Www Studentinsurance Kk Com 2019-2026

Understanding student accident coverage

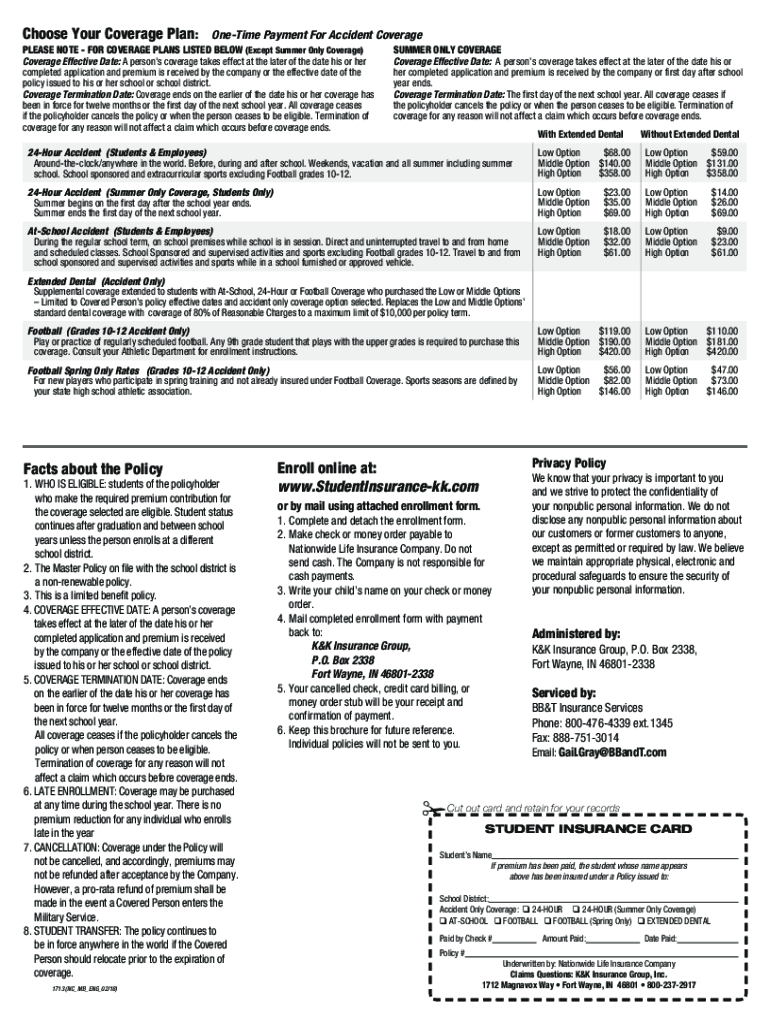

Student accident coverage is a type of insurance designed to provide financial protection for students who may suffer injuries while participating in school-related activities. This coverage typically includes medical expenses, emergency services, and sometimes even lost wages due to injury. It is essential for parents and guardians to understand the specifics of what this coverage entails, as it can vary significantly between institutions and states.

Key elements of student accident coverage

When reviewing student accident coverage, there are several critical elements to consider:

- Coverage Limits: Each policy will outline the maximum amount the insurer will pay for medical expenses related to an accident.

- Exclusions: It's important to be aware of what is not covered, such as pre-existing conditions or injuries sustained during certain activities.

- Claim Process: Understanding how to file a claim and what documentation is necessary is vital for a smooth experience.

- Duration of Coverage: Coverage might only be effective during specific times, such as school hours or while participating in school-sponsored events.

Steps to complete the student accident coverage form

Completing the student accident coverage form can be straightforward if you follow these steps:

- Gather Necessary Information: Collect all required documentation, including personal details, emergency contacts, and any medical history relevant to the coverage.

- Fill Out the Form: Carefully enter the information as required, ensuring accuracy to avoid delays in processing.

- Review the Form: Double-check all entries for completeness and correctness before submission.

- Submit the Form: Follow the specified submission method, whether online or via mail, as indicated on the form.

Legal use of student accident coverage

For student accident coverage to be legally binding, it must comply with various regulations and requirements. This includes adherence to state laws regarding insurance policies and ensuring that all necessary disclosures are made. Institutions typically provide clear guidelines on how to maintain compliance, which is crucial for both students and parents.

Eligibility criteria for student accident coverage

Eligibility for student accident coverage often depends on several factors, including:

- Enrollment Status: The student must be enrolled in a qualifying program or institution.

- Age Restrictions: Some policies may have age limits, typically covering students from kindergarten through college.

- Participation in Activities: Coverage may only apply to injuries incurred during school-related events or activities.

Examples of using student accident coverage

There are various scenarios in which student accident coverage can be beneficial:

- A student gets injured during a physical education class, requiring medical attention.

- A student participates in a school sports event and suffers an injury, leading to hospital visits.

- Accidents occurring during field trips or other school-sponsored activities that require medical assistance.

Quick guide on how to complete www studentinsurance kk com

Prepare Www Studentinsurance Kk Com effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly without delays. Manage Www Studentinsurance Kk Com on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Www Studentinsurance Kk Com with ease

- Find Www Studentinsurance Kk Com and click on Get Form to begin.

- Employ the tools at your disposal to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the exact same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Www Studentinsurance Kk Com while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www studentinsurance kk com

Create this form in 5 minutes!

How to create an eSignature for the www studentinsurance kk com

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is student accident coverage?

Student accident coverage is an insurance policy designed to provide protection for students in the event of accidental injuries. This coverage typically includes medical expenses for treatment, hospitalization, and other related costs. It is essential for schools and parents to ensure their students have proper coverage during school activities.

-

Why do I need student accident coverage?

Student accident coverage is vital for protecting your child while they are engaged in school activities, sports, or other events. It helps cover unexpected medical expenses that might arise from accidents, ensuring that financial burdens do not add stress during recovery. This type of coverage provides peace of mind for parents and guardians.

-

How much does student accident coverage cost?

The cost of student accident coverage varies depending on the policy details, coverage limits, and the provider. Generally, it is a cost-effective solution for parents, with affordable premiums that cater to different budgets. It is advisable to compare various plans to find the best pricing that fits your needs.

-

What benefits does student accident coverage offer?

Student accident coverage offers numerous benefits, including access to medical care, coverage for ambulance services, and reimbursement for expenses related to injuries sustained at school. Additionally, some plans may offer extra features such as accidental death benefits or coverage for sports injuries. Securing this coverage ensures that students receive prompt medical attention when needed.

-

Does student accident coverage include sports injuries?

Yes, student accident coverage typically includes protection against injuries incurred during school-sponsored sports activities. This aspect is crucial for active students who participate in physically demanding sports, as it helps cover medical bills and rehabilitation costs. It's essential to review the specific policy details to understand the extent of this coverage.

-

Can I purchase student accident coverage as an individual?

In many cases, student accident coverage can be purchased individually by parents or guardians for their children. This allows families to customize the level of coverage according to their unique requirements. It's advisable to consult with insurance providers to explore individual policies that fit your needs.

-

How does student accident coverage integrate with other insurance?

Student accident coverage can work alongside other health insurance plans, helping to cover deductibles and co-pays incurred from accidents. This integration ensures that families are not overwhelmed with medical expenses, as the coverage acts as a supplementary policy. Always confirm with your insurance provider for specific integration details.

Get more for Www Studentinsurance Kk Com

- Ampamp4 ll3 palm beach county form

- County of state of virginia hereinafter seller whether one or more form

- Bankruptcy court rules and procedures regarding electronic form

- Summary of reaffirmation agreement form

- Federal judicial center ncjrs form

- Suretys capias and form

- T412546 how to maintain the aspxtreelist state in form

- Noticeofappeal formdoc

Find out other Www Studentinsurance Kk Com

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure