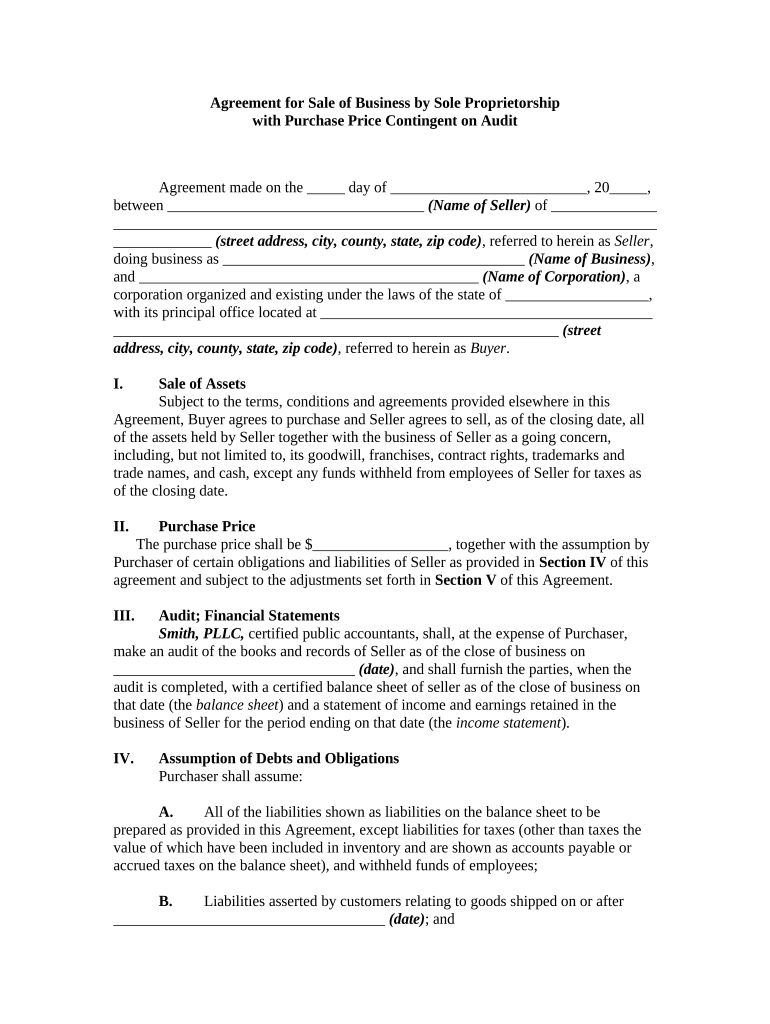

Sole Proprietorship Form

What is the Sole Proprietorship

A sole proprietorship is a business structure owned and operated by a single individual. This type of business is the simplest and most common form of business entity in the United States. It does not require formal registration with the state, making it easy to establish. The owner has complete control over all decisions and retains all profits, but also bears unlimited personal liability for any debts or legal actions against the business.

Steps to Complete the Sole Proprietorship

Completing the necessary forms for a sole proprietorship involves several key steps:

- Choose a business name: Select a unique name that reflects your business and check its availability in your state.

- Register your business name: If your business name differs from your legal name, you may need to file a "Doing Business As" (DBA) registration.

- Obtain necessary licenses and permits: Depending on your business type and location, you may need specific licenses or permits to operate legally.

- Apply for an Employer Identification Number (EIN): While not always required, obtaining an EIN from the IRS can help separate your business and personal finances.

Legal Use of the Sole Proprietorship

Operating a sole proprietorship legally requires compliance with federal, state, and local regulations. This includes obtaining any necessary business licenses, adhering to zoning laws, and following tax obligations. The owner must report business income on their personal tax return, typically using Schedule C of Form 1040. Understanding these legal requirements is crucial to avoid penalties and ensure smooth business operations.

IRS Guidelines

The IRS provides specific guidelines for sole proprietorships, particularly regarding tax obligations. Income generated by the business is reported on the owner's personal tax return. The owner is responsible for self-employment taxes, which cover Social Security and Medicare. It is essential to maintain accurate records of income and expenses to simplify tax filing and ensure compliance with IRS regulations.

Required Documents

To establish and operate a sole proprietorship, several documents may be necessary:

- Business registration documents: If applicable, file a DBA registration with your state.

- Licenses and permits: Gather any required business licenses or permits based on your industry and location.

- Tax forms: Prepare IRS tax forms, including Schedule C for reporting business income.

Eligibility Criteria

Eligibility to operate as a sole proprietorship is generally straightforward. Any individual can start a sole proprietorship, provided they are of legal age and comply with local regulations. There are no specific qualifications or requirements beyond the need to adhere to business licensing and tax obligations. This accessibility makes sole proprietorship an attractive option for many entrepreneurs.

Quick guide on how to complete sole proprietorship 497328767

Prepare Sole Proprietorship seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Sole Proprietorship on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sole Proprietorship effortlessly

- Locate Sole Proprietorship and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Edit and eSign Sole Proprietorship and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a proprietorship and how can airSlate SignNow benefit it?

A proprietorship is a business owned and operated by a single individual. airSlate SignNow benefits proprietorships by providing an easy-to-use platform for sending and electronically signing documents, streamlining their workflow, and ensuring legal compliance.

-

How much does airSlate SignNow cost for proprietorships?

The pricing for airSlate SignNow is designed to be cost-effective for proprietorships. We offer various subscription plans that cater to different business needs, ensuring that proprietorships can choose an option that fits their budget.

-

What features does airSlate SignNow offer for proprietorships?

airSlate SignNow provides several features specifically useful for proprietorships, such as document templates, real-time collaboration, and advanced security measures. These features enhance the efficiency of managing important documents within a proprietorship.

-

Can proprietorships integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with popular software applications that proprietorships commonly use, such as CRM systems, cloud storage solutions, and accounting software. This integration helps proprietorships streamline their operations.

-

What are the benefits of using airSlate SignNow for my proprietorship?

Using airSlate SignNow allows proprietorships to enhance their document management with quick eSigning and secure document storage. The affordability and ease of use make it a valuable tool for proprietorships looking to save time and resources.

-

Is airSlate SignNow secure for proprietorships?

Absolutely, airSlate SignNow prioritizes security, offering features like encryption and audit trails that ensure the protection of sensitive information for proprietorships. Your documents are safe and compliant with industry regulations.

-

How does airSlate SignNow assist proprietorships in managing their contracts?

airSlate SignNow assists proprietorships in managing contracts by simplifying the process of sending, signing, and storing legal documents. This can signNowly reduce turnaround time and improve record-keeping for proprietorships.

Get more for Sole Proprietorship

- Form notice 2018 2019

- Answer to petition and counterpetition for dissol flcourts form

- Answer to petition and counterpetition florida courts flcourts form

- Motion guardian ad litem form

- Form md jo12 order for change of name usa laws searching

- Foc 88 2017 2019 form

- Cards commerce actions and regulatory documents search form

- Instructions for motion to set aside a criminal form

Find out other Sole Proprietorship

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT