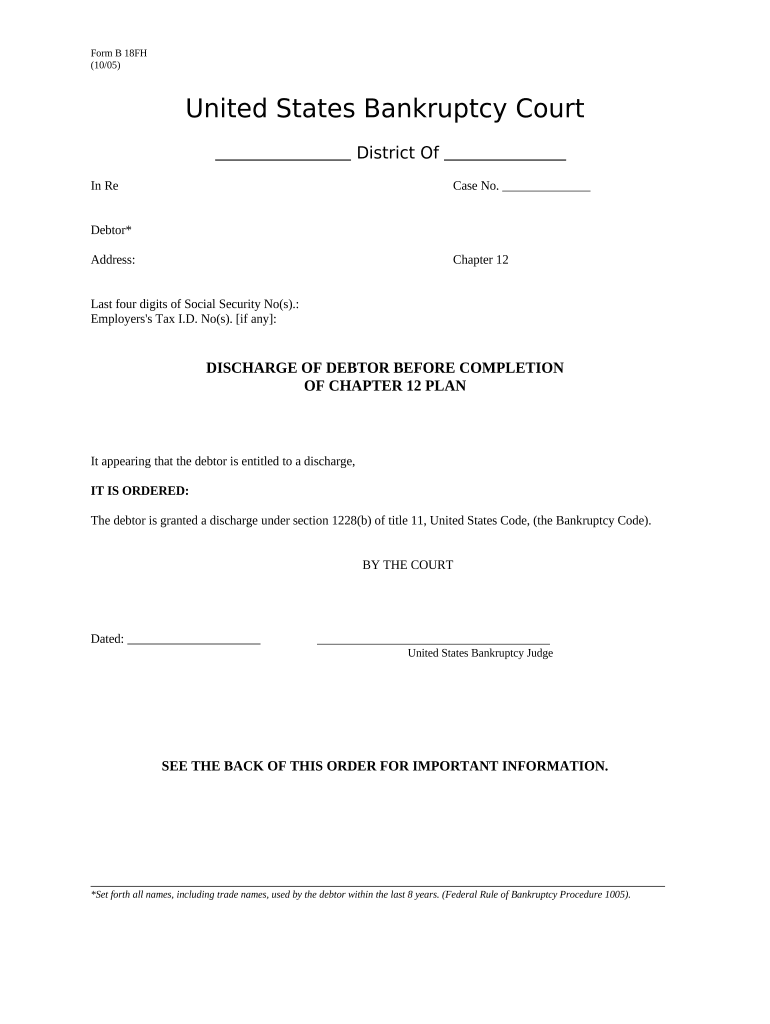

Chapter 12 Form

What is Chapter 12?

Chapter 12 is a section of the U.S. Bankruptcy Code designed specifically for family farmers and fishermen. This legal framework allows individuals engaged in farming or fishing operations to reorganize their debts while continuing their business activities. It provides a unique opportunity for debtors to propose a repayment plan that accommodates their financial situation, ensuring they can maintain their livelihoods while addressing their obligations. The Chapter 12 plan must be confirmed by the court, which evaluates its feasibility and fairness to creditors.

How to Use Chapter 12

Utilizing Chapter 12 involves several key steps. First, debtors must assess their eligibility, ensuring they meet the criteria set forth by the Bankruptcy Code. Next, they prepare a repayment plan that outlines how they intend to repay their debts over a specified period, typically three to five years. This plan must be filed with the bankruptcy court, along with necessary financial disclosures. Once submitted, a confirmation hearing is scheduled, allowing creditors to voice any objections. If the court approves the plan, it becomes binding, and the debtor can begin making payments as outlined.

Steps to Complete the Chapter 12 Plan Form

Completing the Chapter 12 plan form requires careful attention to detail. Here are the essential steps:

- Gather financial information, including income, expenses, assets, and liabilities.

- Draft the repayment plan, specifying the amount and schedule of payments to creditors.

- Ensure compliance with all legal requirements, including eligibility criteria.

- File the completed Chapter 12 plan form with the bankruptcy court.

- Attend the confirmation hearing to address any questions or concerns from the court or creditors.

Legal Use of Chapter 12

Chapter 12 provides a legal avenue for family farmers and fishermen to manage their debts while continuing their operations. It is crucial that debtors follow the legal processes outlined in the Bankruptcy Code to ensure their plan is valid. This includes adhering to timelines for filing, providing accurate information, and attending required hearings. By doing so, debtors can protect their rights and work towards a sustainable financial future.

Eligibility Criteria for Chapter 12

To qualify for Chapter 12, debtors must meet specific eligibility criteria. They must be engaged in a farming or fishing operation, with a regular annual income. Additionally, the total debt must not exceed certain limits set by the Bankruptcy Code, which are adjusted periodically. It is essential for potential filers to review these requirements carefully to determine their eligibility before proceeding with the filing process.

Required Documents for Chapter 12

Filing for Chapter 12 requires several key documents to ensure a complete application. These typically include:

- Financial statements detailing income, expenses, assets, and liabilities.

- A proposed repayment plan outlining how debts will be repaid.

- Tax returns for the previous two years.

- Documentation proving the nature of the farming or fishing operation.

Form Submission Methods for Chapter 12

Debtors can submit the Chapter 12 plan form through various methods, ensuring flexibility and convenience. The primary options include:

- Online submission via the bankruptcy court's electronic filing system.

- Mailing the completed form directly to the appropriate bankruptcy court.

- In-person submission at the court clerk's office.

Quick guide on how to complete chapter 12

Complete Chapter 12 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle Chapter 12 on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to modify and electronically sign Chapter 12 without hassle

- Find Chapter 12 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive details with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Alter and electronically sign Chapter 12 and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does discharging debtor mean in legal terms?

Discharging debtor refers to the legal process by which a debtor is relieved from the obligation to pay certain debts. This can occur through bankruptcy or specific settlements, allowing the individual or business to start fresh. Understanding this term is vital when considering the implications of eSigning relevant documents.

-

How can airSlate SignNow assist in the discharging debtor process?

airSlate SignNow provides an efficient platform for eSigning and managing documents related to discharging debtor procedures. Our user-friendly interface allows you to quickly send out, sign, and organize necessary forms, streamlining what can be a complex process. This ensures that all parties involved can complete critical documentation without delays.

-

What are the costs associated with using airSlate SignNow for discharging debtor documents?

airSlate SignNow offers flexible pricing plans tailored to your business needs, including options for individuals or larger teams. Whether you need basic features or advanced tools for discharging debtor operations, we provide affordable solutions that cater to various budgets. A free trial is also available to help you evaluate our services without commitment.

-

Are there any features specifically designed for handling discharging debtor cases?

Yes, airSlate SignNow includes features that are beneficial for managing discharging debtor scenarios, such as secure document storage, customizable templates, and automated reminders. These tools enhance the efficiency and security of the eSigning process, making it easier for users to navigate through various legal obligations. You can also track document status in real-time.

-

What benefits does airSlate SignNow provide for businesses dealing with discharging debtor situations?

By using airSlate SignNow, businesses can signNowly reduce the time spent on paperwork related to discharging debtor situations. Our platform enhances communication among stakeholders and minimizes errors associated with manual document handling. This leads to greater compliance and smoother operations in critical financial matters.

-

Can airSlate SignNow integrate with other tools to manage discharging debtor documentation?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow for discharging debtor documentation. Whether you use CRM systems or accounting software, our platform allows for seamless data connectivity, ensuring that all necessary information is easily accessible and organized.

-

Is airSlate SignNow secure for managing sensitive discharging debtor documents?

Yes, airSlate SignNow prioritizes security and employs industry-standard encryption protocols to safeguard sensitive discharging debtor documents. Our compliance with regulations such as GDPR ensures that your data is handled securely. You can rest assured that your documents are protected throughout the eSigning process.

Get more for Chapter 12

- Printable 2020 maine new markets capital investment credit new markets capital investment credit form

- General information pension schedule form 4884 michigan

- Pre affidavit form

- Printable 2020 michigan form 4976 home heating credit claim supplemental

- Make michigan individual income tax e paymentsmake michigan individual income tax e paymentsmake michigan individual income tax form

- Michigan form 5678 signed distribution statement for joint

- Make michigan individual income tax e paymentsmichigan net operating loss mi 1045michigan form mi 1040 individual income tax

- Printable 2020 minnesota form m1ls tax on lump sum distribution

Find out other Chapter 12

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form