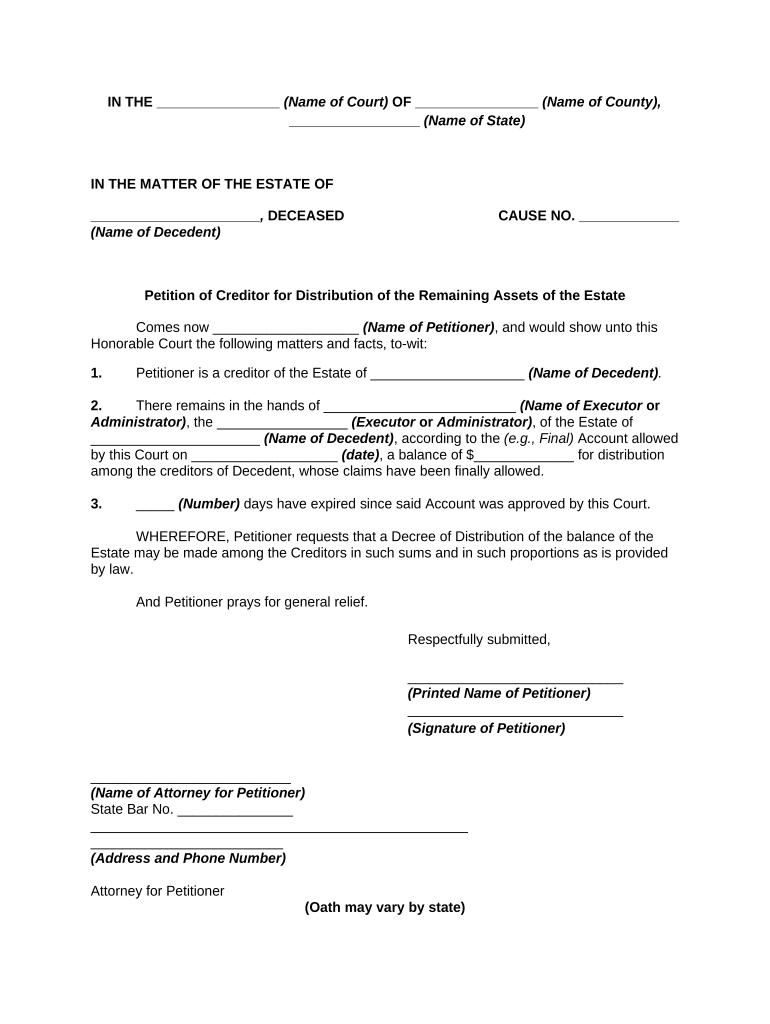

Creditor of Estate Form

What is the creditor of estate?

The creditor of estate refers to an individual or entity that is owed money by a deceased person, known as the decedent. When a decedent passes away, their estate must settle outstanding debts before distributing assets to heirs. Creditors have the right to file claims against the estate to recover the amounts owed. This process ensures that the decedent's financial obligations are addressed in accordance with state laws.

Steps to complete the creditor estate form

Completing the creditor estate form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the decedent, including their full name, date of death, and any relevant estate identification numbers. Next, detail the nature of the debt owed, including the amount and any supporting documentation, such as invoices or contracts. It is crucial to fill out the form clearly and accurately to avoid delays in processing. Finally, submit the completed form to the appropriate probate court or estate administrator within the specified deadlines to ensure your claim is considered.

Legal use of the creditor estate form

The creditor estate form serves a vital legal purpose in the probate process. It formally notifies the estate of the outstanding debt and provides a mechanism for creditors to assert their claims. Proper use of the form is essential for compliance with state probate laws, as it ensures that creditors are given an opportunity to recover what they are owed. Failure to use the form correctly may result in the loss of the right to collect the debt, making it imperative to adhere to legal requirements throughout the process.

Required documents for filing a creditor estate claim

When filing a creditor estate claim, certain documents are typically required to support your claim. These may include:

- A completed creditor estate form.

- Proof of the debt, such as contracts, invoices, or statements.

- The decedent's death certificate.

- Any relevant correspondence related to the debt.

Having these documents ready can facilitate a smoother filing process and help ensure that your claim is processed efficiently.

Filing deadlines and important dates

Each state has specific deadlines for filing creditor claims against an estate, which are typically outlined in probate law. It is essential to be aware of these timelines to ensure that your claim is submitted on time. Generally, creditors must file their claims within a certain period following the appointment of the estate representative or the publication of a notice to creditors. Missing these deadlines may result in the inability to recover the owed amounts, so staying informed about the relevant dates is crucial.

Examples of using the creditor estate form

There are various scenarios in which a creditor estate form may be utilized. For instance, a medical provider may file a claim for unpaid medical bills incurred by the decedent prior to their passing. Similarly, a credit card company can submit a claim for outstanding balances owed. Each of these examples illustrates the importance of the creditor estate form in facilitating the resolution of debts and ensuring that creditors are compensated from the estate before any distributions to heirs occur.

Quick guide on how to complete creditor of estate

Effortlessly Prepare Creditor Of Estate on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents quickly and without delays. Manage Creditor Of Estate on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Creditor Of Estate with Ease

- Obtain Creditor Of Estate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Modify and eSign Creditor Of Estate and ensure exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a creditor decedent and how does it impact estate management?

A creditor decedent refers to an individual who has died leaving unresolved debts. Managing the estate of a creditor decedent involves addressing these debts before distributing assets to heirs. It’s crucial to ensure that all claims are settled in accordance with probate laws, which can be made easier with airSlate SignNow’s electronic signature features for documentation.

-

How can airSlate SignNow help with the administration of a creditor decedent's estate?

airSlate SignNow streamlines the process of gathering necessary signatures and approvals when managing a creditor decedent's estate. By providing an efficient eSignature platform, it allows you to easily send documents for signing, ensuring that all estate dealings are finalized quickly and legally. This efficiency can signNowly reduce the stress of managing a deceased person's finances.

-

What pricing plans does airSlate SignNow offer for managing creditor decedent documentation?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. For users dealing with creditor decedent matters, our plans provide comprehensive features without breaking the bank. You can select a plan that suits your needs, ensuring that managing estate documents remains cost-effective.

-

Are there specific features in airSlate SignNow that cater to creditor decedent scenarios?

Yes, airSlate SignNow includes features specifically beneficial when dealing with creditor decedent matters, such as customizable document templates and automated reminders for signers. These tools ensure that all necessary documents are completed efficiently and on time, which is critical in the context of estate administration.

-

What benefits does airSlate SignNow offer for businesses handling creditor decedent claims?

Using airSlate SignNow provides several benefits for businesses handling creditor decedent claims, including improved turnaround times for document processing and enhanced compliance with legal standards. The platform helps ensure that all parties involved can sign and return documents quickly, making the estate settlement process smoother and more efficient.

-

Can airSlate SignNow integrate with other tools for handling creditor decedent assets?

Absolutely, airSlate SignNow integrates seamlessly with various tools that assist in the management of creditor decedent assets, including accounting software and CRM systems. This integration allows for a holistic approach to estate management, ensuring that all aspects are covered without requiring multiple platforms.

-

Is it safe to use airSlate SignNow for signing creditor decedent documents?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to ensure that all documents related to creditor decedent transactions are protected from unauthorized access. Moreover, our platform complies with industry standards for electronic signatures, providing peace of mind for all users.

Get more for Creditor Of Estate

- North carolina employee enrollmentchange form

- Membership form north carolina bowhunters association

- North carolina small group employee enrollmentchange form aetna north carolina small group employee enrollmentchange form

- Motorcycle ride registration form template

- Sharps injury log form

- Registering a used watercraft purchased from or given to you by an individual send this form the appropriate fee and proof of

- Sts w038 form

- Temperature log sheet nhfoodbank form

Find out other Creditor Of Estate

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document