Dividend Resolution Corporate Form

What is the Dividend Resolution Corporate

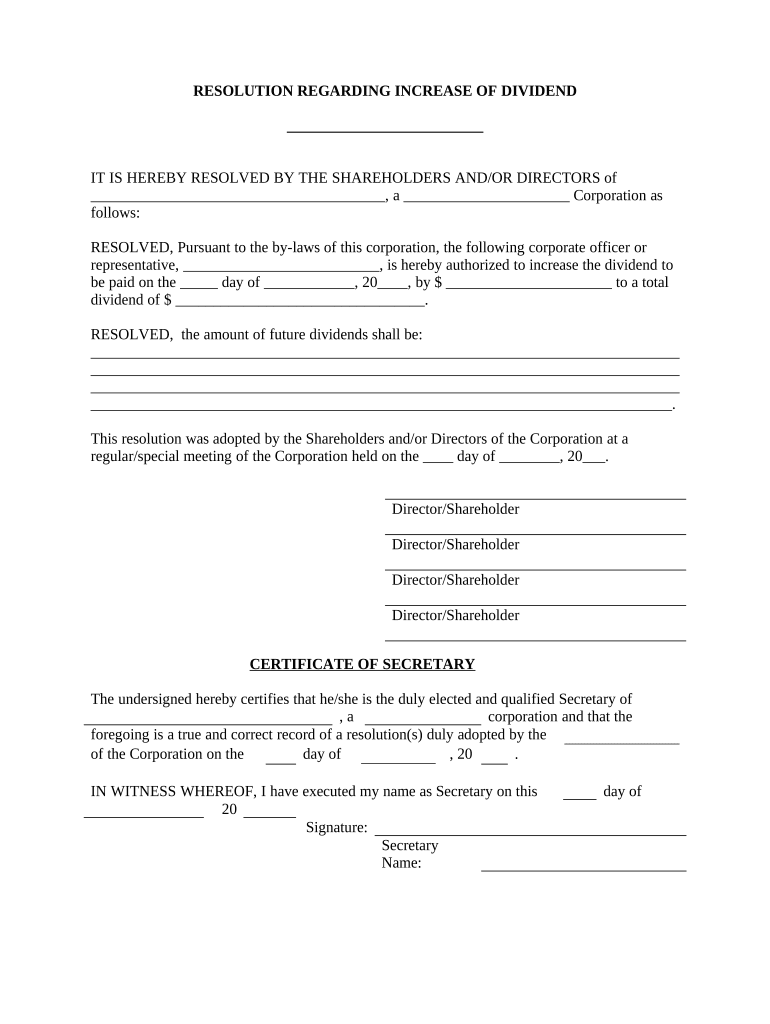

The dividend resolution corporate is a formal document used by corporations to declare dividends to shareholders. This resolution outlines the amount of the dividend, the date of payment, and the record date for shareholders eligible to receive the dividend. It serves as an official record of the board of directors' decision and is crucial for maintaining transparency and compliance with corporate governance standards.

Key elements of the Dividend Resolution Corporate

A well-structured dividend resolution corporate typically includes several key elements:

- Company Name: The legal name of the corporation declaring the dividend.

- Board Approval: A statement confirming that the board of directors has approved the dividend.

- Dividend Amount: The specific amount per share that will be distributed to shareholders.

- Payment Date: The date on which the dividend will be paid to shareholders.

- Record Date: The date by which shareholders must be on record to receive the dividend.

Steps to complete the Dividend Resolution Corporate

Completing a dividend resolution corporate involves several steps to ensure accuracy and compliance:

- Draft the Resolution: Prepare the document, including all necessary details such as the dividend amount and dates.

- Board Meeting: Schedule a meeting for the board of directors to discuss and approve the resolution.

- Vote on the Resolution: Conduct a formal vote during the meeting to approve the dividend declaration.

- Document the Decision: Record the meeting minutes and ensure the resolution is signed by the appropriate officers.

- Distribute to Shareholders: Notify shareholders of the dividend declaration and provide relevant details.

Legal use of the Dividend Resolution Corporate

The legal use of a dividend resolution corporate is essential for compliance with state and federal regulations. This document must adhere to the corporation's bylaws and the relevant laws governing corporate dividends. Proper execution ensures that the dividend is legally binding and protects the interests of both the corporation and its shareholders.

Examples of using the Dividend Resolution Corporate

Examples of using a dividend resolution corporate can vary based on the corporation's policies and financial status. For instance, a corporation may declare a quarterly dividend to reward shareholders for their investment. Another example could be a special dividend declared after a successful fiscal year, providing additional returns to shareholders. Each instance highlights the importance of documenting the decision formally.

Who Issues the Form

The dividend resolution corporate is typically issued by the board of directors of the corporation. The board is responsible for making decisions regarding dividends and ensuring that the resolution complies with corporate governance standards. Once approved, the resolution becomes part of the corporation's official records.

Quick guide on how to complete dividend resolution corporate

Effortlessly Prepare Dividend Resolution Corporate on Any Device

Digital document management has gained traction among corporations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and store it securely online. airSlate SignNow provides all the tools necessary to generate, edit, and eSign your documents rapidly without delays. Manage Dividend Resolution Corporate on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Edit and eSign Dividend Resolution Corporate with Ease

- Locate Dividend Resolution Corporate and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your amendments.

- Choose your preferred method for sending your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Dividend Resolution Corporate while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a dividend resolution corporate and why is it necessary?

A dividend resolution corporate is a formal document that outlines the decision to distribute dividends to shareholders. It is necessary because it provides clear documentation of the board's decision, ensuring compliance with legal requirements and protecting the interests of shareholders.

-

How does airSlate SignNow simplify the dividend resolution corporate process?

airSlate SignNow simplifies the dividend resolution corporate process by offering an easy-to-use platform for creating, sending, and electronically signing documents. This streamlines the workflow, reduces paperwork, and ensures that all necessary signatures are collected efficiently and securely.

-

What are the benefits of using airSlate SignNow for dividend resolution corporate documents?

Using airSlate SignNow for dividend resolution corporate documents offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Additionally, you gain access to a centralized platform that allows for seamless collaboration and tracking of document status.

-

Is airSlate SignNow suitable for small businesses managing dividend resolutions?

Yes, airSlate SignNow is particularly suitable for small businesses managing dividend resolutions as it provides a cost-effective solution tailored to meet various business needs. The platform's user-friendly interface makes it accessible for businesses of all sizes, ensuring smooth handling of dividend resolution corporate documents.

-

What integrations does airSlate SignNow offer for managing dividend resolution corporate processes?

airSlate SignNow offers integrations with various applications that enhance the management of dividend resolution corporate processes. These include popular business tools like Google Drive, Salesforce, and Microsoft Office, allowing you to streamline your workflow and keep all documents organized in one place.

-

How does airSlate SignNow ensure the security of dividend resolution corporate documents?

airSlate SignNow prioritizes security through advanced encryption and compliance with data protection regulations. This ensures that your dividend resolution corporate documents are protected, maintaining confidentiality and integrity throughout the signing and document management process.

-

What is the pricing model for airSlate SignNow when handling dividend resolution corporate documents?

airSlate SignNow offers flexible pricing models tailored to different business needs, making it cost-effective for managing dividend resolution corporate documents. You can choose from various plans based on features and functionality, ensuring that you only pay for what you need.

Get more for Dividend Resolution Corporate

Find out other Dividend Resolution Corporate

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile