Form TA 2, Transient Accommodations Tax Hawaii Gov 2022-2026

What is the Form TA 2, Transient Accommodations Tax

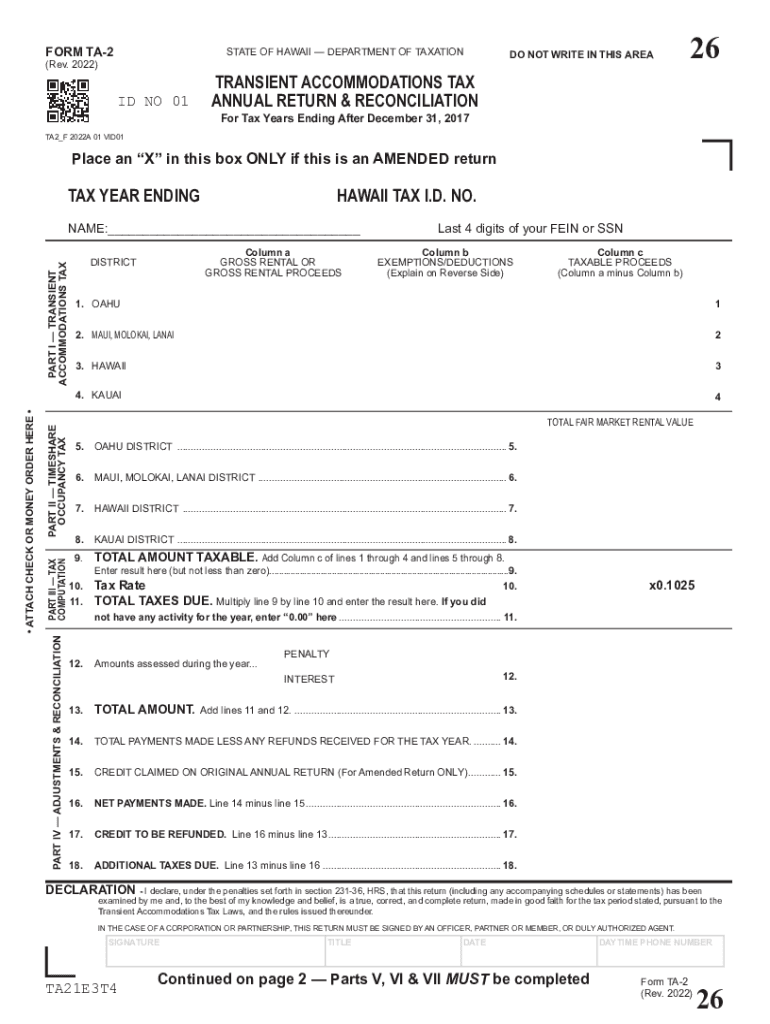

The Form TA 2, also known as the Transient Accommodations Tax (TAT) form, is a crucial document required for businesses in Hawaii that provide transient accommodations. This includes hotels, vacation rentals, and other lodging services. The form is used to report and remit the TAT, which is a tax imposed on the gross rental income received from guests. Understanding the purpose of this form is essential for compliance with state tax regulations.

Steps to complete the Form TA 2, Transient Accommodations Tax

Completing the Form TA 2 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including total rental income and any applicable deductions. Next, accurately fill out the form by entering your business details, including the name, address, and tax identification number. Calculate the total tax due based on the current TAT rate, which is typically a percentage of the gross rental income. Finally, review the form for any errors before submitting it to the appropriate state department.

Filing Deadlines / Important Dates

Timely filing of the Form TA 2 is essential to avoid penalties. The TAT is generally filed on a monthly basis, with returns due by the last day of the month following the reporting period. For instance, the return for January is due by February 28. It is important to stay informed about any changes in deadlines or requirements that may arise from state tax authorities to ensure compliance.

Legal use of the Form TA 2, Transient Accommodations Tax

The legal use of the Form TA 2 is governed by Hawaii state tax laws. This form must be completed accurately and submitted in accordance with the established guidelines to be considered valid. Electronic submissions are acceptable, provided that they comply with the legal standards for eSignatures and document integrity. Using a reliable platform for submission can enhance the legal standing of your filing.

Key elements of the Form TA 2, Transient Accommodations Tax

Several key elements must be included in the Form TA 2 for it to be complete. These elements include the taxpayer's identification information, a detailed account of the gross rental income, the calculation of the TAT owed, and any deductions that may apply. Additionally, the form requires a declaration of accuracy, affirming that all information provided is truthful and complete.

Required Documents

When completing the Form TA 2, certain documents may be required to substantiate the information provided. These documents typically include financial records that reflect rental income, invoices, and any relevant tax identification numbers. Keeping organized records can facilitate the completion of the form and ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form TA 2 can be submitted through various methods, providing flexibility for businesses. Options include online submission through the state’s tax portal, mailing a physical copy to the designated tax office, or delivering the form in person. Each method has its own guidelines and timelines, so it is important to choose the one that best fits your business needs and ensures timely compliance.

Quick guide on how to complete form ta 2 transient accommodations tax hawaiigov

Complete Form TA 2, Transient Accommodations Tax Hawaii gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without setbacks. Handle Form TA 2, Transient Accommodations Tax Hawaii gov on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Form TA 2, Transient Accommodations Tax Hawaii gov without stress

- Locate Form TA 2, Transient Accommodations Tax Hawaii gov and then click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Form TA 2, Transient Accommodations Tax Hawaii gov and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ta 2 transient accommodations tax hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form ta 2 transient accommodations tax hawaiigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii Form TA 2?

The Hawaii Form TA 2 is a tax form used for reporting and filing specific tax obligations in the state of Hawaii. It is essential for businesses operating in Hawaii to stay compliant with state tax regulations. Understanding this form will help ensure that your business meets its tax responsibilities.

-

How can airSlate SignNow help with the Hawaii Form TA 2?

airSlate SignNow provides a streamlined platform for completing, signing, and sending the Hawaii Form TA 2 digitally. This enables businesses to manage their documentation efficiently and securely without the hassle of paper-based forms. Our eSignature solution ensures that your forms are legally binding and compliant with Hawaii's regulations.

-

Is there a cost associated with using airSlate SignNow for the Hawaii Form TA 2?

Yes, there is a subscription fee for using airSlate SignNow, but it offers various pricing plans to fit different business needs. The cost is often offset by the savings in time and resources when preparing and submitting the Hawaii Form TA 2 electronically. We also provide a free trial for new users to experience the benefits before committing.

-

What features does airSlate SignNow offer for completing the Hawaii Form TA 2?

airSlate SignNow offers several features that make filling out the Hawaii Form TA 2 easier, including customizable templates, automated workflows, and cloud storage. Additionally, users can track document status in real-time and retain copies for their records. These features simplify the process and improve accuracy in form submission.

-

Can airSlate SignNow integrate with other software for processing the Hawaii Form TA 2?

Yes, airSlate SignNow integrates seamlessly with various applications and software to facilitate the processing of the Hawaii Form TA 2. Whether it's customer relationship management systems or accounting software, you can easily link your tools for more efficient document management. This integration saves time and ensures all necessary data is synchronized.

-

What are the benefits of using airSlate SignNow for the Hawaii Form TA 2?

Using airSlate SignNow for the Hawaii Form TA 2 provides several benefits, including enhanced security and reduced turnaround time for document handling. The platform’s user-friendly interface makes it easy to complete and send documents, ensuring compliance with state regulations. Moreover, it helps businesses save costs by limiting the need for physical paperwork.

-

How long does it take to complete the Hawaii Form TA 2 using airSlate SignNow?

With airSlate SignNow, completing the Hawaii Form TA 2 is a quick and efficient process. Most users can fill out and sign the form in just a matter of minutes, especially with our intuitive templates and autofill options. This speed allows businesses to focus on other important tasks instead of getting bogged down in paperwork.

Get more for Form TA 2, Transient Accommodations Tax Hawaii gov

Find out other Form TA 2, Transient Accommodations Tax Hawaii gov

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed