About Form 1094 CInternal Revenue Service IRS Gov 2014

What is the About Form 1094 CInternal Revenue Service IRS gov

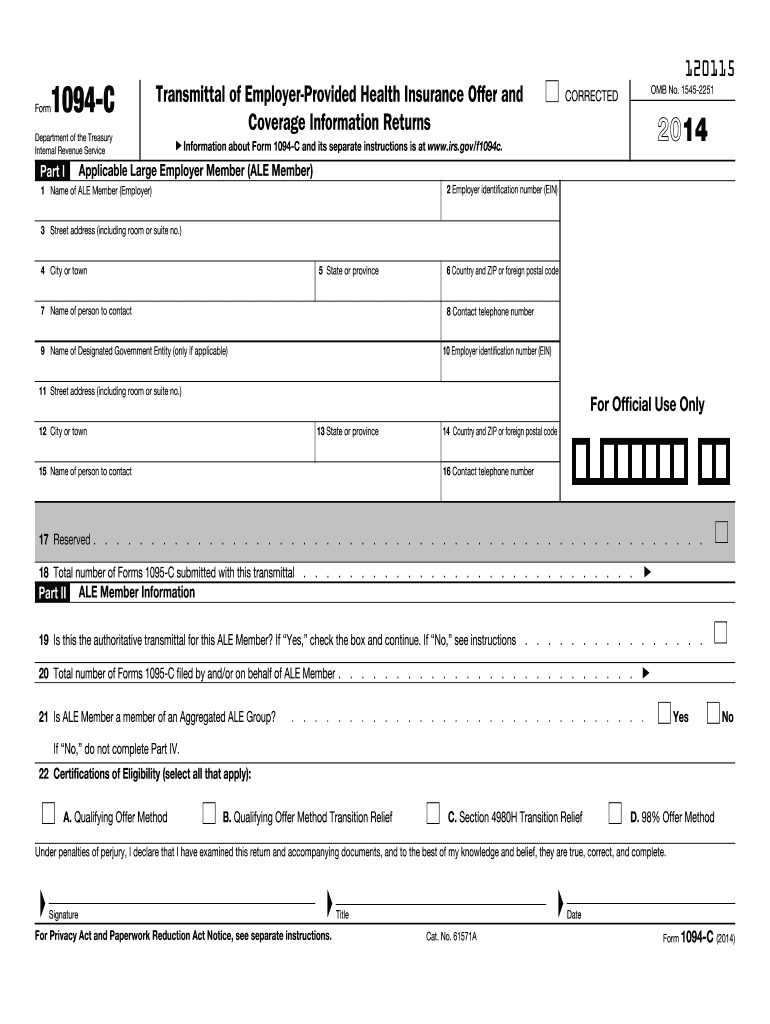

The About Form 1094 C is a crucial document issued by the Internal Revenue Service (IRS) that serves as a transmittal form for the Employer Shared Responsibility Payment. This form is primarily used by applicable large employers (ALEs) to report information about the health insurance coverage they offered to their full-time employees. It provides the IRS with essential data to determine compliance with the Affordable Care Act (ACA) requirements.

How to use the About Form 1094 CInternal Revenue Service IRS gov

Using the About Form 1094 C involves several steps. First, employers must gather information about their health insurance offerings and employee coverage. This includes details such as the number of full-time employees, the months during which coverage was offered, and the type of coverage provided. Once the necessary information is compiled, employers can accurately fill out the form and submit it to the IRS, either electronically or by mail, depending on their filing requirements.

Steps to complete the About Form 1094 CInternal Revenue Service IRS gov

Completing the About Form 1094 C requires careful attention to detail. Here are the key steps:

- Collect employee data, including names, Social Security numbers, and the months they were covered.

- Determine the number of full-time employees for the reporting year.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form to the IRS by the specified deadline.

Legal use of the About Form 1094 CInternal Revenue Service IRS gov

The legal use of the About Form 1094 C is essential for compliance with federal regulations. Employers must complete and submit this form to avoid penalties associated with the ACA. Accurate reporting ensures that the IRS can verify whether employers are meeting their obligations regarding health coverage for full-time employees. Failure to file the form or providing inaccurate information can result in significant fines and legal repercussions.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the About Form 1094 C. Generally, the form is due on the last day of February if filed by paper, or by March 31 if filed electronically. It is crucial for employers to be aware of these deadlines to ensure timely compliance and avoid penalties. Additionally, employers should keep abreast of any changes in filing requirements or deadlines announced by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The About Form 1094 C can be submitted to the IRS through various methods. Employers have the option to file electronically, which is often the preferred method due to its efficiency and speed. Alternatively, the form can be mailed to the appropriate IRS address. In-person submission is generally not an option for this form. Employers should choose the method that best suits their needs while ensuring compliance with IRS guidelines.

Quick guide on how to complete about form 1094 cinternal revenue service irsgov

Effortlessly Prepare About Form 1094 CInternal Revenue Service IRS gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct template and securely save it online. airSlate SignNow provides all the tools necessary to produce, edit, and electronically sign your documents swiftly and without hassle. Manage About Form 1094 CInternal Revenue Service IRS gov on any system with the airSlate SignNow apps available for Android or iOS, and enhance any document-related process today.

How to Edit and Electronically Sign About Form 1094 CInternal Revenue Service IRS gov with Ease

- Locate About Form 1094 CInternal Revenue Service IRS gov and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Verify all details and then click the Done button to finalize your changes.

- Choose how you wish to share your form: via email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements within just a few clicks from any device you prefer. Edit and electronically sign About Form 1094 CInternal Revenue Service IRS gov to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1094 cinternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 1094 cinternal revenue service irsgov

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is Form 1094-C and why is it important?

Form 1094-C is a cover sheet used by applicable large employers to report information about their health coverage to the Internal Revenue Service (IRS). Understanding About Form 1094 CInternal Revenue Service IRS gov. helps ensure compliance with the Affordable Care Act and avoids potential penalties.

-

How can airSlate SignNow assist with Form 1094-C submissions?

airSlate SignNow provides an efficient way to eSign and send documents, including Form 1094-C. With its secure platform, you can streamline the submission process, ensuring that you meet all deadlines while maintaining compliance with About Form 1094 CInternal Revenue Service IRS gov.

-

What are the key features of airSlate SignNow that support Form 1094-C management?

airSlate SignNow offers features like customizable templates, automatic reminders, and secure storage, which are essential for managing Form 1094-C documents effectively. These features align with the requirements outlined in About Form 1094 CInternal Revenue Service IRS gov., making document handling more efficient.

-

Is airSlate SignNow cost-effective for businesses managing Form 1094-C?

Yes, airSlate SignNow offers competitive pricing plans designed to fit various business needs. Using this service can signNowly reduce costs and time associated with managing Form 1094-C, all while ensuring compliance with About Form 1094 CInternal Revenue Service IRS gov.

-

Can I integrate airSlate SignNow with other software for Form 1094-C processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software, enabling you to manage Form 1094-C submissions more efficiently. This interoperability enhances your workflow and aligns with the guidelines provided in About Form 1094 CInternal Revenue Service IRS gov.

-

What are the benefits of using airSlate SignNow for eSigning Form 1094-C?

Using airSlate SignNow for eSigning Form 1094-C offers convenience, speed, and security. It ensures your submissions are timely and comply with the requirements set forth in About Form 1094 CInternal Revenue Service IRS gov., helping to avoid potential penalties.

-

How does airSlate SignNow ensure the security of Form 1094-C documents?

airSlate SignNow employs advanced security measures, including encryption and secure access controls to protect Form 1094-C documents. This commitment to security is crucial for businesses needing to comply with regulations outlined in About Form 1094 CInternal Revenue Service IRS gov.

Get more for About Form 1094 CInternal Revenue Service IRS gov

- Guest parking pass guest parking pass reflections at hidden lake form

- Apply for an ardf grantthe anglican relief and form

- Pizza scorecard form

- Financial planning questionnaire form

- Refund request form proflight zambiacom

- Junior bison volleyball form

- Participants nameage birth date form

- Gillian ortega mary kay form

Find out other About Form 1094 CInternal Revenue Service IRS gov

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now