Form 50 132 2017

What is the Form 50 132

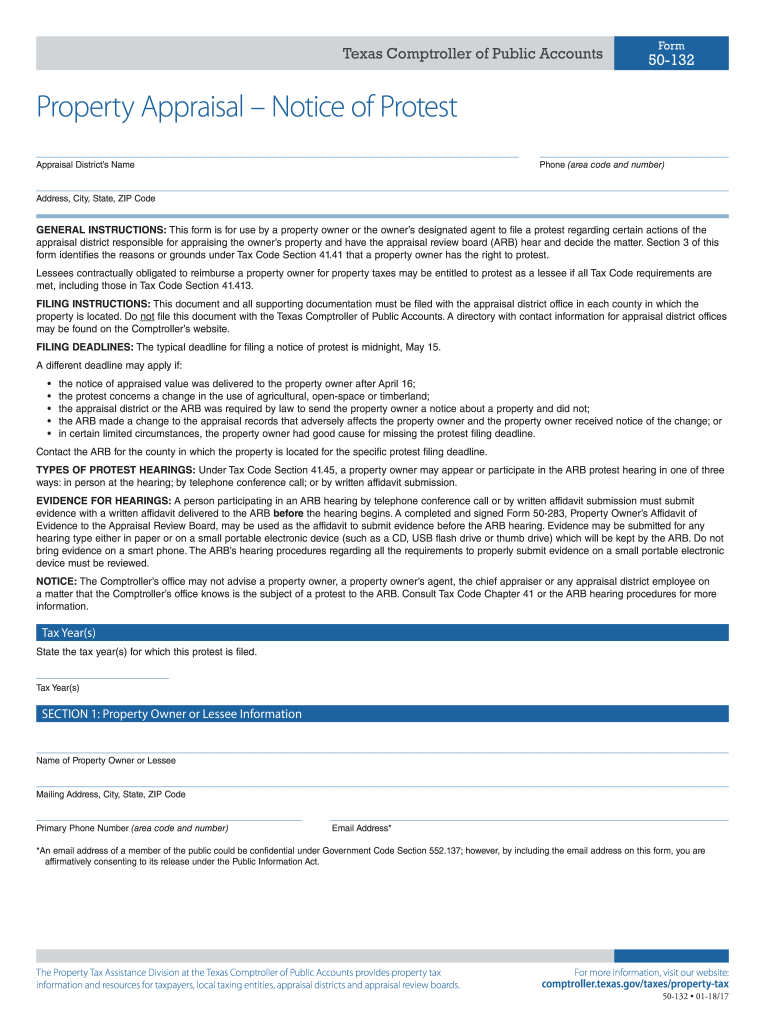

The Form 50 132 is a Texas property tax form used to protest the appraised value of a property. This form is essential for property owners who believe their property has been overvalued by the local appraisal district. By submitting this form, taxpayers initiate the process to formally challenge the assessed value, which can lead to a potential reduction in property taxes. Understanding the specifics of this form is crucial for effective participation in the property tax system in Texas.

How to use the Form 50 132

Using the Form 50 132 involves several straightforward steps. First, property owners must accurately complete the form, providing necessary details such as the property’s identification number and the appraised value they are contesting. Next, they should gather supporting documentation that substantiates their claim, such as comparable property sales or evidence of property condition. Once completed, the form must be submitted to the appropriate appraisal review board within the designated timeframe to ensure the protest is considered.

Steps to complete the Form 50 132

To effectively complete the Form 50 132, follow these steps:

- Obtain the form from the Texas Comptroller's website or your local appraisal district.

- Fill in the required information, including property details and the reason for the protest.

- Attach any relevant evidence that supports your claim, such as photographs or sales data.

- Review the completed form for accuracy and completeness.

- Submit the form to the local appraisal review board by the specified deadline.

Legal use of the Form 50 132

The legal use of the Form 50 132 is governed by Texas property tax laws. Property owners have the right to protest their property’s appraised value, and this form serves as the official notice of that protest. It is important to adhere to all legal requirements, including submission deadlines and the inclusion of necessary documentation. Failure to comply with these regulations may result in the dismissal of the protest.

Form Submission Methods

The Form 50 132 can be submitted through various methods to accommodate different preferences. Property owners may choose to file the form online through the local appraisal district's website, which is often the fastest option. Alternatively, they can submit the form by mail or deliver it in person to the appraisal review board. Each method has its own considerations, such as processing times and confirmation of receipt.

Key elements of the Form 50 132

Understanding the key elements of the Form 50 132 is crucial for a successful protest. The form typically includes sections for:

- Property identification, including the account number and physical address.

- The appraised value being contested.

- Reasons for the protest, which should be clearly articulated.

- Supporting evidence that backs the protest claims.

Completing these sections accurately ensures that the protest is valid and increases the chances of a favorable outcome.

Quick guide on how to complete property appraisal notice of protest texas comptroller texasgov

Your assistance manual on how to prepare your Form 50 132

If you’re interested in understanding how to finish and submit your Form 50 132, here are some brief instructions on how to simplify tax reporting.

To get started, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an intuitive and powerful document management solution that enables you to edit, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and return to modify details as necessary. Streamline your tax administration with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to complete your Form 50 132 in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form 50 132 in our editor.

- Populate the required fillable sections with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can increase return errors and delay refunds. Before e-filing your taxes, make sure to consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct property appraisal notice of protest texas comptroller texasgov

FAQs

-

My 2019 property tax appraisal came back way too high, how do I protest this with the state of Texas?

The due date to request a protest hearing for real estate values in Texas is typically May 15th. The statutes give you 30 days from when you receive the county notice of an increase in assessed value as of January 1st. Counties start their mailings on April 12th to ensure receipt by April 15th. If the mailing was sent late, then you still have 30 days from date of receipt. Hence, look at the postmark date on your notice and keep the envelope if it was mailed after April 12th. If your property is zoned commercial and the increase exceeds 30%, you still have time to protest. Residential property assessed values cannot be increased by more than 10% per year.The hearing last 15 minutes and only a small portion is given to you to state your case. Most people are clueless about what evidence is impermissible and squander their allotted time only to feel ignored. Either spend a week or two studying the statutes and more hours gathering your support or outsource to a licensed Senior Property Tax Consultant or CPA who specializes in helping taxpayers with protesting property values. I happen to have both licenses. We have over 300 properties to protest this season. Actual sales data for comparable sales must be less than 18 months old and be actual sales, not offers or reduced asking prices. Sales data must be presented in appraiser format to add/remove property features to make the comparison comparable. Other strategies vary depending on what county your property is in.You can request an informal hearing if you filed your protest on time but don’t be surprised if the county assessor omits data favourable to your case.If your property was under construction on January 1st, then you will need evidence of payments made for various stages up to January 1st and afterwards to help derive what value existed as of January 1st. If the county’s drone pic and permit data is after January 1st, you will likely win a reduced value.Fees to protest start at 30% of savings down to 20% or lower if you have multiple properties to protest.

-

How do I probate an old will to get property out of it in Texas?

As a general rule you are supposed to probate the will of a Texas resident within 4 years of their death. However, there are exceptions. One exception would be if the will was made outside of Texas. The other exception is when a person was not in “default” in failing to probate the will. Exactly what “default” means is not something I know off the top of my head and would need to research.As a general rule, most probates are uncontested so filing an application for an old will and alleging that the administrator is not in default would probably go unchallenged and the will would be admitted to probate.There may be alternatives to probate to transfer property however that would depend upon what the buyer of the property requires. It’s best to consult an attorney and provide them all the facts of the case.

-

Looking to buy a tract of land in Texas. The Texas RR commission shows a gas line on the property, the survey does not, not an emergency and don't own the land, so how do we find out whether there is actually a pipeline on the property?

Pull title on the land. Somewhere along the line you should find a pipeline easement. Usually the holder of that easement will be who you would contact. It is a bit of a puzzler that the surveyor did not show this on his survey.This is a bit imprecise and you still may need to do other investigation such as looking at adjoining properties or as someone suggested a satellite image (Brilliant idea by the way!)

-

My ex moved out without any notice, left most of her junk, doesn't intend to pay rent, and is still on the lease. Our apartment is in Texas, how long do I have to wait before I can throw her stuff out?

You can start action this week:Speak to the landlord first in regards to the lease and rent. *If you can contact your ex, ask what she wants done with her belongings. If she says you can have it, don’t dump it out on the street or you can get fined. Instead, call your city sanitation dept for instructions on how to dispose of it legally. *If your ex is your wife and you want a divorce, see an attorney. *

-

How should I proceed? My tenant is out of the country for at least 3 months. I have not received rent, and there is no communication. I can't evict because there is no one there to be served. Can I class the property as abandoned? I am in Texas.

You can always evict for non-payment in Texas. Here, the Constable must make six attempts in not less than 10 days to do the process service face-to-face.If that doesn’t happen, he can get permission from the Justice Of The Peace to tape it to the front door and just walk away. Also, he can try alternative service, such as Certified Mail.The better option, though is to pursue abandonment if you can. That doesn’t take 6–7 weeks and cost hundreds of dollars.Check your lease to see what it says about Abandonment, because the Texas Property Code does not define it at all.If your lease doesn’t specify what Abandonment is, then it gets down to “your reasonable judgment” as to whether an abandonment notice was appropriate.It would be a good idea if he was behind on rent AND his utilities were not active. Does he have electricity and water on?Assuming that he left all his furniture behind (and that DOES happen sometimes when a tenant abandons), it would be a good idea to pack it up and store it for at least 30 days. You can charge him for the packing, moving and storage if he comes for it, or if he doesn’t, you can sell it in a garage sale or whatever to cover it, and apply any overage to back rent.Rent not paid plus tenant not present at the property, for a while (usually 7–10 days) will usually be sufficient for Abandonment.The tenant never has to be present at a property to remain a tenant, so long as the rent is always paid up current.In order to prove the tenant hasn’t been present, you need to re-key the locks, and that is a procedure in itself.To re-key, you must post a notice on the outside and inside of the front door saying locks will be re-keyed three days later., with your contact information.After the locks are changed, a notice must be posted on the outside of the front door, telling your tenant where he can come to pick up his new key.If there is no request for the key, that is documentation that the tenant hasn’t been back to the house since locks were changed.Then, you need to post an Abandonment Notice on the outside and the inside of the front door, giving the tenant at least two days to contact you and say the property is NOT abandoned, including a phone number and address where they can accomplish that.The Texas Association Of Realtors changed their TAR lease a few years ago to eliminate the requirement that tenant not be present.Instead, it says:You have abandoned the dwelling when all of the following have occurred:(1) everyone appears to have moved out in our reasonable judgment;(2) clothes, furniture, and personal belongings have been substantially removed in our reasonable judgment;(3) you’ve been in default for non-payment of rent for 5 consecutive days, or water, gas, or electric service for the dwelling not connected in our name has been terminated or transferred;and (4) you’ve not responded for 2 days to our notice left on the inside of the main entry door, stating that we consider the dwelling abandoned.Surrender, abandonment, or judicial eviction ends your right of possession for all purposes and gives us the immediate right to: clean up, make repairs in, and relet the dwelling; determine any security deposit deductions; and remove property left in the dwelling. Surrender, abandonment, and judicial eviction affect your rights to property left in the dwelling (paragraph 13), but do not affect our mitigation obligations

Create this form in 5 minutes!

How to create an eSignature for the property appraisal notice of protest texas comptroller texasgov

How to generate an electronic signature for the Property Appraisal Notice Of Protest Texas Comptroller Texasgov in the online mode

How to make an eSignature for the Property Appraisal Notice Of Protest Texas Comptroller Texasgov in Chrome

How to create an electronic signature for putting it on the Property Appraisal Notice Of Protest Texas Comptroller Texasgov in Gmail

How to generate an electronic signature for the Property Appraisal Notice Of Protest Texas Comptroller Texasgov right from your smartphone

How to make an eSignature for the Property Appraisal Notice Of Protest Texas Comptroller Texasgov on iOS devices

How to generate an eSignature for the Property Appraisal Notice Of Protest Texas Comptroller Texasgov on Android devices

People also ask

-

What are texas property tax forms comptroller forms texas?

Texas property tax forms comptroller forms Texas refer to the official documentation required for property tax purposes in Texas. These forms are essential for property owners to report, file, and appeal property tax assessments to the Texas Comptroller's office.

-

How can airSlate SignNow help with texas property tax forms comptroller forms texas?

airSlate SignNow streamlines the process of filling out and eSigning texas property tax forms comptroller forms Texas. With its user-friendly platform, you can effortlessly manage these important forms, ensuring that your submissions are timely and accurate.

-

Are there any fees associated with using airSlate SignNow for texas property tax forms comptroller forms texas?

While airSlate SignNow offers various pricing plans, costs associated with using it for texas property tax forms comptroller forms Texas are typically lower than traditional methods. Users can choose from monthly or annual subscriptions based on their needs, and many find it a cost-effective solution.

-

What features does airSlate SignNow offer for managing texas property tax forms comptroller forms texas?

airSlate SignNow provides features such as eSigning, secure document storage, and customizable templates specifically for texas property tax forms comptroller forms Texas. These features simplify the filing process and enhance the overall user experience.

-

Can I integrate airSlate SignNow with other software for texas property tax forms comptroller forms texas?

Yes, airSlate SignNow offers integration capabilities with popular software, making it easy to manage texas property tax forms comptroller forms Texas alongside your existing systems. This interoperability allows for greater efficiency and data management.

-

Is airSlate SignNow suitable for businesses of all sizes when handling texas property tax forms comptroller forms texas?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an excellent choice for managing texas property tax forms comptroller forms Texas. Whether a small business or a large corporation, users can benefit from its scalable features.

-

What are the benefits of using airSlate SignNow for texas property tax forms comptroller forms texas?

Using airSlate SignNow for texas property tax forms comptroller forms Texas offers numerous benefits, including increased efficiency, reduced paperwork, and the convenience of eSigning. This can lead to faster processing times and fewer errors in tax submissions.

Get more for Form 50 132

- Idaho w 4 form

- Ealth history form ada american dental association

- Dangerous goods manifest form

- Zaproszenie dla cudzoziemca wzr pdf form

- V 3 200 15apdf 100372720 form

- Autocertificazione matrimonio form

- Authorization for disclosure of medical or dental information

- Affidavit for change of signature tata steel form

Find out other Form 50 132

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online