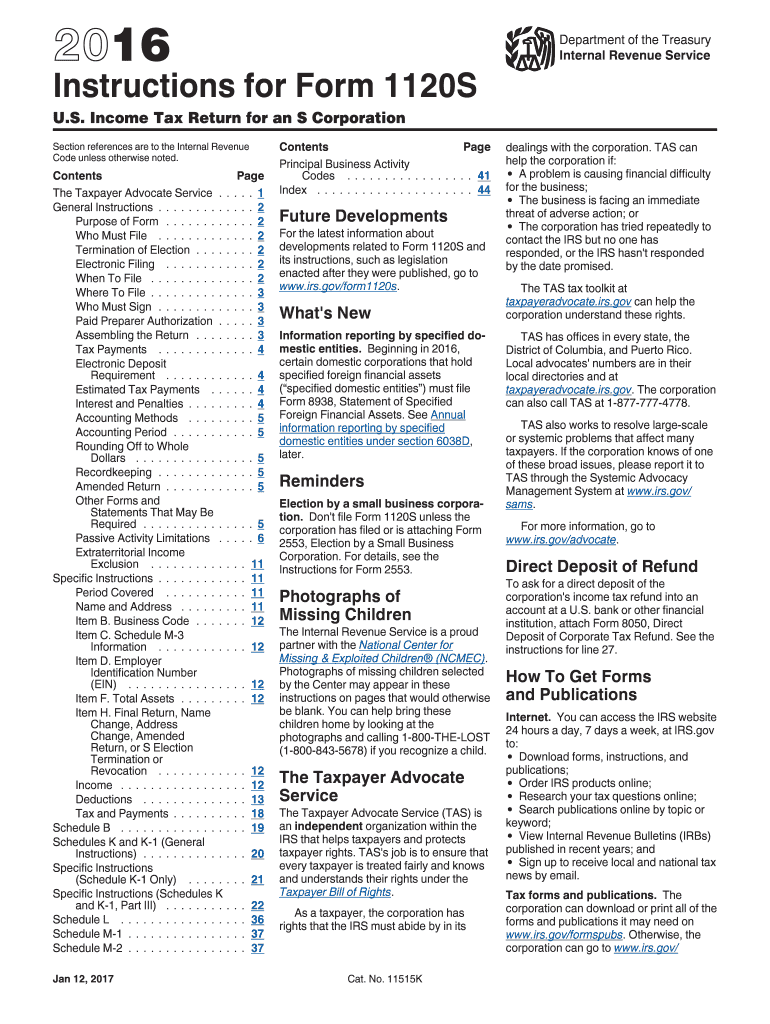

I1120s PDF Department of the Treasury Internal Revenue 2016

What is the I1120S PDF Department Of The Treasury Internal Revenue

The I1120S PDF is a tax form issued by the Department of the Treasury Internal Revenue Service (IRS) for S corporations. This form is used to report income, deductions, gains, losses, and other tax-related information. S corporations are unique business entities that allow for pass-through taxation, meaning the income is taxed at the shareholder level rather than at the corporate level. The I1120S PDF is essential for ensuring compliance with federal tax regulations and provides a structured way to report the financial activities of an S corporation.

How to use the I1120S PDF Department Of The Treasury Internal Revenue

Using the I1120S PDF involves several key steps. First, download the form from the IRS website or a trusted source. Next, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Carefully fill out the form, ensuring all information is accurate and complete. Once completed, the form can be submitted electronically through e-filing or mailed to the appropriate IRS address. It's important to keep a copy for your records.

Steps to complete the I1120S PDF Department Of The Treasury Internal Revenue

Completing the I1120S PDF requires attention to detail. Follow these steps:

- Download the form from the IRS website.

- Review the instructions provided with the form for specific guidance.

- Gather financial records, including income, expenses, and deductions.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check your entries for errors or omissions.

- Submit the form electronically or via mail, following the IRS submission guidelines.

Legal use of the I1120S PDF Department Of The Treasury Internal Revenue

The I1120S PDF is legally binding when completed and submitted according to IRS regulations. To ensure its validity, the form must be signed by an authorized officer of the S corporation. Additionally, compliance with eSignature laws, such as ESIGN and UETA, is crucial if the form is submitted electronically. Maintaining accurate records and adhering to filing deadlines is also essential to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the I1120S PDF are critical for compliance. Generally, the form must be filed by the 15th day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It's advisable to plan ahead to ensure timely submission and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The I1120S PDF can be submitted in various ways. Electronic filing is the most efficient method, allowing for quicker processing and confirmation. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on the corporation's location. In-person submission is generally not available for this form, making electronic and mail options the primary methods for filing.

Quick guide on how to complete i1120spdf 2018 department of the treasury internal revenue

Complete I1120s pdf Department Of The Treasury Internal Revenue effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow furnishes you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage I1120s pdf Department Of The Treasury Internal Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign I1120s pdf Department Of The Treasury Internal Revenue with ease

- Obtain I1120s pdf Department Of The Treasury Internal Revenue and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important portions of the documents or redact sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal authority as a conventional ink signature.

- Review the details and then click on the Done button to save your edits.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign I1120s pdf Department Of The Treasury Internal Revenue and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i1120spdf 2018 department of the treasury internal revenue

Create this form in 5 minutes!

How to create an eSignature for the i1120spdf 2018 department of the treasury internal revenue

How to make an eSignature for your I1120spdf 2018 Department Of The Treasury Internal Revenue in the online mode

How to generate an electronic signature for the I1120spdf 2018 Department Of The Treasury Internal Revenue in Chrome

How to make an electronic signature for putting it on the I1120spdf 2018 Department Of The Treasury Internal Revenue in Gmail

How to make an eSignature for the I1120spdf 2018 Department Of The Treasury Internal Revenue straight from your smart phone

How to generate an electronic signature for the I1120spdf 2018 Department Of The Treasury Internal Revenue on iOS

How to create an electronic signature for the I1120spdf 2018 Department Of The Treasury Internal Revenue on Android

People also ask

-

What is the I1120s pdf Department Of The Treasury Internal Revenue?

The I1120s pdf Department Of The Treasury Internal Revenue is a specific tax form used by S corporations to report their income, deductions, and other relevant financial information. This form is essential for ensuring compliance with federal tax regulations. Understanding how to fill it out correctly can signNowly impact your business's tax liabilities.

-

How can airSlate SignNow help with the I1120s pdf Department Of The Treasury Internal Revenue?

airSlate SignNow provides a seamless solution for businesses to electronically fill out, sign, and send the I1120s pdf Department Of The Treasury Internal Revenue. This platform not only streamlines the documentation process but also enhances the security and accessibility of your important tax documents.

-

Is airSlate SignNow cost-effective for managing the I1120s pdf Department Of The Treasury Internal Revenue?

Yes, airSlate SignNow offers a cost-effective solution for managing documents like the I1120s pdf Department Of The Treasury Internal Revenue. With competitive pricing plans, businesses can enjoy a powerful tool without breaking the bank, ensuring they have everything they need to stay compliant while saving money.

-

What features does airSlate SignNow offer for the I1120s pdf Department Of The Treasury Internal Revenue?

Among its numerous features, airSlate SignNow offers customizable templates, integration with cloud storage solutions, and multi-party signing for the I1120s pdf Department Of The Treasury Internal Revenue. These tools help streamline the process and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for filing the I1120s pdf Department Of The Treasury Internal Revenue?

Absolutely! airSlate SignNow offers integrations with a variety of business software, allowing for easier management of the I1120s pdf Department Of The Treasury Internal Revenue. Whether you use accounting, CRM, or document management systems, you can ensure a seamless workflow by connecting them with airSlate SignNow.

-

What are the benefits of using airSlate SignNow for the I1120s pdf Department Of The Treasury Internal Revenue?

Using airSlate SignNow for the I1120s pdf Department Of The Treasury Internal Revenue provides multiple benefits, including increased efficiency, improved document security, and enhanced compliance. By automating your document management process, you can focus more on running your business while ensuring your tax paperwork is always in order.

-

Is it easy to use airSlate SignNow for the I1120s pdf Department Of The Treasury Internal Revenue?

Yes, airSlate SignNow is designed to be user-friendly, making it simple for anyone to fill out the I1120s pdf Department Of The Treasury Internal Revenue. The interface is intuitive, meaning that even those with minimal technical skills can navigate the platform with ease to manage their electronic signatures and document submissions.

Get more for I1120s pdf Department Of The Treasury Internal Revenue

- Louisiana behavioral health partnership dhh louisiana new dhh louisiana form

- Register to vote alabama fillable application form

- Moped form

- Improvment certificate formpdffillercom

- National standard for arts information exchange data form

- Fim scale pdf form

- Homebuilt boat builder certificate form

- Storm water pollution prevention plan summary form

Find out other I1120s pdf Department Of The Treasury Internal Revenue

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now