Tx Living Trust Form

What is the Tx Living Trust

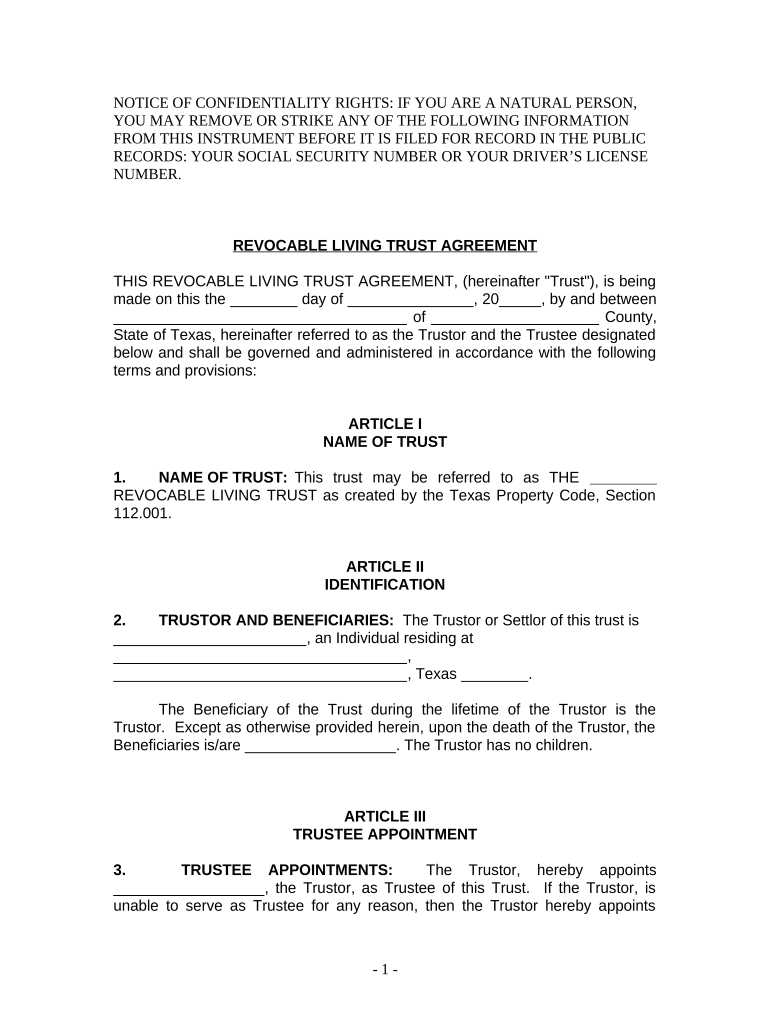

A Tx living trust is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. Unlike a will, a living trust can help avoid probate, which is the legal process of distributing a deceased person's estate. This can lead to a quicker and more private transfer of assets. The trust is created while the individual is still alive and can be altered or revoked at any time, providing flexibility in estate planning.

Key elements of the Tx Living Trust

Several key elements define a Tx living trust. First, it requires a grantor, who is the person creating the trust, and a trustee, who manages the trust's assets. The grantor can also serve as the trustee during their lifetime. Additionally, the trust must clearly outline the beneficiaries, who will receive the assets upon the grantor's death. Another important aspect is the funding of the trust, which involves transferring ownership of assets into the trust to ensure they are managed according to the trust's terms.

Steps to complete the Tx Living Trust

Completing a Tx living trust involves several steps. First, individuals should assess their assets and decide which ones to include in the trust. Next, they need to choose a reliable trustee, which could be themselves or another trusted individual. After that, they can draft the trust document, outlining the terms, beneficiaries, and any specific instructions for asset distribution. Once the document is prepared, it should be signed and notarized to ensure its legal validity. Finally, transferring the chosen assets into the trust is crucial to make it effective.

Legal use of the Tx Living Trust

The Tx living trust is legally recognized in Texas and can be used to manage a wide range of assets, including real estate, bank accounts, and investments. To ensure that the trust is legally binding, it must comply with Texas state laws. This includes proper execution, such as notarization and witnessing, depending on the type of trust. It is important to regularly review and update the trust to reflect any changes in personal circumstances or state laws.

How to obtain the Tx Living Trust

Obtaining a Tx living trust typically involves consulting with an estate planning attorney or using a reputable online legal service. An attorney can provide personalized guidance based on individual needs and ensure that the trust complies with Texas laws. Alternatively, individuals can find templates and resources online to create their own living trust, though it is advisable to have any drafted document reviewed by a legal professional to avoid potential issues.

State-specific rules for the Tx Living Trust

Texas has specific rules governing living trusts that differ from other states. For instance, Texas does not require living trusts to be recorded, but it is essential to ensure that all assets are properly transferred into the trust. Additionally, Texas law allows for the creation of both revocable and irrevocable trusts, each serving different purposes. Understanding these state-specific regulations is crucial for effective estate planning and ensuring the trust operates as intended.

Quick guide on how to complete tx living trust

Complete Tx Living Trust effortlessly on any device

Online document handling has gained popularity among enterprises and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Tx Living Trust on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Tx Living Trust with ease

- Find Tx Living Trust and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you prefer. Edit and electronically sign Tx Living Trust and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a TX living trust, and how does it work?

A TX living trust is a legal document that allows you to manage your assets during your lifetime and distribute them after your death. It bypasses the probate process, making it easier for your beneficiaries to inherit your estate. By establishing a TX living trust, you can maintain control over your assets while ensuring they are distributed according to your wishes.

-

How can airSlate SignNow assist in creating a TX living trust?

airSlate SignNow provides a user-friendly interface that simplifies the process of creating a TX living trust. With our eSignature capabilities, you can easily sign and share your living trust documents securely. This digital solution is both efficient and cost-effective, helping you save time and avoid the complexities associated with traditional paper processes.

-

What are the benefits of using airSlate SignNow for my TX living trust?

Using airSlate SignNow for your TX living trust offers various benefits, including increased efficiency and security. Our platform allows you to store, sign, and manage your documents all in one place, ensuring easy access at any time. Additionally, eSigning eliminates the need for physical meetings, helping to streamline the entire process.

-

Is there a cost associated with creating a TX living trust through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for your TX living trust. However, our pricing plans are competitive and cater to various needs and budgets. You'll find that our cost-effective solutions provide signNow value compared to traditional legal services.

-

Can I customize my TX living trust using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your TX living trust documents to fit your specific needs. You can modify terms, asset distributions, and guardianship provisions within our platform to ensure your living trust aligns perfectly with your intentions.

-

What kind of support does airSlate SignNow offer for TX living trust users?

airSlate SignNow offers excellent support for users creating a TX living trust. Our customer service team is available to assist you with any questions or concerns you may have while using our platform. Additionally, we provide comprehensive tutorials and resources to guide you through the entire process.

-

Are there any legal requirements for a TX living trust?

Yes, there are specific legal requirements for a TX living trust to be valid, including proper wording and witnessing. It's important to ensure that your TX living trust complies with Texas state laws to avoid potential issues. By using airSlate SignNow, you can access templates and resources that adhere to these legal standards.

Get more for Tx Living Trust

Find out other Tx Living Trust

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF