Information Spouse

What is the information spouse?

The information spouse refers to a non-working spouse who may be considered a dependent for various tax purposes. This classification can impact tax filings, eligibility for certain credits, and overall financial planning. Understanding the implications of being classified as an information spouse is essential for accurate tax reporting and compliance with IRS regulations.

How to obtain the information spouse

To obtain the information spouse classification, individuals typically need to complete the relevant forms and provide necessary documentation. This process often involves gathering personal information, such as Social Security numbers, income details, and marital status. Depending on the context, additional forms may be required to substantiate the dependent status.

Steps to complete the information spouse

Completing the information spouse form involves several key steps:

- Gather personal information for both the taxpayer and the spouse.

- Determine eligibility based on IRS guidelines for dependents.

- Fill out the required forms accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the information spouse

The legal use of the information spouse classification is governed by IRS regulations. Proper classification can provide tax benefits, such as qualifying for certain deductions or credits. It is crucial to ensure compliance with all relevant tax laws to avoid penalties or issues with the IRS.

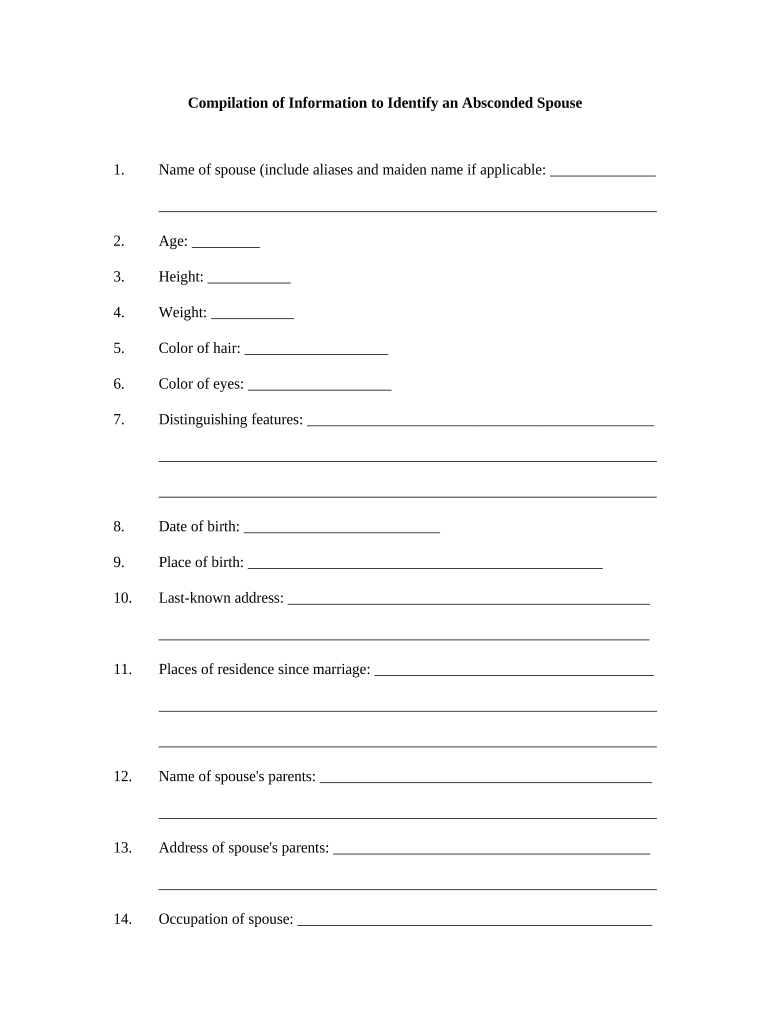

Key elements of the information spouse

Key elements of the information spouse include:

- Relationship status: Must be legally married to the primary taxpayer.

- Income level: Generally, a non-working spouse has little to no income.

- Documentation: Necessary forms and identification must be provided.

- IRS guidelines: Must adhere to the criteria set forth by the IRS for dependents.

Eligibility criteria

Eligibility criteria for being classified as an information spouse typically include:

- Legal marriage to the primary taxpayer.

- Living together for the majority of the tax year.

- Meeting income thresholds as defined by IRS guidelines.

- Providing necessary documentation to support the classification.

Quick guide on how to complete information spouse

Accomplish Information Spouse effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Information Spouse on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Information Spouse smoothly

- Find Information Spouse and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Information Spouse and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What information do I need to provide about my spouse for signing documents?

When using airSlate SignNow, you will need to provide basic information about your spouse, such as their name and email address. This information ensures that they receive the documents for signing and can easily navigate through the eSigning process. Additionally, it allows for proper identification and tracking of the signed documents.

-

How does airSlate SignNow ensure the security of my spouse's information?

airSlate SignNow prioritizes the security of all users' information, including that of your spouse. We use advanced encryption methods and comply with industry standards to safeguard personal data. Our platform also allows you to set specific permissions for document access, enhancing privacy for you and your spouse.

-

Can I store my spouse's information for future use in airSlate SignNow?

Yes, airSlate SignNow allows you to create a contact list, enabling you to store your spouse's information for future use. This feature simplifies the document signing process for recurring tasks and saves time on data entry. Just ensure to maintain security practices when handling sensitive information.

-

What features does airSlate SignNow offer for eSigning documents with my spouse?

airSlate SignNow provides multiple features for eSigning documents, including customizable templates, a user-friendly interface, and the ability to sign on any device. These features streamline the signing process, ensuring that you and your spouse can finalize documents efficiently. Additionally, in-app notifications keep you updated on the signing status.

-

Is there a cost associated with adding my spouse as a signatory on airSlate SignNow?

Adding your spouse as a signatory on airSlate SignNow does not incur additional costs. Our pricing model is designed to be cost-effective, allowing you to invite multiple signatories without increasing your expenses. This makes it easier for you and your spouse to manage document workflows together.

-

Can I track the status of documents sent to my spouse for signing?

Absolutely! With airSlate SignNow, you can easily track the status of documents sent to your spouse for signing. Our platform provides real-time updates, so you know when your spouse has viewed and signed the document. This transparency is vital for effective communication and document management.

-

What are the benefits of using airSlate SignNow to send documents to my spouse?

Using airSlate SignNow to send documents to your spouse comes with several benefits, such as speed, convenience, and legal validity. The easy-to-use interface allows for quick document preparation, while eSigning provides a legally recognized signature. These benefits enhance your overall workflow, enabling you and your spouse to focus on what matters most.

Get more for Information Spouse

Find out other Information Spouse

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms