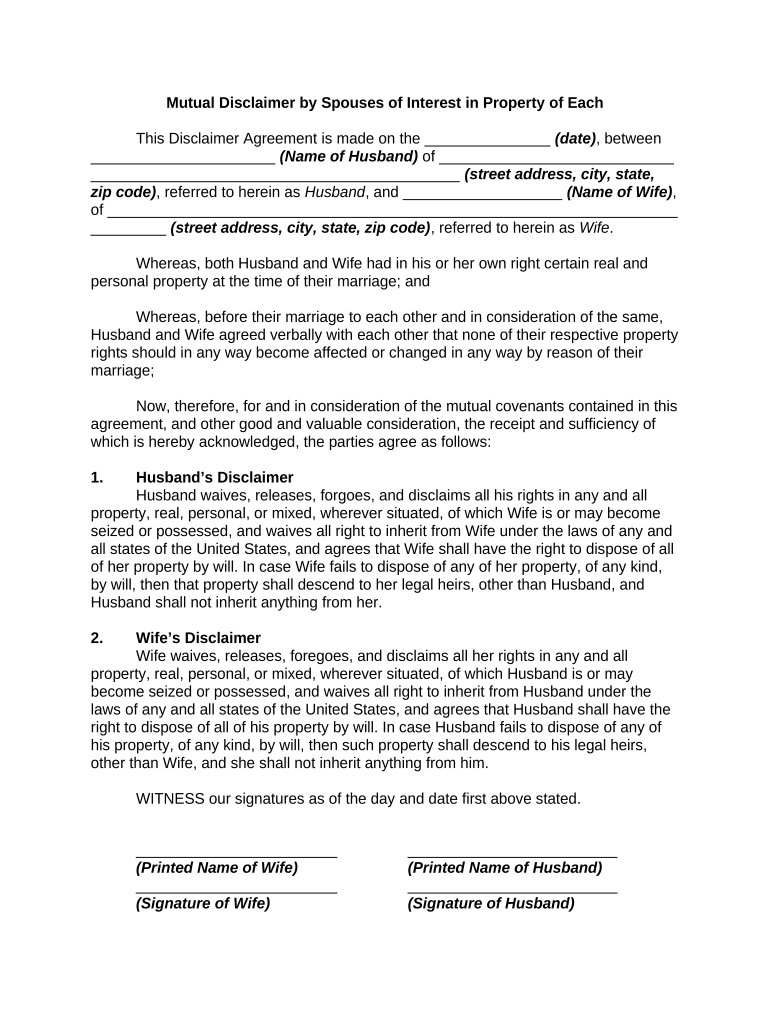

Spouses Property Form

What is the spouses property?

The spouses property refers to the assets and real estate owned jointly or individually by married partners. This can include homes, land, and other forms of property acquired during the marriage. Understanding what constitutes spouses property is crucial for legal and financial planning, especially in the context of divorce, inheritance, or estate planning. In many states, property acquired during the marriage is considered marital property, while assets owned prior to marriage may be classified as separate property.

Key elements of the spouses property

Several key elements define the spouses property, which can impact ownership rights and responsibilities:

- Ownership type: Property can be owned jointly or separately, affecting how it is divided in legal situations.

- Acquisition date: The date when property was acquired plays a significant role in determining its classification as marital or separate property.

- State laws: Different states have varying laws regarding the classification and division of spouses property, influencing how assets are handled in divorce or inheritance cases.

- Debt liabilities: Liabilities associated with the property, such as mortgages or loans, can also affect ownership and division.

Steps to complete the spouses property

Completing a spouses property agreement involves several important steps to ensure clarity and legal validity:

- Identify the property: List all assets owned by both spouses, noting whether they are considered marital or separate property.

- Consult legal counsel: Seek advice from a legal professional to understand state-specific laws and implications of the agreement.

- Draft the agreement: Create a detailed document outlining ownership, rights, and responsibilities regarding the property.

- Review and sign: Both spouses should review the agreement thoroughly before signing to ensure mutual understanding and consent.

- File the agreement: Depending on state laws, it may be necessary to file the agreement with a court or local government office.

Legal use of the spouses property

The legal use of spouses property encompasses various scenarios, including divorce proceedings, estate planning, and tax implications. In divorce, understanding the classification of property can determine how assets are divided. For estate planning, spouses property may need to be addressed to ensure proper distribution upon death. Additionally, tax considerations such as capital gains tax can arise when selling jointly owned property, making it essential to consult with a tax professional.

Required documents

When preparing a spouses property agreement, certain documents may be required to support the claims and ensure legal compliance:

- Property deeds: Documentation proving ownership of real estate or other significant assets.

- Financial statements: Bank statements, investment account statements, and other financial documents to assess the value of assets.

- Debt documentation: Information regarding any mortgages, loans, or other liabilities associated with the property.

- Previous agreements: Any prior agreements related to property ownership or division, particularly in the case of remarriage.

State-specific rules for the spouses property

Each state in the U.S. has its own laws regarding spouses property, which can significantly affect how property is classified and divided. For example, community property states treat most assets acquired during marriage as jointly owned, while equitable distribution states consider various factors to determine a fair division. It is important for spouses to understand their state’s specific rules to navigate property agreements effectively and ensure compliance with local laws.

Quick guide on how to complete spouses property

Complete Spouses Property effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an exemplary eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without interruptions. Manage Spouses Property on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Spouses Property with ease

- Obtain Spouses Property and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your PC.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Spouses Property and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a spouses property agreement?

A spouses property agreement is a legal document that outlines how property will be divided between spouses in the event of separation or divorce. airSlate SignNow provides a secure platform to create, sign, and store these agreements, ensuring all parties have a clear understanding of their rights.

-

How can airSlate SignNow help with spouses property agreements?

airSlate SignNow simplifies the process of creating and signing spouses property agreements by offering customizable templates and a user-friendly interface. With our platform, couples can easily collaborate and finalize their agreements digitally, saving time and reducing stress.

-

What are the costs associated with using airSlate SignNow for spouses property agreements?

airSlate SignNow offers flexible pricing plans tailored to different needs, making it affordable for anyone looking to create a spouses property agreement. Users can choose a plan based on the number of documents and features they require, ensuring cost-effective access to quality legal documentation.

-

Is it easy to integrate airSlate SignNow with other tools for spouses property agreements?

Yes, airSlate SignNow offers seamless integration with various tools and platforms that can enhance the management of your spouses property agreement. Whether you use CRM systems, cloud storage, or collaboration tools, our platform easily connects to support your workflow.

-

What features does airSlate SignNow provide for managing spouses property agreements?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure eSigning for spouses property agreements. Additionally, it offers tracking capabilities, reminders, and a mobile-friendly experience to ensure documents are managed efficiently.

-

Can airSlate SignNow help if my spouses property agreement needs to be revised?

Absolutely! airSlate SignNow allows users to easily edit and revise spouses property agreements with just a few clicks. You can streamline the process of updating any terms and conditions, ensuring that all parties are synchronized and informed of the changes.

-

What benefits does using airSlate SignNow offer for spouses property agreements compared to traditional methods?

Using airSlate SignNow for spouses property agreements provides signNow benefits over traditional methods, such as enhanced security, reduced paperwork, and faster turnaround times. Clients can sign documents electronically, leading to a more efficient and modern approach to legal agreements.

Get more for Spouses Property

Find out other Spouses Property

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement