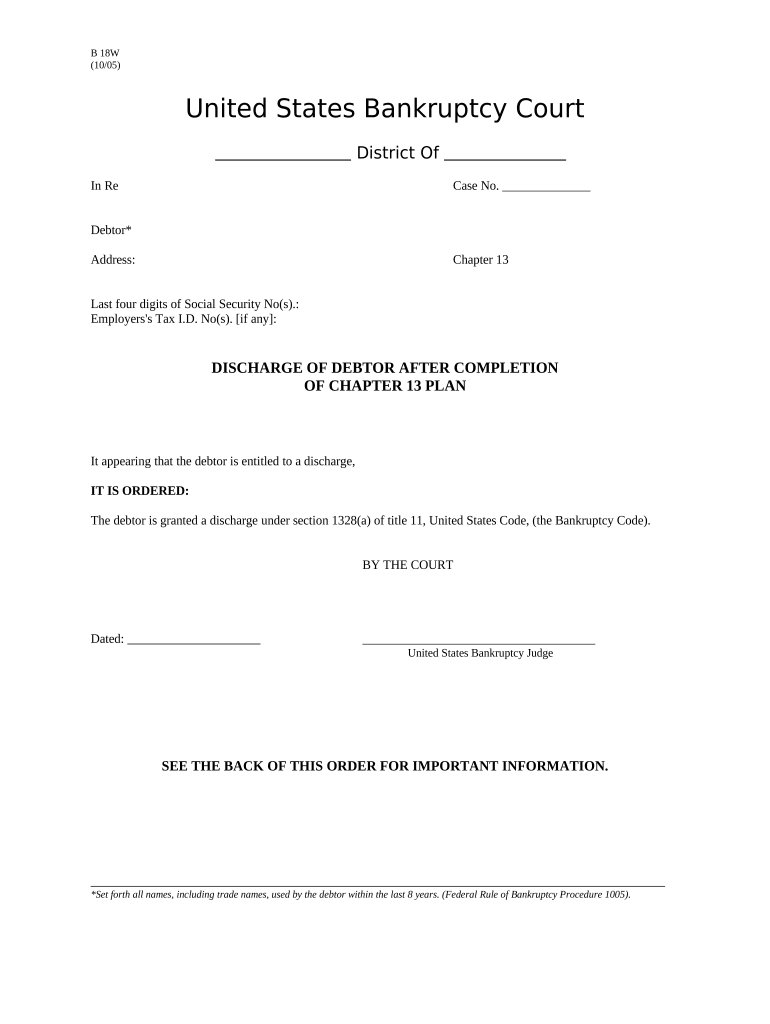

Chapter 13 Plan Form

What is the Chapter 13 Plan

The Chapter 13 Plan is a legal framework designed for individuals seeking to reorganize their debts while maintaining their assets. This plan allows debtors to propose a repayment schedule to creditors over a three to five-year period. Unlike Chapter 7 bankruptcy, which involves liquidating assets, Chapter 13 enables individuals to keep their property while making manageable payments based on their income and expenses. The plan must be approved by the bankruptcy court, ensuring that it meets legal requirements and is feasible for the debtor.

Steps to Complete the Chapter 13 Plan

Completing the Chapter 13 Plan involves several key steps that ensure compliance with legal requirements. First, the debtor must gather all necessary financial information, including income, expenses, and debts. Next, they should draft the plan, outlining how they intend to repay creditors. This plan must be submitted to the bankruptcy court for approval. Once approved, the debtor will begin making payments according to the plan's terms. It is crucial to adhere to the payment schedule to avoid complications or potential dismissal of the case.

Key Elements of the Chapter 13 Plan

The Chapter 13 Plan includes several essential elements that must be addressed for successful execution. These elements typically consist of:

- Payment amount: The monthly payment the debtor proposes to make to the trustee.

- Duration: The length of the repayment period, usually three to five years.

- Priority debts: Identification of debts that must be paid in full, such as tax obligations and child support.

- Secured and unsecured debts: Classification of debts and how they will be treated under the plan.

Addressing these elements clearly in the plan is vital for court approval and successful debt management.

Legal Use of the Chapter 13 Plan

The legal use of the Chapter 13 Plan is governed by federal bankruptcy laws, which outline the rights and obligations of both debtors and creditors. For the plan to be legally binding, it must be filed with the bankruptcy court and approved by a judge. The plan must also comply with the requirements set forth in the Bankruptcy Code, including the necessity for the debtor to have a regular income and the ability to make the proposed payments. Failure to adhere to these legal standards can result in dismissal of the case or denial of discharge of debts.

Required Documents

When preparing to file a Chapter 13 Plan, certain documents are required to support the application. These typically include:

- Income documentation: Pay stubs, tax returns, and other proof of income.

- Debt information: A list of all creditors, amounts owed, and the nature of each debt.

- Expense records: Documentation of monthly expenses to establish the repayment ability.

- Credit counseling certificate: Proof of completion of a credit counseling course.

Gathering these documents is essential for a smooth filing process and to ensure compliance with court requirements.

Form Submission Methods

Submitting the Chapter 13 Plan can be done through various methods, ensuring accessibility for debtors. The primary methods include:

- Online submission: Many courts allow electronic filing through their websites, which can expedite the process.

- Mail: Debtors can send their completed forms via postal mail to the appropriate bankruptcy court.

- In-person filing: Individuals may also choose to file their forms directly at the courthouse, where they can receive immediate assistance.

Choosing the right submission method can help ensure that the plan is filed correctly and on time, minimizing delays in the bankruptcy process.

Quick guide on how to complete chapter 13 plan 497335351

Execute Chapter 13 Plan effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and sign your documents quickly without delays. Manage Chapter 13 Plan on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and sign Chapter 13 Plan hassle-free

- Locate Chapter 13 Plan and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Modify and sign Chapter 13 Plan and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is discharging chapter 13 and how does it relate to airSlate SignNow?

Discharging chapter 13 refers to the process of eliminating debts under a Chapter 13 bankruptcy after completing the repayment plan. airSlate SignNow can help you eSign and manage important documents involved in this process efficiently, ensuring you stay organized and compliant with legal requirements.

-

How does airSlate SignNow assist with document management during the discharging chapter 13 process?

airSlate SignNow provides an intuitive platform for sending and eSigning documents, which is essential during the discharging chapter 13 process. The ability to track document status and receive notifications helps you manage deadlines and ensures that all paperwork is in order.

-

What are the pricing options for airSlate SignNow when dealing with discharging chapter 13?

airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing documents related to discharging chapter 13. You can choose from monthly or annual subscriptions, allowing you to select a plan that fits your budget.

-

Are there any features specifically beneficial for discharging chapter 13 in airSlate SignNow?

Yes, airSlate SignNow includes features such as document templates, customizable workflows, and secure storage, all of which are particularly beneficial when discharging chapter 13. These features help streamline the process, saving you time and reducing the risk of errors.

-

Can airSlate SignNow integrate with other platforms for better management of discharging chapter 13?

Absolutely! airSlate SignNow integrates seamlessly with various productivity and document management platforms, enhancing your workflow during the discharging chapter 13 process. You can connect it with applications like Google Drive and Dropbox to manage your documents more effectively.

-

What are the benefits of using airSlate SignNow for individuals discharging chapter 13?

Using airSlate SignNow provides numerous benefits for individuals discharging chapter 13, such as improved efficiency and reduced paper usage. The eSigning feature also speeds up document handling, allowing you to focus more on your financial recovery.

-

Is airSlate SignNow secure for handling sensitive information related to discharging chapter 13?

Yes, airSlate SignNow prioritizes security and compliance, making it safe for handling sensitive information related to discharging chapter 13. With features like data encryption and secure access controls, you can trust that your documents are well-protected.

Get more for Chapter 13 Plan

- Schedule in 113 income adjustment vermont department of taxes form

- Form pc 220 revenue wi

- Tax exempt fillable formpdffillercom 2011

- Wi w4 2004 form

- 2017 wisconsin 1 es form

- Schedule h wisconsin department of revenue revenue wi form

- Rent certificate 2012 form

- Form wt 7 electronic filing mandate 3 options wisconsin revenue wi

Find out other Chapter 13 Plan

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now