Income Tax Forms 2022-2026

What is the Income Tax Forms

Income tax forms are official documents used by individuals and businesses to report their income, calculate their tax liability, and claim deductions or credits. These forms are essential for compliance with federal and state tax laws in the United States. The Internal Revenue Service (IRS) oversees the creation and distribution of these forms, which vary based on the type of taxpayer and the nature of the income being reported. Common forms include the 1040 for individual taxpayers, the W-2 for wage earners, and the 1099 series for independent contractors and other non-employment income.

How to obtain the Income Tax Forms

Obtaining income tax forms is a straightforward process. Taxpayers can access these forms through several channels:

- Visit the IRS website for downloadable versions of all federal income tax forms.

- Request forms by mail from the IRS by calling their customer service line.

- Visit local IRS offices or libraries that may have physical copies available.

- Utilize tax preparation software that often includes the necessary forms for filing.

Steps to complete the Income Tax Forms

Completing income tax forms involves several key steps to ensure accuracy and compliance:

- Gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions.

- Choose the appropriate form based on your filing status and income type.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Double-check calculations, especially for income, deductions, and credits.

- Sign and date the form before submission, as an unsigned form will be considered invalid.

Legal use of the Income Tax Forms

Income tax forms must be completed and submitted in accordance with IRS regulations to be considered legally valid. This includes using the correct forms for the tax year, providing truthful information, and adhering to filing deadlines. Failure to comply can result in penalties or audits. Additionally, electronic submissions must meet specific legal standards, such as the ESIGN Act, to ensure they are recognized as legally binding.

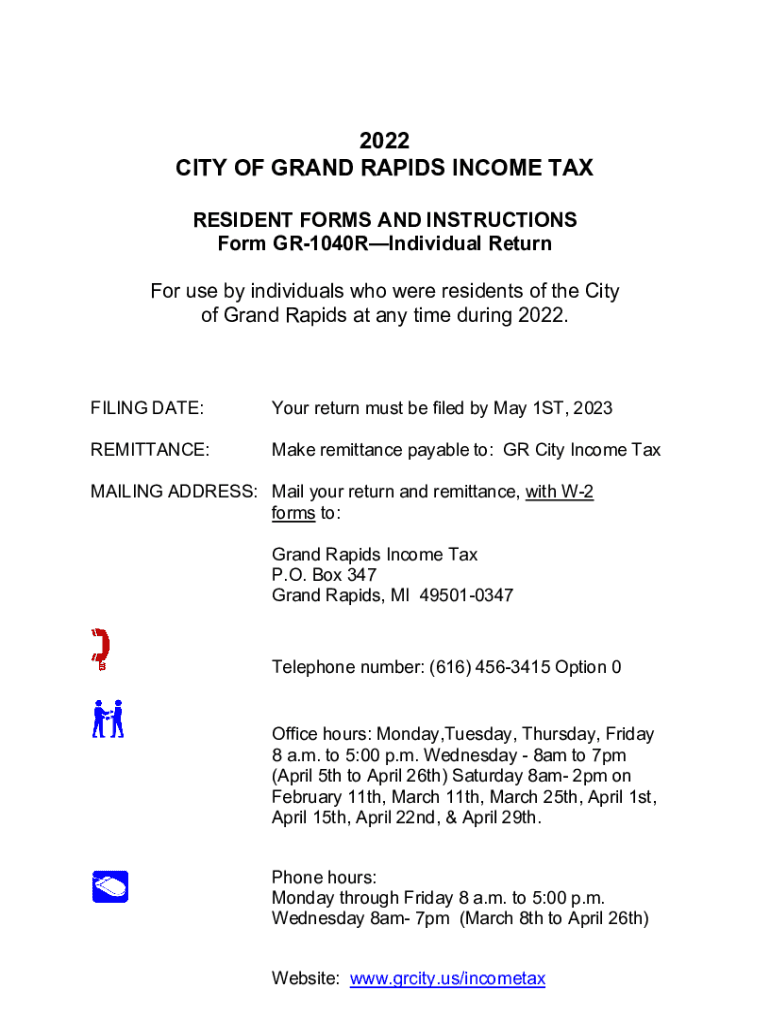

Filing Deadlines / Important Dates

Filing deadlines for income tax forms are crucial for avoiding penalties. Generally, individual taxpayers must file their federal income tax returns by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. State tax deadlines may vary, so it is important to check with local tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Income tax forms can be submitted through various methods, each with its own advantages:

- Online: Many taxpayers choose to file electronically using tax software or through the IRS e-file system, which is faster and often results in quicker refunds.

- Mail: Forms can be printed and mailed to the IRS or state tax agency. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers can also visit local IRS offices to submit forms directly, though appointments may be necessary.

Quick guide on how to complete income tax forms 473151079

Prepare Income Tax Forms seamlessly on any device

Web-based document administration has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Income Tax Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Income Tax Forms with ease

- Locate Income Tax Forms and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Income Tax Forms and guarantee superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax forms 473151079

Create this form in 5 minutes!

How to create an eSignature for the income tax forms 473151079

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Income Tax Forms and why are they important?

Income Tax Forms are documents used by individuals and businesses to report their earnings to the IRS and determine their tax obligations. Proper completion of these forms is crucial to ensure compliance with tax regulations and avoid potential penalties or audits.

-

How does airSlate SignNow simplify the process of filling out Income Tax Forms?

airSlate SignNow offers an intuitive platform that streamlines the process of completing Income Tax Forms. With features like easy drag-and-drop templates and automated data population, users can efficiently fill out their forms, reducing the chances of errors.

-

Can I eSign my Income Tax Forms using airSlate SignNow?

Yes, airSlate SignNow enables users to electronically sign their Income Tax Forms securely. This feature not only saves time but also enhances the legitimacy of your documents, making it easier to submit them to the IRS.

-

Are there any costs associated with using airSlate SignNow for Income Tax Forms?

airSlate SignNow offers flexible pricing plans to suit various business needs, including options for those who primarily handle Income Tax Forms. This cost-effective solution provides great value with its comprehensive features tailored for efficient document management.

-

What features does airSlate SignNow offer for managing Income Tax Forms?

airSlate SignNow includes features such as template creation, collaborative editing, and secure document storage specifically designed for managing Income Tax Forms. These tools enhance productivity and ensure that your tax preparation process is organized and efficient.

-

Is it easy to integrate airSlate SignNow with other applications for filing Income Tax Forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software, making it easy to incorporate your Income Tax Forms into your overall tax management workflow. This interoperability ensures that you can manage your documents efficiently across platforms.

-

Can airSlate SignNow help me track the status of my Income Tax Forms?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Income Tax Forms. You’ll receive notifications and updates on document completions and signatures, ensuring you're always informed about your tax-related submissions.

Get more for Income Tax Forms

Find out other Income Tax Forms

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word