Form 2553 2007

What is the Form 2553

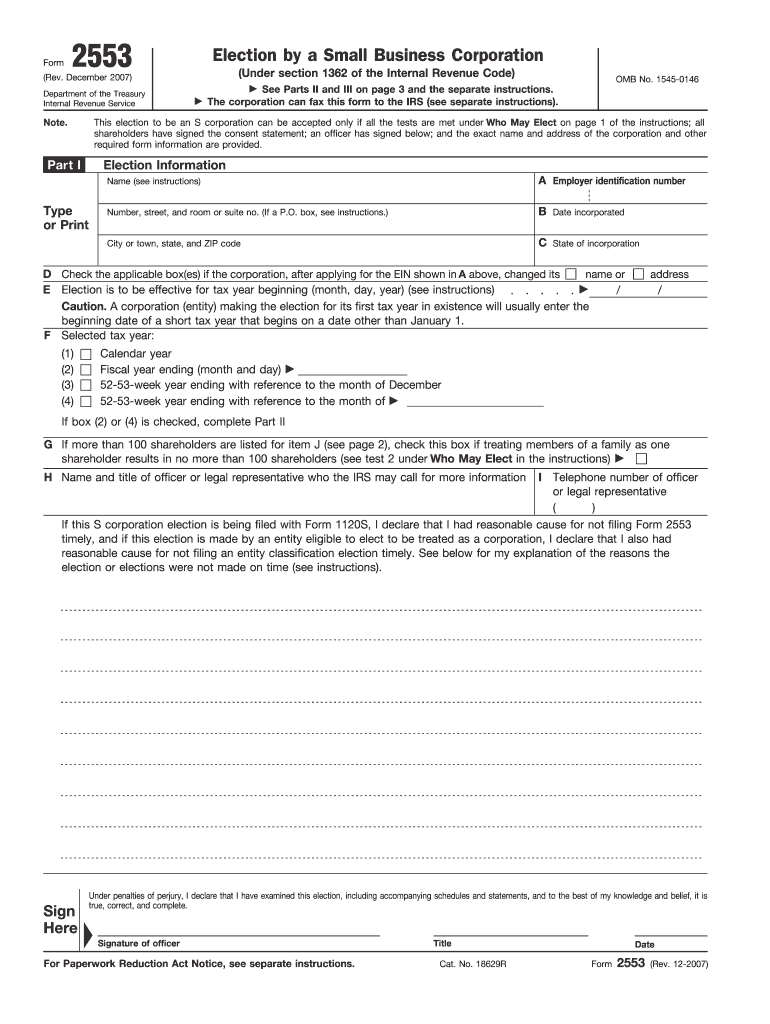

The Form 2553 is a tax form used by small businesses in the United States to elect to be taxed as an S Corporation. This election allows corporations and limited liability companies (LLCs) to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. By choosing this status, businesses can potentially reduce their overall tax burden, as S Corporations generally do not pay federal income tax at the corporate level.

How to use the Form 2553

Using the Form 2553 involves several key steps. First, a business must ensure it meets the eligibility criteria for S Corporation status, which includes having no more than one hundred shareholders and only one class of stock. Next, the form must be completed accurately, providing necessary details such as the business name, address, and the date of incorporation. Once the form is filled out, it should be submitted to the IRS within the specified timeframe to ensure the election is effective for the desired tax year.

Steps to complete the Form 2553

Completing the Form 2553 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the business's legal name, address, and Employer Identification Number (EIN).

- Determine eligibility by confirming that the business meets the S Corporation requirements.

- Fill out the form, ensuring all sections are completed accurately, including shareholder information and consent.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the deadline, which is typically within two months and fifteen days of the start of the tax year for which the election is to take effect.

Legal use of the Form 2553

The legal use of Form 2553 is essential for ensuring compliance with IRS regulations. The form must be signed by all shareholders, indicating their consent to the S Corporation election. It is important to file the form within the required timeframe to avoid penalties and ensure the election is recognized for the intended tax year. Additionally, maintaining accurate records and documentation related to the form is crucial for future audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 2553 are critical for businesses wishing to elect S Corporation status. Generally, the form must be submitted to the IRS by the fifteenth day of the third month after the beginning of the tax year. For example, if a business's tax year begins on January 1, the form must be filed by March 15. If the deadline is missed, the business may have to wait until the next tax year to make the election unless it qualifies for late election relief.

Eligibility Criteria

To qualify for S Corporation status using Form 2553, a business must meet specific eligibility criteria. These include:

- Being a domestic corporation or LLC.

- Having no more than one hundred shareholders.

- Having only allowable shareholders, which include individuals, certain trusts, and estates.

- Having only one class of stock.

- Not being an ineligible corporation, such as certain financial institutions, insurance companies, and domestic international sales corporations.

Form Submission Methods (Online / Mail / In-Person)

The Form 2553 can be submitted to the IRS through various methods. It can be mailed directly to the appropriate IRS address, which depends on the business's location. While electronic filing options are limited for this form, businesses can also consult with tax professionals who may assist in submitting the form through their systems. It is important to ensure that the form is sent well before the deadline to avoid any issues with the election's acceptance.

Quick guide on how to complete form 2553 2007

Effortlessly Prepare Form 2553 on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2553 on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

The easiest way to alter and electronically sign Form 2553 with ease

- Find Form 2553 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant parts of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Modify and electronically sign Form 2553 and ensure effective communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2553 2007

Create this form in 5 minutes!

How to create an eSignature for the form 2553 2007

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 2553 and why do I need it?

Form 2553 is a tax form used by small businesses to elect to be taxed as an S corporation. Filing Form 2553 allows eligible corporations to enjoy potential tax benefits, including avoiding double taxation. Understanding how to properly complete Form 2553 is essential for maximizing your business's tax efficiency.

-

How can airSlate SignNow help me with Form 2553?

airSlate SignNow simplifies the process of completing and eSigning important documents like Form 2553. Our user-friendly platform allows you to fill out the form electronically, ensuring accuracy and compliance. Additionally, you can securely send and track your Form 2553 submissions, making the process seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for Form 2553?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Our plans are designed to be cost-effective, ensuring you get great value while managing documents like Form 2553. Explore our pricing options to find the best fit for your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 2553?

airSlate SignNow provides several features for managing Form 2553, including customizable templates, electronic signatures, and real-time collaboration. These features streamline the completion and submission process, ensuring that your Form 2553 is filled out correctly and promptly. Additionally, our platform offers secure cloud storage for easy access to your documents.

-

Can I integrate airSlate SignNow with other software for Form 2553 processing?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for processing Form 2553. Whether you're using CRM systems, cloud storage, or accounting software, our integrations allow for efficient document management and collaboration. This connectivity minimizes manual data entry and saves time.

-

What are the benefits of using airSlate SignNow for my Form 2553 submissions?

Using airSlate SignNow for your Form 2553 submissions provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are processed quickly and accurately while maintaining compliance with regulations. Plus, you can easily track the status of your submissions in real-time.

-

How secure is my information when using airSlate SignNow for Form 2553?

Security is a top priority at airSlate SignNow. When using our platform to submit Form 2553, your information is protected with advanced encryption and secure data storage practices. We comply with industry standards to ensure that your sensitive business information remains confidential and secure.

Get more for Form 2553

Find out other Form 2553

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document