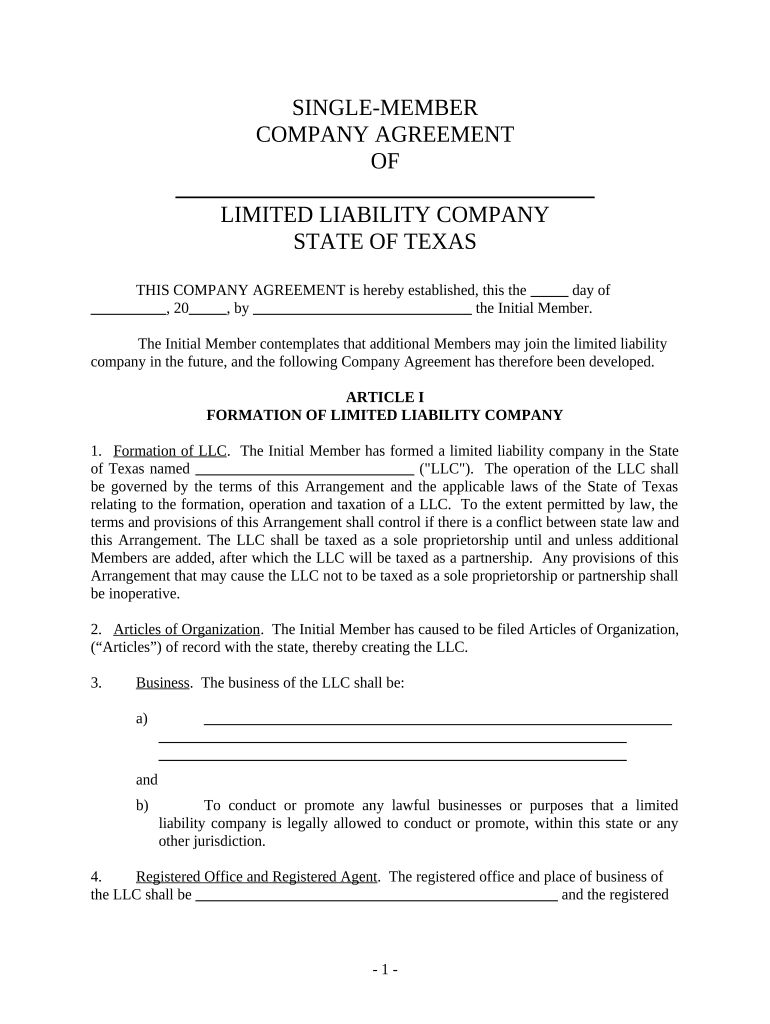

Texas Company Llc Form

What is the Texas Company LLC?

The Texas Company LLC is a legal business structure that combines the benefits of a corporation and a partnership. It allows for limited liability protection, meaning that the personal assets of the owners, also known as members, are generally protected from business debts and liabilities. This structure is popular among small business owners in Texas due to its flexibility in management and taxation options. An LLC can be owned by one or more members, and it can be managed by its members or designated managers.

How to Obtain the Texas Company LLC

To obtain a Texas Company LLC, you must follow a series of steps. First, choose a unique name for your LLC that complies with Texas naming requirements. Next, designate a registered agent who will receive legal documents on behalf of the LLC. After that, file the Certificate of Formation with the Texas Secretary of State, which includes essential information such as the LLC's name, registered agent, and address. There is a filing fee associated with this form. Once approved, you will receive a Certificate of Formation, officially establishing your LLC.

Steps to Complete the Texas Company LLC

Completing the Texas Company LLC involves several key steps:

- Choose a Name: Ensure the name is unique and includes "LLC" or "Limited Liability Company."

- Designate a Registered Agent: This can be an individual or a business entity authorized to conduct business in Texas.

- File the Certificate of Formation: Submit this document to the Texas Secretary of State, either online or by mail.

- Create an Operating Agreement: Although not required, this document outlines the management structure and operating procedures of the LLC.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS for tax purposes.

Legal Use of the Texas Company LLC

The Texas Company LLC can be used for various business activities, providing a legal framework that protects members from personal liability. This structure is suitable for small businesses, startups, and even larger enterprises looking for flexibility in management and taxation. It is essential to comply with state laws and regulations, including filing annual reports and maintaining proper records to ensure the LLC remains in good standing.

Key Elements of the Texas Company LLC

Several key elements define a Texas Company LLC:

- Limited Liability Protection: Members are not personally liable for the LLC's debts.

- Flexible Management Structure: Members can choose to manage the LLC themselves or appoint managers.

- Pass-Through Taxation: Income is typically taxed at the member level, avoiding double taxation.

- Fewer Formalities: Unlike corporations, LLCs have fewer ongoing compliance requirements.

State-Specific Rules for the Texas Company LLC

Texas has specific rules governing the formation and operation of LLCs. These include naming requirements, the necessity of a registered agent, and the filing of annual reports. Additionally, Texas law mandates that LLCs maintain certain records, such as financial statements and meeting minutes. Understanding these state-specific rules is crucial for compliance and maintaining the LLC's good standing.

Quick guide on how to complete texas company llc

Manage Texas Company Llc effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without hindrances. Handle Texas Company Llc on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Texas Company Llc with ease

- Find Texas Company Llc and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a customary wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Texas Company Llc and ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Company LLC and how does it benefit my business?

A Texas Company LLC is a limited liability company registered in Texas, providing personal liability protection for its owners while offering flexibility in management and tax treatment. By choosing a Texas Company LLC, you can safeguard your personal assets from business debts and liabilities, making it an ideal structure for small businesses.

-

How much does it cost to form a Texas Company LLC?

The cost to form a Texas Company LLC typically includes a filing fee payable to the Texas Secretary of State, which is currently around $300. Additionally, there may be costs for obtaining an EIN, legal assistance, or any desired licenses. Overall, setting up a Texas Company LLC is a cost-effective investment for aspiring business owners.

-

What features does airSlate SignNow offer for a Texas Company LLC?

airSlate SignNow provides a range of features suitable for Texas Company LLCs, including electronic signatures, document templates, and a secure cloud storage system. These tools streamline the signing process and enhance collaboration among team members, all while ensuring compliance with Texas laws.

-

Can I integrate airSlate SignNow with other tools for my Texas Company LLC?

Yes, airSlate SignNow offers integrations with popular tools like Google Workspace, Salesforce, and Microsoft Office, making it easier to manage your Texas Company LLC’s documents. These integrations allow seamless workflow automation and enhance productivity within your organization.

-

What are the benefits of eSigning documents for a Texas Company LLC?

eSigning documents for your Texas Company LLC enhances efficiency by reducing the time required for document turnaround and eliminating the need for physical paperwork. Additionally, it provides security and compliance with electronic signature laws, ensuring your signed documents are legally binding.

-

Is airSlate SignNow easy to use for a Texas Company LLC?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those who may not be tech-savvy. The intuitive interface allows Texas Company LLC owners to easily send, eSign, and manage their documents without any extensive training.

-

What types of documents can a Texas Company LLC send using airSlate SignNow?

Texas Company LLCs can use airSlate SignNow to send a variety of documents, including contracts, agreements, waivers, and employee onboarding forms. This versatility helps streamline operations and keep your business organized.

Get more for Texas Company Llc

Find out other Texas Company Llc

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document