Promissory Note Maturity Form

What is the promissory note maturity?

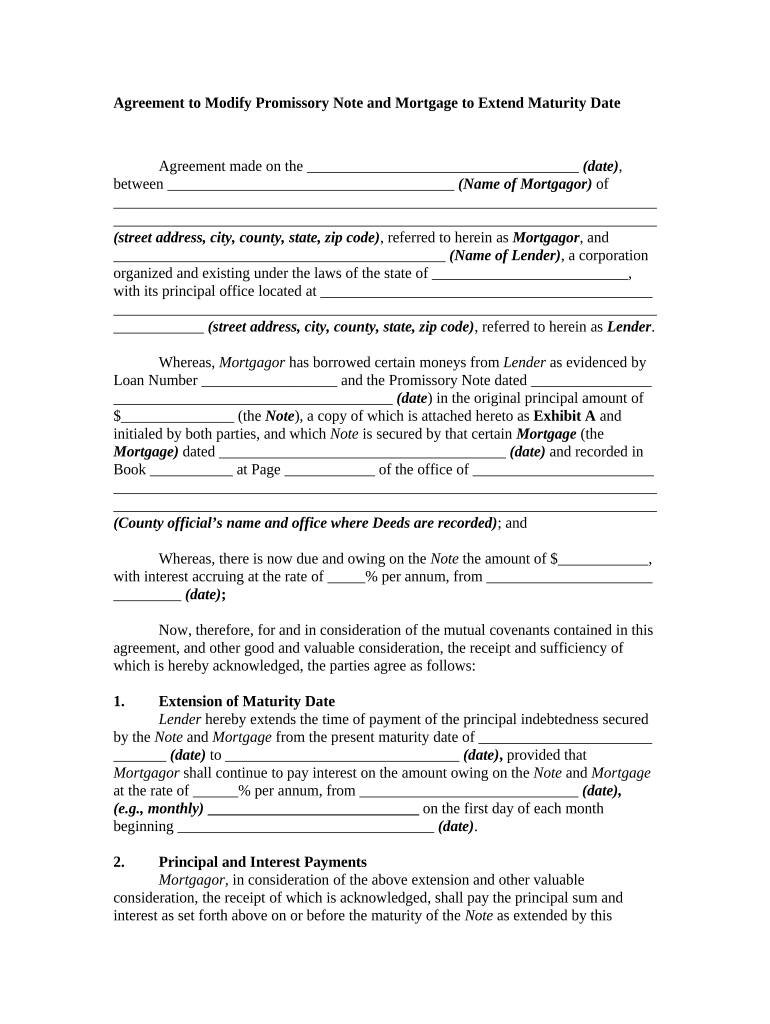

The maturity date of a promissory note is the specific date when the principal amount, along with any accrued interest, is due to be paid back to the lender. This date is crucial as it marks the end of the loan term and signifies the obligation of the borrower to fulfill their repayment duties. Understanding the maturity date is essential for both parties involved, as it helps in planning financial obligations and ensuring compliance with the terms outlined in the note.

Key elements of the promissory note maturity

Several key elements define the maturity date within a promissory note. These include:

- Principal Amount: The original sum of money borrowed, which must be repaid on or before the maturity date.

- Interest Rate: The rate at which interest accrues on the borrowed amount, impacting the total repayment amount.

- Maturity Date: The exact date when the full repayment is due, which should be clearly stated in the note.

- Payment Schedule: Details on how and when payments will be made leading up to the maturity date.

- Signatures: The signatures of both the borrower and lender, which validate the agreement and its terms.

Steps to complete the promissory note maturity

Completing a promissory note maturity involves several important steps:

- Draft the Note: Clearly outline the terms, including the principal amount, interest rate, and maturity date.

- Review Legal Requirements: Ensure compliance with state laws regarding promissory notes.

- Sign the Document: Both parties should sign the note to validate the agreement.

- Distribute Copies: Provide copies to all parties involved for their records.

- Monitor Payments: Keep track of any payments made prior to the maturity date to ensure compliance.

Legal use of the promissory note maturity

The legal use of a promissory note maturity is governed by various state and federal laws. A properly executed promissory note is enforceable in a court of law, provided it meets specific legal requirements. This includes having a clear maturity date, defined payment terms, and the necessary signatures. Understanding these legal aspects is crucial for both borrowers and lenders to protect their rights and ensure that the agreement is upheld.

Examples of using the promissory note maturity

Promissory notes can be utilized in various scenarios, such as:

- Personal Loans: Individuals borrowing money from friends or family often use promissory notes to formalize the loan terms.

- Business Financing: Companies may issue promissory notes to secure funding from investors or banks.

- Real Estate Transactions: A note mortgage sample may be used when financing property purchases, detailing the maturity date for the loan repayment.

State-specific rules for the promissory note maturity

Each state may have unique regulations regarding promissory notes, including specific requirements for their validity and enforceability. It is important for both borrowers and lenders to familiarize themselves with these state-specific rules. This includes understanding the maximum allowable interest rates, required disclosures, and any other legal stipulations that may apply to the maturity date and repayment terms.

Quick guide on how to complete promissory note maturity

Effortlessly Prepare Promissory Note Maturity on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Promissory Note Maturity on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Promissory Note Maturity with Ease

- Locate Promissory Note Maturity and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information using tools available from airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either via email, text (SMS), invitation link, or download it to your computer.

Leave behind the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Promissory Note Maturity and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a maturity date in the context of airSlate SignNow?

The maturity date in airSlate SignNow refers to the deadline by which a document must be completed and signed. Understanding the maturity date is crucial as it helps ensure that all parties are aware of when the contract becomes active. By setting a clear maturity date, you can streamline your document management process and avoid unnecessary delays.

-

How can I set a maturity date for my documents in airSlate SignNow?

Setting a maturity date in airSlate SignNow is straightforward. When you create or upload a document, you'll find an option to specify the maturity date in the settings. This feature allows you to enforce clear timelines, making it easier for all signers to complete the process in a timely manner.

-

Does airSlate SignNow offer flexibility with maturity dates?

Yes, airSlate SignNow provides the flexibility to adjust maturity dates as needed. Should circumstances change, you can easily modify the maturity date to accommodate your project timelines. This adaptability helps maintain workflow efficiency and ensures all parties are aligned.

-

What are the benefits of setting a maturity date in airSlate SignNow?

Setting a maturity date in airSlate SignNow helps clarify expectations for all parties involved in a document transaction. It promotes timely responses and ensures that agreements are executed within a specified timeframe. This not only enhances accountability but also improves overall business efficiency.

-

Is there a cost associated with utilizing the maturity date feature in airSlate SignNow?

The maturity date feature is included in all pricing plans of airSlate SignNow. This means you can use it without any additional fees, making it a cost-effective solution for businesses of all sizes. Knowing that you have an integrated feature like the maturity date can improve your document management approach without breaking the bank.

-

Can I integrate external calendars to manage maturity dates in airSlate SignNow?

Yes, airSlate SignNow allows integration with popular calendar applications to manage maturity dates effectively. By syncing your maturity dates with your calendar, you can receive timely reminders and track document completions easily. This ensures you never miss essential deadlines.

-

What types of documents can have maturity dates set in airSlate SignNow?

You can set maturity dates for a wide variety of documents in airSlate SignNow, including contracts, agreements, and forms. This feature is designed to enhance any type of document where timing is critical. By specifying a maturity date, you ensure that all signers understand when the document needs to be finalized.

Get more for Promissory Note Maturity

- How to create promissory note form the balance small business

- Bill of sale know all men by these presents that for and in form

- Minor waiver of liability habitat for humanity of angelina county form

- Mutual rescission and release agreement template wonderlegal form

- Release and authorization to record form

- Subordination agreementfree legal forms

- Instructions to bidders city of louisville co form

- What is an employment contract the balance careers form

Find out other Promissory Note Maturity

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF