Notice of Default Letter Mortgage Form

What is the Notice of Default Letter Mortgage

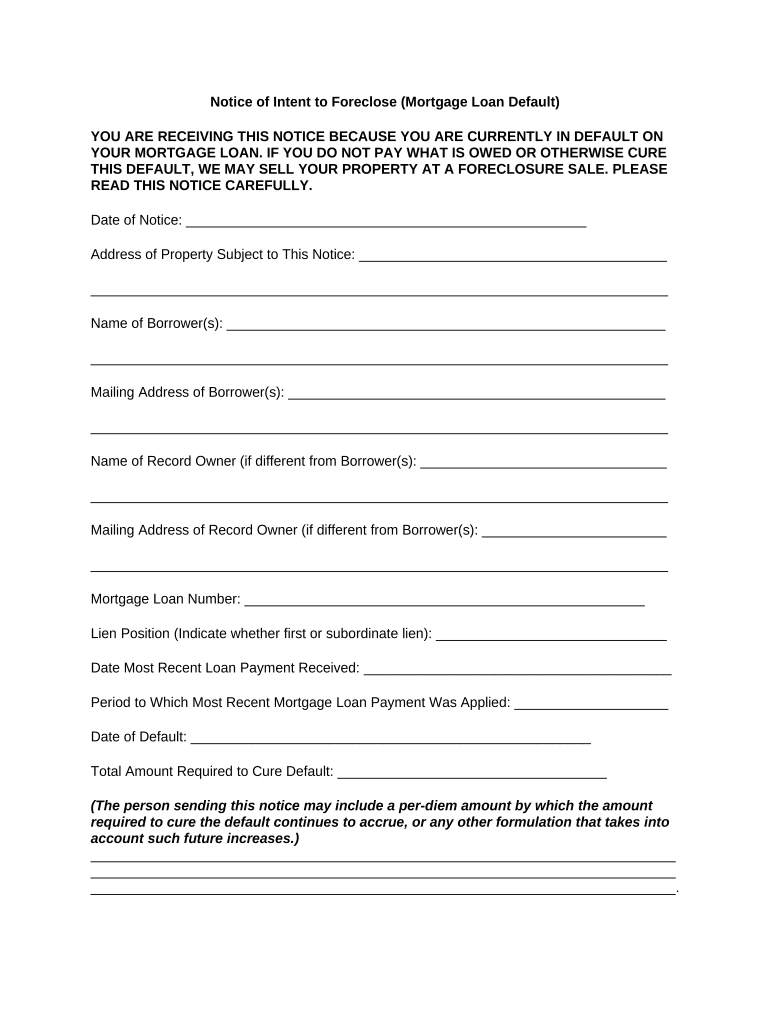

The Notice of Default Letter Mortgage is a formal document issued by a lender when a borrower fails to make mortgage payments on time. This letter serves as an official notification that the borrower is in default on their mortgage loan. It typically outlines the amount owed, the due dates of missed payments, and the potential consequences if the default is not resolved. Understanding this document is crucial for homeowners facing financial difficulties, as it marks the beginning of the foreclosure process.

Key Elements of the Notice of Default Letter Mortgage

The key elements of a Notice of Default Letter Mortgage include:

- Borrower Information: The name and address of the borrower are clearly stated.

- Lender Information: Details about the lender, including their contact information.

- Loan Details: Information about the mortgage loan, such as the loan number and property address.

- Payment History: A summary of missed payments and the total amount due.

- Consequences of Default: A description of the actions the lender may take if the default is not cured, including the possibility of foreclosure.

Steps to Complete the Notice of Default Letter Mortgage

Completing the Notice of Default Letter Mortgage involves several important steps:

- Review Your Mortgage Agreement: Understand the terms and conditions of your loan.

- Gather Documentation: Collect all relevant documents, including payment records and correspondence with the lender.

- Fill Out the Notice: Accurately complete the notice with all required information, ensuring clarity and correctness.

- Sign and Date: Ensure that the notice is signed and dated by the appropriate parties.

- Send the Notice: Deliver the completed notice to the lender through the preferred method, whether by mail or electronically.

Legal Use of the Notice of Default Letter Mortgage

The legal use of the Notice of Default Letter Mortgage is critical in the foreclosure process. This document must comply with state laws and regulations regarding mortgage defaults. It serves as an official record that the borrower has been notified of their default status. Failure to issue this notice correctly can lead to legal complications for the lender, including the potential for delays in foreclosure proceedings. It is essential for both borrowers and lenders to understand their rights and obligations related to this document.

State-Specific Rules for the Notice of Default Letter Mortgage

State-specific rules govern the issuance and content of the Notice of Default Letter Mortgage. Each state has its own regulations regarding the timing, format, and delivery of this notice. For instance, some states may require additional disclosures or specify a minimum notice period before foreclosure proceedings can begin. Homeowners should familiarize themselves with their state's laws to ensure compliance and protect their rights during the mortgage default process.

How to Obtain the Notice of Default Letter Mortgage

Obtaining a Notice of Default Letter Mortgage can typically be done through the lender or mortgage servicer. Borrowers may request a copy directly from their lender, who is obligated to provide this document upon request. Additionally, some states may have online resources or government offices where copies of such notices can be accessed. It is important to keep a record of all communications and requests related to this document for future reference.

Quick guide on how to complete notice of default letter mortgage

Effortlessly Prepare Notice Of Default Letter Mortgage on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Handle Notice Of Default Letter Mortgage across any platform with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Modify and eSign Notice Of Default Letter Mortgage Seamlessly

- Find Notice Of Default Letter Mortgage and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from your chosen device. Edit and eSign Notice Of Default Letter Mortgage and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a notice mortgage default?

A notice mortgage default is a formal notification sent to a borrower when their mortgage payments are overdue. This document serves as a warning that the lender may initiate foreclosure proceedings if the delinquency is not resolved. Understanding this notice is crucial for homeowners facing financial difficulties.

-

How can airSlate SignNow help with handling a notice mortgage default?

airSlate SignNow allows users to efficiently manage and eSign documents related to a notice mortgage default. By streamlining the document signing process, you can quickly respond to any legal communications and prevent further complications. Our solution simplifies document management during high-stress situations.

-

Is airSlate SignNow a cost-effective solution for managing notices related to mortgage default?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, including notices regarding mortgage default. Our pricing plans are designed to fit various budgets, ensuring that businesses and individuals can afford the tools they need to manage their legal documents efficiently.

-

What features does airSlate SignNow provide for eSigning notices mortgage default?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, which are essential for eSigning notices mortgage default. These tools help users save time and ensure that all necessary documents are signed and stored safely, improving overall efficiency.

-

Can airSlate SignNow integrate with other software for managing mortgage defaults?

Absolutely! airSlate SignNow can integrate seamlessly with various CRM and document management systems to assist with handling notices mortgage default. This integration enhances your workflow by allowing you to manage all related documents in one place, ensuring no detail is overlooked.

-

What are the benefits of using airSlate SignNow for notice mortgage default processing?

Using airSlate SignNow for processing a notice mortgage default allows for faster resolution of document issues and reduces the risk of errors. The platform’s user-friendly interface makes it easy for anyone to navigate and complete necessary actions. Additionally, our robust security features protect sensitive information during this critical time.

-

Is it easy to access and store notices mortgage default with airSlate SignNow?

Yes, airSlate SignNow provides a user-friendly platform that makes it easy to access and store notices mortgage default securely. Our cloud storage system ensures that your documents are always available when needed. Moreover, you can quickly retrieve any past communications within moments.

Get more for Notice Of Default Letter Mortgage

Find out other Notice Of Default Letter Mortgage

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT