Financial Account Transfer to Living Trust Tennessee Form

What is the Financial Account Transfer To Living Trust Tennessee

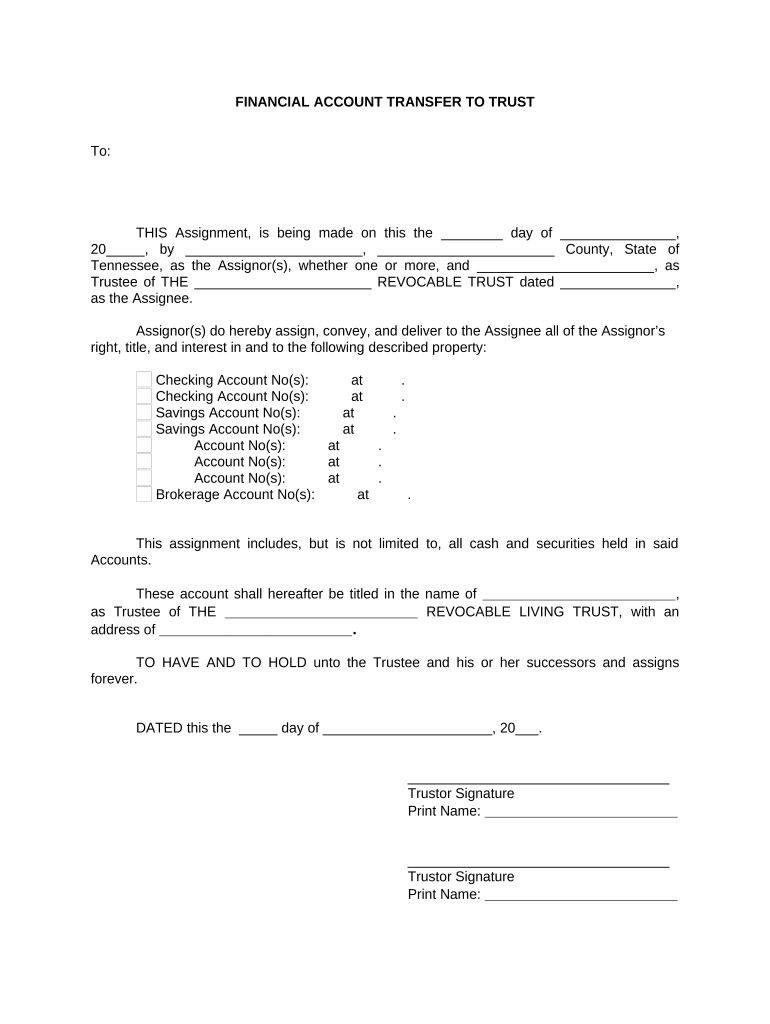

The Financial Account Transfer To Living Trust Tennessee form is a legal document used to transfer ownership of financial accounts into a living trust. This process helps in estate planning by allowing individuals to manage their assets during their lifetime and ensuring a smooth transition of those assets upon death. By placing financial accounts into a living trust, the assets can avoid probate, which can save time and costs for beneficiaries. This form is essential for anyone looking to streamline their estate management and protect their assets in Tennessee.

Steps to complete the Financial Account Transfer To Living Trust Tennessee

Completing the Financial Account Transfer To Living Trust Tennessee form involves several key steps:

- Gather necessary information about the financial accounts you wish to transfer, including account numbers and financial institution details.

- Obtain the Financial Account Transfer To Living Trust Tennessee form from a reliable source.

- Fill out the form accurately, ensuring that all information matches the records held by the financial institutions.

- Sign the form in accordance with the requirements set by Tennessee law, which may include notarization.

- Submit the completed form to the relevant financial institutions, following their specific submission guidelines.

Legal use of the Financial Account Transfer To Living Trust Tennessee

The Financial Account Transfer To Living Trust Tennessee form is legally binding when completed correctly. It must adhere to Tennessee laws regarding trusts and estate planning. This includes proper execution, which may require signatures from witnesses or a notary public. The form serves as a legal instrument that facilitates the transfer of assets into a trust, ensuring that the trust's terms are honored and that the assets are managed according to the grantor's wishes.

Required Documents

To successfully complete the Financial Account Transfer To Living Trust Tennessee form, you will need to prepare several documents:

- A copy of the living trust document, which outlines the terms and conditions of the trust.

- Identification documents, such as a driver's license or passport, to verify your identity.

- Account statements or documentation from the financial institutions that detail the accounts being transferred.

- Any specific forms or requirements requested by the financial institutions involved.

State-specific rules for the Financial Account Transfer To Living Trust Tennessee

Tennessee has specific regulations governing the creation and management of living trusts, which impact the Financial Account Transfer To Living Trust Tennessee form. These rules dictate how trusts must be established, the rights of beneficiaries, and the responsibilities of trustees. It is essential to comply with these regulations to ensure that the transfer is valid and that the trust operates according to state law. Consulting with a legal professional familiar with Tennessee trust law can provide additional guidance.

How to use the Financial Account Transfer To Living Trust Tennessee

Using the Financial Account Transfer To Living Trust Tennessee form involves several practical steps. After completing the form, it is crucial to submit it to the respective financial institutions where your accounts are held. Each institution may have its own requirements for processing the transfer, so it is advisable to contact them directly for guidance. Additionally, keep copies of all submitted documents for your records. This ensures that you have proof of the transfer and can address any potential issues that may arise in the future.

Quick guide on how to complete financial account transfer to living trust tennessee

Effortlessly Create Financial Account Transfer To Living Trust Tennessee on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to find the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Financial Account Transfer To Living Trust Tennessee on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Adjust and Electronically Sign Financial Account Transfer To Living Trust Tennessee with Ease

- Find Financial Account Transfer To Living Trust Tennessee and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a customary wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, exhausting form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Financial Account Transfer To Living Trust Tennessee and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Financial Account Transfer To Living Trust in Tennessee?

The Financial Account Transfer To Living Trust in Tennessee involves several steps, including selecting the appropriate trust type, transferring assets, and updating account information. It's essential to ensure all documentation is accurately completed to avoid delays. Consulting with an attorney familiar with Tennessee laws can streamline this process and ensure compliance.

-

What are the benefits of transferring my financial accounts to a living trust in Tennessee?

Transferring your financial accounts to a living trust in Tennessee offers several benefits, such as avoiding probate, maintaining privacy, and ensuring your assets are managed according to your wishes. This can provide peace of mind, knowing your finances are protected. Additionally, it may simplify the management of your assets for your beneficiaries.

-

Are there any costs associated with a Financial Account Transfer To Living Trust in Tennessee?

Yes, there can be costs associated with a Financial Account Transfer To Living Trust in Tennessee, including legal fees, transfer fees, and potential taxes depending on the assets involved. These costs vary widely based on the complexity of your trust and the nature of your financial accounts. It's advisable to consult with a financial advisor to understand the specific costs you may incur.

-

How long does it take to complete a Financial Account Transfer To Living Trust in Tennessee?

The timeline for a Financial Account Transfer To Living Trust in Tennessee can vary depending on the complexity of the trust and the financial institutions involved. Typically, the process can take anywhere from a few weeks to a few months. Working with experienced professionals can help expedite the process and ensure everything is completed efficiently.

-

Can I manage my financial accounts after a transfer to a living trust in Tennessee?

Yes, after a Financial Account Transfer To Living Trust in Tennessee, you can still manage your financial accounts, provided you are named as the trustee. As the trustee, you have full control over the assets while adhering to the trust's terms. This flexibility allows you to make changes or investments as needed while ensuring your assets are directed according to your wishes.

-

What types of financial accounts can be transferred to a living trust in Tennessee?

In Tennessee, a variety of financial accounts can be transferred to a living trust, including bank accounts, investment accounts, and retirement accounts. Specific procedures may vary by financial institution, so it's essential to check with them to ensure compliance. Proper documentation will help facilitate a smoother transfer of your accounts.

-

Is there a specific legal documentation required for a Financial Account Transfer To Living Trust in Tennessee?

Yes, several legal documents are required for a Financial Account Transfer To Living Trust in Tennessee, including the trust agreement and possibly a certificate of trust. These documents outline the trust's terms and confirm its validity. It's important to have these documents prepared accurately to avoid any complications during the transfer.

Get more for Financial Account Transfer To Living Trust Tennessee

Find out other Financial Account Transfer To Living Trust Tennessee

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document