Texas Commercial Lease Form

What is the Texas Commercial Lease?

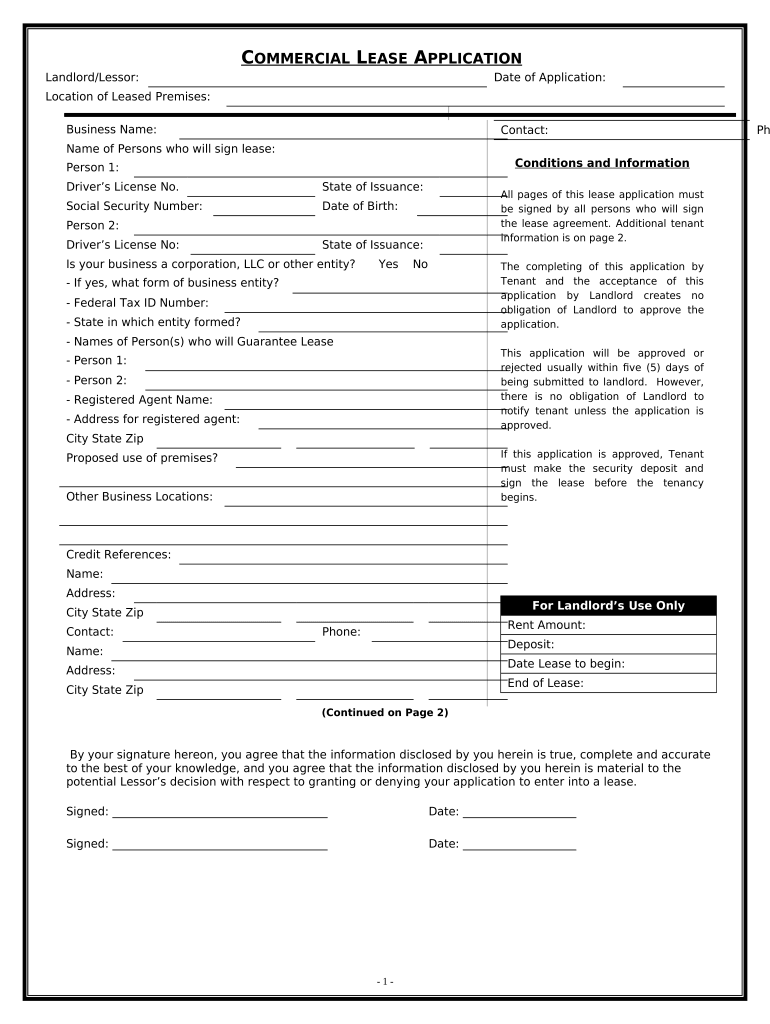

The Texas commercial lease is a legally binding agreement between a landlord and a business tenant, outlining the terms and conditions for renting commercial property in Texas. This document specifies key details such as the duration of the lease, rental payments, property maintenance responsibilities, and any restrictions on the use of the property. Understanding the components of a commercial lease is essential for both parties to ensure compliance with Texas laws and to protect their interests.

Key Elements of the Texas Commercial Lease

A comprehensive Texas commercial lease includes several critical elements that define the relationship between the landlord and tenant. These elements typically consist of:

- Parties Involved: Identification of the landlord and tenant, including their legal names and contact information.

- Property Description: A detailed description of the commercial property being leased, including its address and any specific features.

- Lease Term: The duration of the lease, specifying the start and end dates.

- Rent Payment Terms: The amount of rent due, payment frequency, and acceptable payment methods.

- Security Deposit: Information regarding the security deposit, including the amount and conditions for its return.

- Maintenance Responsibilities: Clear delineation of responsibilities for property maintenance and repairs between the landlord and tenant.

- Termination Conditions: Terms under which the lease can be terminated by either party.

Steps to Complete the Texas Commercial Lease

Completing a Texas commercial lease involves several important steps to ensure that the document is legally binding and accurately reflects the agreement between the parties. Follow these steps:

- Review the Lease Terms: Carefully read through the lease agreement to understand all terms and conditions.

- Negotiate Terms: Discuss any terms that may need modification or clarification with the other party.

- Fill Out the Lease: Complete the lease form with accurate information, ensuring all required fields are filled.

- Sign the Lease: Both parties should sign the lease in the presence of a witness or notary, if required.

- Distribute Copies: Provide each party with a signed copy of the lease for their records.

Legal Use of the Texas Commercial Lease

The legal use of a Texas commercial lease hinges on compliance with state laws governing lease agreements. It is essential that both parties understand their rights and obligations under the lease. The lease must adhere to the Texas Property Code and other relevant regulations to be enforceable in court. Additionally, utilizing a reliable eSignature platform can help ensure that the lease is executed properly, maintaining its legal validity.

How to Obtain the Texas Commercial Lease

Obtaining a Texas commercial lease can be done through various means. Many landlords provide their own lease agreements, which can be tailored to specific properties. Additionally, templates are available online for download. It is advisable to consult with a legal professional to review any lease agreement before signing to ensure it meets all legal requirements and adequately protects your interests.

State-Specific Rules for the Texas Commercial Lease

Texas has specific regulations that govern commercial leases, including provisions related to security deposits, maintenance obligations, and termination rights. Understanding these state-specific rules is crucial for both landlords and tenants. For instance, Texas law limits the amount a landlord can charge for a security deposit and outlines the timeline for its return after the lease ends. Familiarizing oneself with these rules can help prevent disputes and ensure compliance with state laws.

Quick guide on how to complete texas commercial lease

Prepare Texas Commercial Lease effortlessly on any device

Online document organization has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Texas Commercial Lease on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to change and eSign Texas Commercial Lease with ease

- Locate Texas Commercial Lease and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and has the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Texas Commercial Lease and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a TX lease agreement?

A TX lease agreement is a legally binding contract between a landlord and tenant, outlining the terms and conditions of renting a property in Texas. It includes details such as the rental amount, lease duration, and responsibilities of both parties. Utilizing airSlate SignNow helps streamline the process of creating and signing TX lease agreements electronically.

-

How does airSlate SignNow simplify the TX lease agreement signing process?

airSlate SignNow provides an intuitive platform that allows both landlords and tenants to electronically sign TX lease agreements from anywhere, at any time. This eliminates the need for physical paperwork and enhances the speed of the transaction. Features like template storage and document tracking further simplify the signing process.

-

What are the pricing options for using airSlate SignNow for TX lease agreements?

airSlate SignNow offers several pricing plans that cater to different needs, from small businesses to large enterprises. The plans provide flexible options for sending and signing TX lease agreements without breaking the bank. You can choose a plan that best fits your leasing needs and budget.

-

Can I customize my TX lease agreement using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your TX lease agreement templates to fit specific requirements. You can add fields, clauses, and terms that are pertinent to your leasing situation, ensuring that your document meets all legal standards in Texas. This flexibility helps in creating personalized and compliant lease agreements.

-

What features does airSlate SignNow offer for TX lease agreements?

airSlate SignNow offers features such as document templates, secure eSignatures, real-time notifications, and integration with popular platforms. These tools enhance the efficiency of managing TX lease agreements, making it easy to track the document’s status and ensure both parties receive timely updates.

-

Is airSlate SignNow secure for signing TX lease agreements?

Absolutely! airSlate SignNow employs top-notch security measures such as encryption and multi-factor authentication to protect your TX lease agreements. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for managing TX lease agreements?

Yes, airSlate SignNow integrates seamlessly with numerous applications, including CRM systems, cloud storage services, and project management tools. This allows you to manage your TX lease agreements alongside other business processes efficiently. The integration capability enhances usability and improves workflow automation.

Get more for Texas Commercial Lease

- Consensus auditory perceptual evaluation of voice cape v specialed spps form

- H6 dmv ca form

- Stanford house staff wellness survey stepsforwardorg stepsforward form

- Organelle function checklist form

- Waiver form 242513262

- Csc renewal verification of bedside hours aacn form

- S 2323 1 16 wellmark inc statewide universal practitioner credentialing applicaiton addendum form

- Divorce questionnaire divorce client questionnaire law office of john millard form

Find out other Texas Commercial Lease

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself