1120 Form 2015

What is the 1120 Form

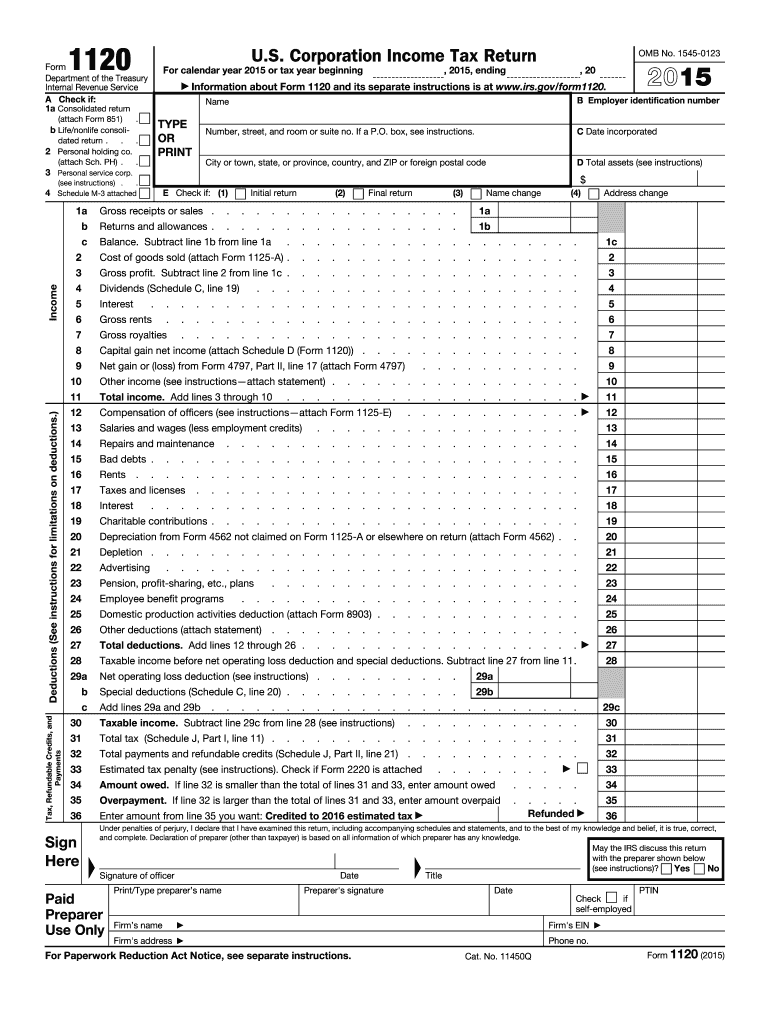

The 1120 Form is a federal tax return used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate tax entities from their owners. By filing the 1120 Form, corporations fulfill their tax obligations to the Internal Revenue Service (IRS) and provide a comprehensive overview of their financial activities for the tax year.

Steps to complete the 1120 Form

Completing the 1120 Form involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, fill out the form, starting with basic information about the corporation, such as its name, address, and Employer Identification Number (EIN). Proceed to report income, deductions, and credits. Finally, review the completed form for any errors before submitting it to the IRS by the designated deadline.

How to obtain the 1120 Form

The 1120 Form can be easily obtained from the IRS website, where it is available for download in PDF format. Alternatively, businesses can request a physical copy by contacting the IRS directly. Additionally, many tax preparation software programs include the 1120 Form as part of their offerings, allowing for a more streamlined filing process.

Legal use of the 1120 Form

To ensure the legal validity of the 1120 Form, it must be completed accurately and submitted on time. The IRS requires that all information reported is truthful and verifiable. Any discrepancies or fraudulent claims can lead to penalties or legal consequences. Using reliable eSignature solutions can also enhance the legal standing of the form when submitted electronically, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

The deadline for filing the 1120 Form is typically the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can also file for an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance

Failure to file the 1120 Form on time can result in significant penalties. The IRS imposes a late filing penalty, which can accumulate daily until the form is submitted. Additionally, if a corporation underreports its income or fails to pay taxes owed, it may face further penalties and interest charges. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete 1120 form 2015

Finalize 1120 Form effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage 1120 Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign 1120 Form without hassle

- Obtain 1120 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign 1120 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 form 2015

Create this form in 5 minutes!

How to create an eSignature for the 1120 form 2015

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1120 Form and why is it important?

The 1120 Form is a tax return form used by corporations to report their income, gains, losses, deductions, and credits to the IRS. It is crucial for businesses to accurately complete the 1120 Form to ensure compliance with tax regulations and to avoid potential penalties. Using airSlate SignNow can simplify the process of signing and submitting your 1120 Form electronically.

-

How does airSlate SignNow help with signing the 1120 Form?

airSlate SignNow offers a user-friendly platform that allows you to easily upload, send, and eSign your 1120 Form. Our secure electronic signature solution ensures that your documents are legally binding and compliant with IRS regulations. With airSlate SignNow, you can streamline your tax filing process and save valuable time.

-

Is there a cost associated with using airSlate SignNow for the 1120 Form?

Yes, airSlate SignNow provides flexible pricing plans that cater to different business needs. Our cost-effective solution allows you to sign the 1120 Form and other documents without breaking the bank. You can choose from various subscription options that best suit your company's requirements.

-

Can I integrate airSlate SignNow with other software for managing the 1120 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular software solutions, enabling you to manage your 1120 Form alongside other business documents. Whether you use accounting software or document management systems, our integrations help streamline your workflow and enhance productivity.

-

What features does airSlate SignNow offer for handling the 1120 Form?

airSlate SignNow provides essential features such as customizable templates, document tracking, and secure electronic signatures, which are perfect for managing your 1120 Form. These tools help ensure that every step of the signing process is efficient and organized, allowing you to focus on your business.

-

How secure is my information when using airSlate SignNow for the 1120 Form?

Security is a top priority at airSlate SignNow. When you use our platform to handle your 1120 Form, your data is protected with advanced encryption technologies and secure cloud storage. We comply with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I access my signed 1120 Form from anywhere?

Yes, with airSlate SignNow, you can access your signed 1120 Form from any device with internet connectivity. Our cloud-based platform allows you to manage your documents on-the-go, ensuring that you can retrieve important tax documents whenever you need them.

Get more for 1120 Form

Find out other 1120 Form

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage