940 Form 2000

What is the 940 Form

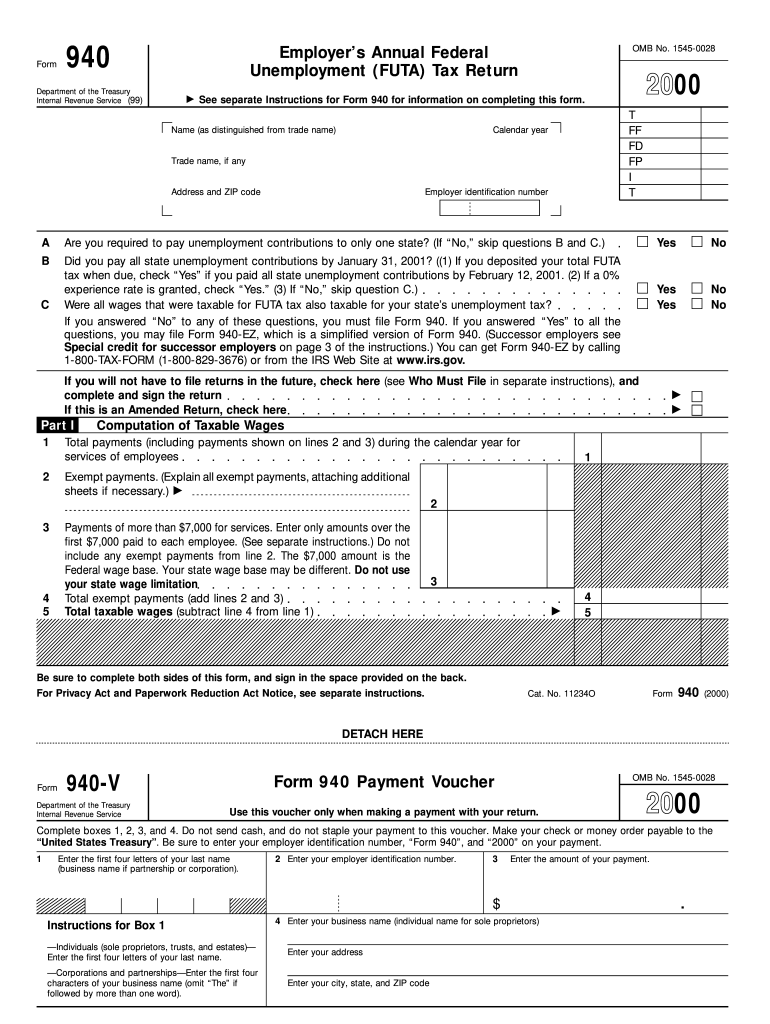

The 940 Form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document used by employers in the United States to report and pay unemployment taxes. This form is specifically designed for businesses that pay wages to employees and are subject to the Federal Unemployment Tax Act. The primary purpose of the 940 Form is to calculate the employer's annual FUTA tax liability, which funds unemployment compensation for workers who have lost their jobs. Understanding this form is essential for compliance with federal tax regulations.

How to use the 940 Form

Using the 940 Form involves several key steps to ensure accurate reporting and compliance with tax obligations. Employers must first gather necessary information, including total wages paid to employees and any state unemployment taxes paid throughout the year. The form requires details such as the employer's identification number (EIN) and the total amount of FUTA tax owed. After completing the form, employers can submit it electronically or via mail to the IRS. It is important to keep a copy of the submitted form for record-keeping and future reference.

Steps to complete the 940 Form

Completing the 940 Form requires careful attention to detail. Here are the essential steps:

- Gather all necessary payroll records and tax documents.

- Input the employer's identification number (EIN) and business name.

- Calculate total wages paid to employees subject to FUTA tax.

- Determine the amount of state unemployment taxes paid.

- Complete the form by filling in the required fields, including tax calculations.

- Review the form for accuracy before submission.

- Submit the completed form electronically through the IRS e-file system or mail it to the appropriate address.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 940 Form to avoid penalties. The form is due annually on January 31 of the following year for the previous tax year. If January 31 falls on a weekend or holiday, the due date is extended to the next business day. Employers should also be aware of any state-specific deadlines for unemployment tax filings, as these may differ from federal timelines.

Legal use of the 940 Form

The 940 Form serves a legal purpose in the context of federal tax compliance. It is mandated by the IRS for employers who meet certain criteria regarding employee wages. Filing the form accurately and on time helps businesses avoid penalties and interest charges. Additionally, proper completion of the 940 Form ensures that employers contribute to the federal unemployment insurance program, which provides essential support to unemployed workers.

Penalties for Non-Compliance

Failure to file the 940 Form or inaccuracies in reporting can result in significant penalties for employers. The IRS may impose fines for late filings, which can accumulate over time. Additionally, incorrect calculations of FUTA tax liability may lead to further financial consequences. Employers are encouraged to maintain accurate records and seek assistance if needed to ensure compliance with all federal regulations associated with the 940 Form.

Quick guide on how to complete 2000 940 form

Effortlessly prepare 940 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle 940 Form on any device using the airSlate SignNow applications available for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign 940 Form with no hassle

- Obtain 940 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your selected device. Edit and electronically sign 940 Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2000 940 form

Create this form in 5 minutes!

How to create an eSignature for the 2000 940 form

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is a 940 Form and why is it important?

The 940 Form is an annual federal unemployment tax return that employers must file to report their unemployment tax liability. Understanding how to complete the 940 Form is crucial for compliance with IRS regulations and avoiding penalties. Utilizing tools like airSlate SignNow can simplify the eSigning process for your 940 Form, ensuring timely and accurate submissions.

-

How can airSlate SignNow help with my 940 Form?

airSlate SignNow streamlines the process of completing and eSigning your 940 Form, making it user-friendly and efficient. With our platform, you can easily send your 940 Form for signatures, track its status, and store it securely. This minimizes the hassle of paperwork and helps you meet your filing deadlines.

-

Is airSlate SignNow affordable for small businesses needing to file a 940 Form?

Yes, airSlate SignNow offers cost-effective plans tailored for small businesses that need to manage documents like the 940 Form. Our pricing structures are designed to fit various budgets while providing robust features to enhance your document workflow. You can choose a plan that best suits your business needs without overspending.

-

Can I integrate airSlate SignNow with my existing accounting software for the 940 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, helping you manage your 940 Form and other tax documents efficiently. This integration ensures that your data syncs automatically, reducing the risk of errors and saving you valuable time in your document management process.

-

What are the benefits of using airSlate SignNow for my 940 Form?

Using airSlate SignNow for your 940 Form offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the eSigning feature allows for faster approvals, helping you stay compliant with IRS deadlines without stress.

-

How does the eSigning process work for the 940 Form with airSlate SignNow?

The eSigning process for the 940 Form with airSlate SignNow is straightforward. Simply upload your completed 940 Form, invite your signers via email, and they can sign it electronically from any device. Once signed, you’ll receive a completed copy instantly, ensuring a smooth and efficient workflow.

-

Is my data safe when using airSlate SignNow for my 940 Form?

Yes, your data is safe with airSlate SignNow. We implement robust security measures, including encryption and secure data storage, to protect your sensitive information when filing your 940 Form. You can trust that your documents are handled with the highest level of security and compliance.

Get more for 940 Form

- Local moving checklist pdf form

- Express autogap cancellation form

- Robert frederick smith internship and fellowship program form

- Modelo 145 word form

- Community ampamp civic engagement small grants programthe form

- 2014 battle of the books journal forms academy at the lakes

- Fbi release form

- Immunology amp allergy gleneagles hospital hong kong form

Find out other 940 Form

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online