Texas Trust Property Form

What is the Texas Trust Property

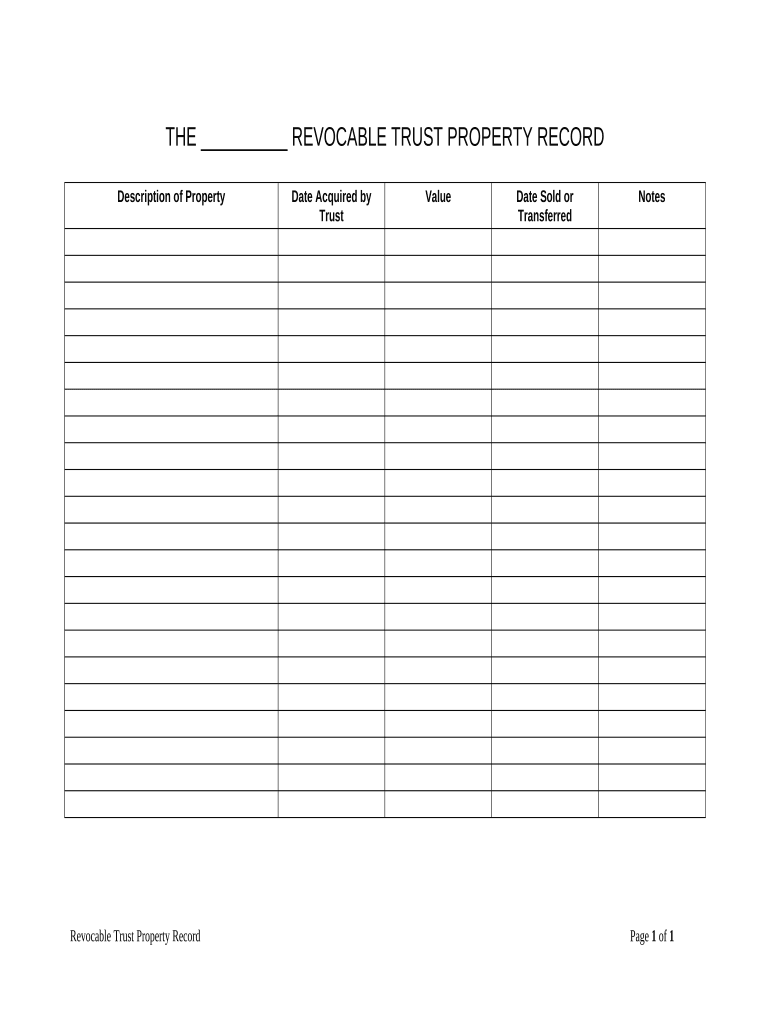

The Texas Trust Property refers to a legal arrangement where property is held by one party for the benefit of another. This type of property ownership is governed by Texas law and is often used in estate planning, allowing individuals to manage their assets effectively. Trusts can be revocable or irrevocable, impacting how assets are handled during the grantor's lifetime and after their death. Understanding the nuances of Texas Trust Property is essential for ensuring compliance with state regulations and for achieving specific financial goals.

How to use the Texas Trust Property

Using Texas Trust Property involves several steps, including establishing the trust, transferring assets, and managing the trust according to its terms. Initially, a trust document must be created, outlining the purpose of the trust, the trustee's responsibilities, and the beneficiaries' rights. Once established, assets such as real estate, investments, or personal property can be transferred into the trust. Ongoing management may involve regular reporting to beneficiaries and adhering to any specific instructions set forth in the trust document.

Legal use of the Texas Trust Property

The legal use of Texas Trust Property is defined by state law, which outlines the rights and responsibilities of trustees and beneficiaries. Trustees must act in the best interests of the beneficiaries, adhering to the terms of the trust and Texas trust law. This includes maintaining accurate records, making prudent investment decisions, and distributing assets according to the trust's provisions. Legal compliance is crucial to avoid disputes and ensure that the trust operates smoothly.

Steps to complete the Texas Trust Property

Completing the Texas Trust Property involves a series of methodical steps:

- Draft the trust document, specifying the terms and conditions.

- Choose a reliable trustee who will manage the trust.

- Transfer assets into the trust, ensuring proper documentation.

- Notify beneficiaries of their rights and the trust's existence.

- Regularly review and update the trust as necessary to reflect changes in circumstances.

Key elements of the Texas Trust Property

Key elements of Texas Trust Property include the trust document, the trustee, the beneficiaries, and the assets held within the trust. The trust document serves as the foundational legal agreement, detailing the purpose and management of the trust. The trustee is responsible for overseeing the trust's operations, while beneficiaries are the individuals or entities entitled to receive benefits from the trust. The assets can vary widely, encompassing real estate, financial accounts, and personal property.

Eligibility Criteria

Eligibility to create or benefit from Texas Trust Property typically requires the grantor to be of legal age and mentally competent. Additionally, the trust must have a lawful purpose, such as estate planning, charitable giving, or asset protection. Beneficiaries can be individuals, organizations, or even pets, depending on the trust's design. It's important to consult legal guidance to ensure that all eligibility criteria are met and that the trust complies with Texas law.

Quick guide on how to complete texas trust property

Effortlessly Prepare Texas Trust Property on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle Texas Trust Property on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The Easiest Way to Modify and eSign Texas Trust Property Stress-Free

- Obtain Texas Trust Property and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your changes.

- Select your preferred method of sharing the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that require reprinting documents. airSlate SignNow addresses your document management needs with just a few clicks from your device of choice. Modify and eSign Texas Trust Property while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a texas trust property?

A texas trust property refers to real estate that is managed by a trust in the state of Texas. The trust controls the property for the benefit of designated beneficiaries. Understanding how texas trust property works is essential for estate planning and asset management.

-

How can airSlate SignNow help with texas trust property documentation?

airSlate SignNow provides a seamless platform to manage all documentation related to texas trust property. With our eSigning capabilities, you can easily send, sign, and securely store important trust documents. This ensures that all transactions involving texas trust property are legally binding and efficiently managed.

-

What are the benefits of using airSlate SignNow for texas trust property transactions?

Using airSlate SignNow for texas trust property transactions streamlines the signing process, saving time and reducing errors. Our platform offers secure document storage and easy access to important files, making it a perfect choice for managing texas trust properties. Additionally, it enhances transparency and communication among all stakeholders.

-

Are there any specific features in airSlate SignNow for managing texas trust property?

Yes, airSlate SignNow offers features specifically designed for managing texas trust property, including customizable templates for trust documents and automated workflows. You can set reminders for important deadlines, track document statuses, and integrate your management processes seamlessly. These features make handling texas trust property both efficient and user-friendly.

-

How much does airSlate SignNow cost for texas trust property management?

The pricing for airSlate SignNow depends on the plan you choose, with options suitable for individuals and businesses managing texas trust property. We offer competitive pricing that provides exceptional value for the features available to assist with trust documentation. You can request a quote to understand the best plan for your needs.

-

Can airSlate SignNow integrate with other tools related to texas trust property?

Absolutely! airSlate SignNow offers integrations with numerous tools that can assist with managing texas trust property, including CRM systems, cloud storage, and accounting platforms. This interoperability enhances your workflow efficiency, as you can manage all aspects of texas trust property transactions in one ecosystem.

-

What types of users benefit from using airSlate SignNow for texas trust property?

Various users can benefit from airSlate SignNow when it comes to texas trust property, including estate planners, real estate agents, and property managers. Whether you need to execute a trust agreement or track property transfers, our platform is designed to cater to the unique needs of anyone involved with texas trust property. Our user-friendly interface makes it accessible to all skill levels.

Get more for Texas Trust Property

Find out other Texas Trust Property

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast