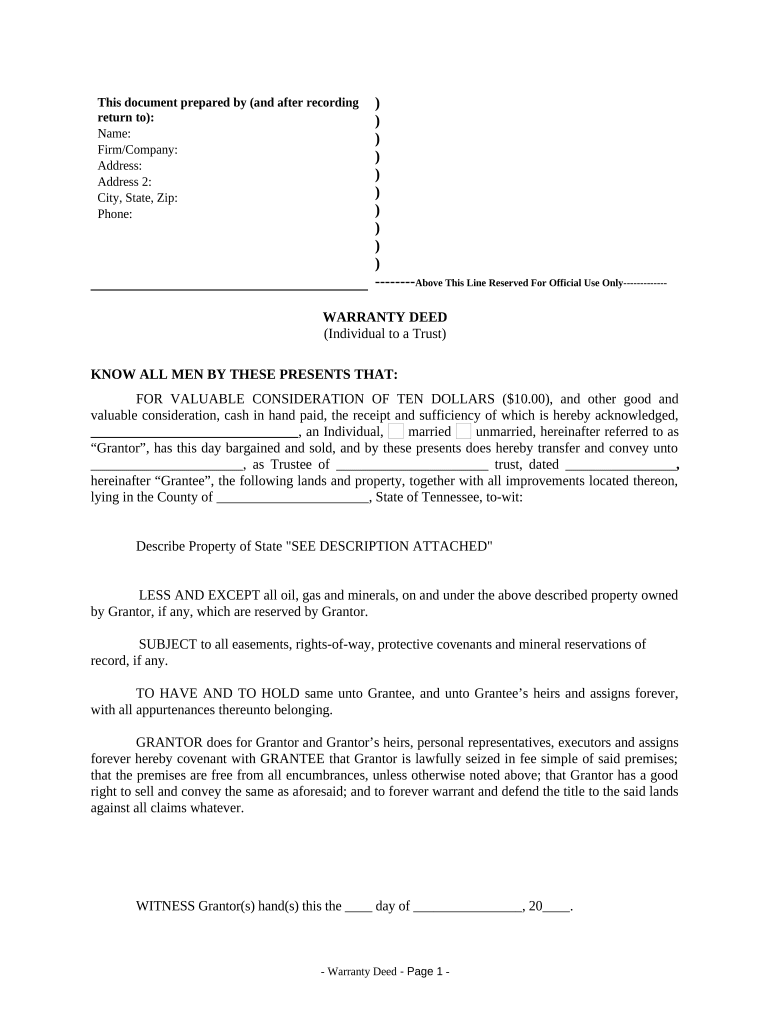

Tennessee Trust Form

What is the Tennessee Trust

The Tennessee Trust is a legal arrangement that allows individuals to manage and protect their assets during their lifetime and after their death. It is designed to provide flexibility in asset management, ensuring that the grantor's wishes are honored. This trust can be used for various purposes, including estate planning, tax benefits, and providing for beneficiaries. By establishing a Tennessee Trust, individuals can dictate how their assets are distributed, manage their estate, and potentially avoid probate, which can be a lengthy and costly process.

Key Elements of the Tennessee Trust

A Tennessee Trust typically includes several key elements that define its structure and function:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust and its assets according to the grantor's instructions.

- Beneficiaries: The individuals or entities that will receive benefits from the trust, either during the grantor's lifetime or after their death.

- Trust Document: A legal document that outlines the terms of the trust, including how assets are to be managed and distributed.

Steps to Complete the Tennessee Trust

Completing a Tennessee Trust involves several important steps:

- Identify Assets: Determine which assets you wish to place in the trust. This can include real estate, bank accounts, investments, and personal property.

- Select a Trustee: Choose a trustworthy individual or institution to manage the trust. Consider their ability to handle financial matters and their willingness to serve.

- Draft the Trust Document: Work with a legal professional to create a trust document that clearly outlines your wishes, including how assets should be managed and distributed.

- Transfer Assets: Legally transfer ownership of the identified assets into the trust. This may involve changing titles or account names.

- Review and Update: Regularly review the trust to ensure it aligns with your current wishes and make updates as necessary.

Legal Use of the Tennessee Trust

The Tennessee Trust is legally recognized and can be used for various legal purposes, including estate planning and asset protection. It is essential to comply with state laws when establishing and managing the trust. This includes adhering to regulations regarding the trust's formation, management, and distribution of assets. Proper legal guidance is recommended to ensure that the trust is valid and enforceable.

State-Specific Rules for the Tennessee Trust

Each state has its own regulations governing trusts, and Tennessee is no exception. Key state-specific rules include:

- The trust must be created in writing and signed by the grantor.

- Trustees must adhere to fiduciary duties, acting in the best interest of the beneficiaries.

- Certain types of trusts, such as revocable and irrevocable trusts, have different implications for asset management and tax treatment.

Examples of Using the Tennessee Trust

Individuals utilize the Tennessee Trust for various scenarios, such as:

- Providing for minor children or dependents by ensuring funds are managed until they reach adulthood.

- Protecting assets from creditors in the event of financial difficulties.

- Designating specific distributions for charitable organizations while retaining control over the assets during their lifetime.

Quick guide on how to complete tennessee trust 497326631

Complete Tennessee Trust effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents swiftly without any delays. Manage Tennessee Trust on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest method to modify and eSign Tennessee Trust without stress

- Find Tennessee Trust and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Move past lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tennessee Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee trust?

A Tennessee trust is a legal entity established under Tennessee law to hold and manage assets for the benefit of designated beneficiaries. It offers unique benefits such as asset protection and estate planning flexibility, making it a popular choice for individuals in Tennessee. Understanding how a Tennessee trust works can help you make informed decisions about your financial future.

-

What are the benefits of setting up a Tennessee trust?

Setting up a Tennessee trust provides several advantages, including enhanced asset protection, privacy, and control over asset distribution. It allows you to specify conditions for when and how beneficiaries receive their assets, catering to diverse family needs. Utilizing a Tennessee trust can ensure your wishes are honored while potentially reducing estate taxes.

-

How much does it cost to create a Tennessee trust?

The cost of establishing a Tennessee trust can vary depending on various factors, including the complexity of the trust and the legal services required. Typically, you might expect to pay anywhere from a few hundred to several thousand dollars. It’s essential to consult with a legal professional to get a comprehensive estimate based on your specific needs.

-

Can I manage a Tennessee trust myself?

Yes, you can manage a Tennessee trust yourself if you understand the legal requirements and responsibilities involved. However, many individuals opt to work with a trust administrator to ensure compliance with state laws and to alleviate the administrative burden. A proper management strategy is vital to ensure the trust operates according to its intended purpose.

-

What types of assets can be placed in a Tennessee trust?

A variety of assets can be placed in a Tennessee trust, including real estate, bank accounts, investments, and personal property. This flexibility allows you to tailor the trust to meet your specific financial goals. By placing assets in a Tennessee trust, you can effectively control how these assets are managed and distributed.

-

Are Tennessee trusts revocable or irrevocable?

Tennessee trusts can be either revocable or irrevocable, depending on your needs and goals. A revocable trust allows you to make changes during your lifetime, while an irrevocable trust generally cannot be amended once it is established. Understanding the differences between these types of trusts is crucial for effective estate planning.

-

How does airSlate SignNow help with Tennessee trust documentation?

AirSlate SignNow provides a streamlined solution for electronically signing and managing documents related to your Tennessee trust. Its user-friendly interface makes creating, sharing, and signing trust documents easy and efficient. With airSlate SignNow, you can ensure that your important paperwork is handled securely and promptly.

Get more for Tennessee Trust

- Usborne books order form mail to cheryl simonusborne

- Free throw a thon carolina dynasty basketball form

- 4 page sample of your electricity bill southern california edison form

- Church matching scholarships william jewell college jewell form

- Behaviour guidance plan horsham district kindergarten form

- Zoning certificate application cityofberkeley form

- Gesuch fr ein carnet de passages en douane cpd tcsch form

- Vazquez v deutsche bank reversed and remanded form

Find out other Tennessee Trust

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later