Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret 2020

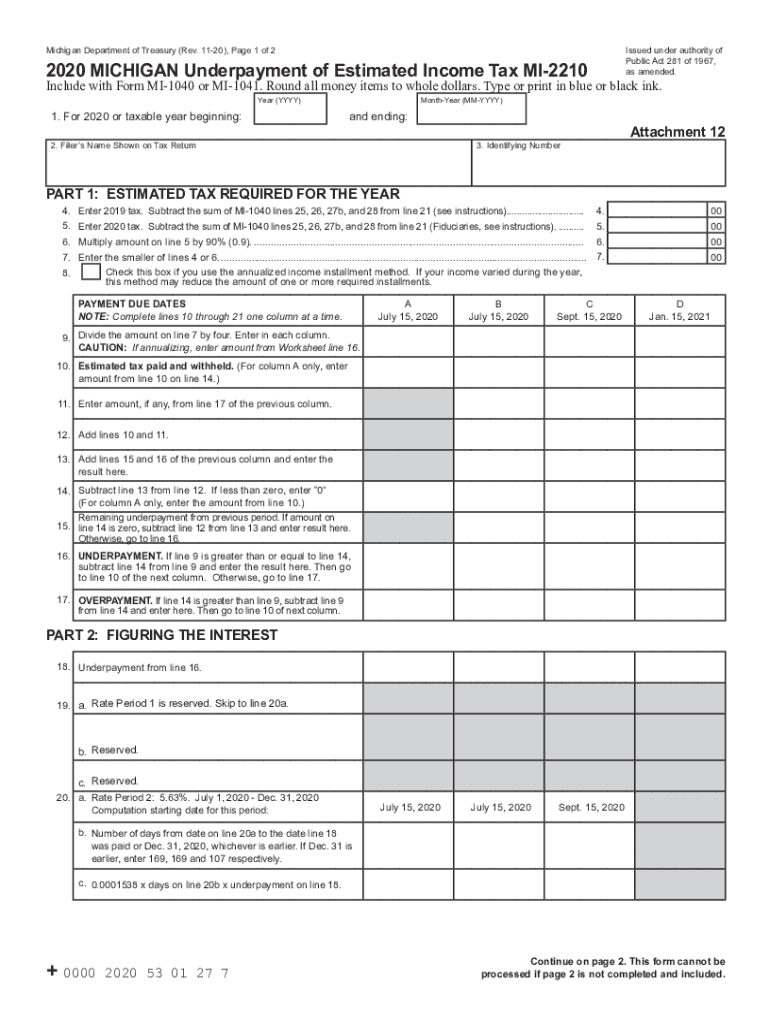

Understanding the MI 2210 Form

The MI 2210 form is used by Michigan taxpayers to report underpayment of estimated income tax. This form is essential for individuals who do not meet the required payment thresholds throughout the tax year. By accurately completing the MI 2210, taxpayers can avoid penalties associated with underpayment. It is particularly important for self-employed individuals or those with significant income fluctuations to monitor their estimated tax payments.

Steps to Complete the MI 2210 Form

Filling out the MI 2210 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Determine your total income for the year and calculate your estimated tax liability.

- Compare your estimated tax payments to the required amounts based on your income.

- Complete the MI 2210 form by providing necessary details, including your income and payment history.

- Review the form for accuracy before submission.

Legal Use of the MI 2210 Form

The MI 2210 form serves a legal purpose in ensuring compliance with Michigan tax laws. Proper use of this form can protect taxpayers from penalties associated with underpayment. It is crucial to understand the legal implications of submitting this form, as failure to do so may result in financial repercussions. The form must be filed accurately and on time to maintain compliance with state regulations.

Filing Deadlines for the MI 2210 Form

Timely submission of the MI 2210 form is essential to avoid penalties. The form is typically due on the same date as your annual tax return. Taxpayers should be aware of specific deadlines, especially if they are filing for an extension. Keeping track of these dates ensures that you remain compliant with Michigan tax laws.

Required Documents for the MI 2210 Form

To complete the MI 2210 form, you will need several documents:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of estimated tax payments made throughout the year.

- Any supporting documentation for deductions or credits claimed.

Penalties for Non-Compliance with the MI 2210 Form

Failure to file the MI 2210 form or underpayment of estimated taxes can result in significant penalties. The state of Michigan imposes interest and penalties on any unpaid tax amounts. Understanding these potential consequences is vital for taxpayers to avoid unnecessary financial burdens.

Quick guide on how to complete make michigan individual income tax e paymentsmichigan net operating loss mi 1045michigan form mi 1040 individual income tax

Effortlessly prepare Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret seamlessly

- Obtain Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct make michigan individual income tax e paymentsmichigan net operating loss mi 1045michigan form mi 1040 individual income tax

Create this form in 5 minutes!

How to create an eSignature for the make michigan individual income tax e paymentsmichigan net operating loss mi 1045michigan form mi 1040 individual income tax

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is mi 2210 and how does it benefit my business?

The mi 2210 is a powerful electronic signature solution offered by airSlate SignNow that streamlines the document signing process. By using mi 2210, businesses can reduce turnaround times and improve workflow efficiency. This solution is designed to cater to businesses of all sizes, ensuring a user-friendly experience that enhances productivity.

-

How much does the mi 2210 solution cost?

The pricing for the mi 2210 solution varies depending on the features and number of users. airSlate SignNow offers competitive pricing plans that ensure you receive the best value for your investment. You can visit our pricing page for detailed information on the various packages available.

-

What features are included with mi 2210?

The mi 2210 comes with a range of robust features, including customizable templates, automated workflows, and real-time tracking. These features are designed to enhance the signing experience and improve overall document management. With mi 2210, you can also integrate with other applications to further streamline your business processes.

-

How does mi 2210 ensure document security?

Security is a top priority with mi 2210. airSlate SignNow uses advanced encryption protocols and complies with industry standards to protect your documents and data. You can trust that every document signed with mi 2210 is securely stored and accessible only to authorized users.

-

Can mi 2210 integrate with other software?

Yes, mi 2210 offers seamless integration with various software applications, including CRM systems, cloud storage services, and project management tools. This integration capability allows for a unified workflow, making it easier to manage your documentation process. By connecting mi 2210 with your existing tools, you can enhance productivity across your organization.

-

Is there a mobile app for mi 2210?

Absolutely! The mi 2210 solution includes a mobile app that allows you to send and sign documents on-the-go. This feature ensures that you and your team can stay productive regardless of your location, making it easier to get documents signed quickly and efficiently.

-

How can mi 2210 improve workflow efficiency?

By using mi 2210, businesses can automate repetitive tasks and reduce the time spent on document handling. This increased efficiency translates to faster approvals and a smoother overall workflow. With tools like document templates and reminders, the mi 2210 solution simplifies the signing process considerably.

Get more for Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret

- Dss 4449c form

- Public pool and spa injury incident report form toledo lucas

- Initial health assessment ohio department mental health and form

- Parental consent form state of oklahoma website ok

- Form 04af001e oklahoma department of human services okdhs

- Home health agency application and certification processes form

- Parental consent form for a minor seeking abortion

- Pa 1829 form

Find out other Make Michigan Individual Income Tax E PaymentsMICHIGAN Net Operating Loss MI 1045Michigan Form MI 1040 Individual Income Tax Ret

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors