Underwriting Agreement Sample Form

What is the underwriting agreement sample?

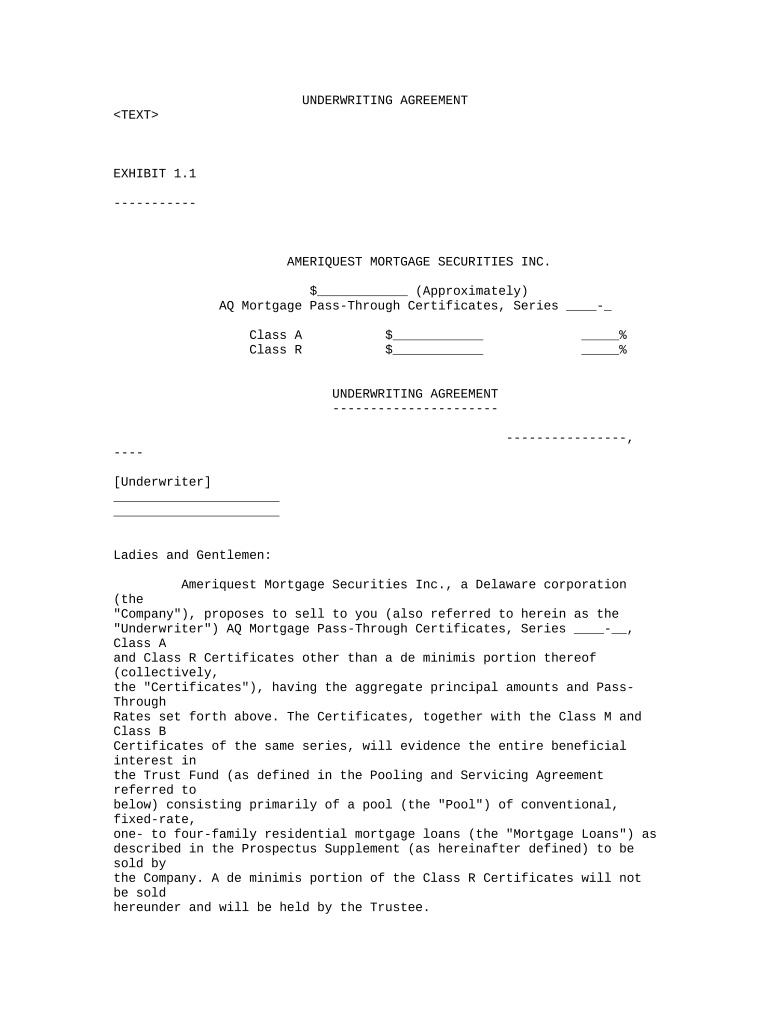

An underwriting agreement is a legal document that outlines the terms and conditions under which an underwriter agrees to purchase and sell securities on behalf of an issuer. This agreement is crucial in the context of public offerings, as it establishes the responsibilities of both parties and the financial arrangements involved. The underwriting agreement sample serves as a template for businesses looking to draft their own agreements, ensuring that they include all necessary elements to protect their interests and comply with legal standards.

Key elements of the underwriting agreement sample

Understanding the key elements of an underwriting agreement is essential for effective contract creation. The main components typically include:

- Parties involved: Identification of the issuer and the underwriter.

- Type of securities: Specific details about the securities being offered, such as stocks or bonds.

- Pricing and underwriting discount: Terms regarding the pricing of the securities and any fees associated with underwriting.

- Closing conditions: Requirements that must be met before the transaction can be finalized.

- Representations and warranties: Assurances made by both parties regarding their authority and the validity of the agreement.

- Indemnification: Provisions that protect the underwriter from legal liabilities arising from the issuer's actions.

How to use the underwriting agreement sample

Using an underwriting agreement sample involves several steps to ensure it meets your specific needs. Start by reviewing the template to understand its structure and content. Next, customize the sample by filling in the relevant details, such as the names of the parties involved and the specifics of the securities. It is also important to consult with legal counsel to ensure that the agreement complies with applicable laws and regulations. This step helps to avoid potential legal issues and ensures that the agreement is enforceable.

Steps to complete the underwriting agreement sample

Completing the underwriting agreement sample requires careful attention to detail. Follow these steps:

- Gather necessary information: Collect all relevant details about the issuer, underwriter, and securities.

- Fill in the template: Input the gathered information into the sample, ensuring accuracy and completeness.

- Review for compliance: Check the agreement against legal requirements and industry standards.

- Consult with legal professionals: Have a lawyer review the document to ensure it meets all legal obligations.

- Execute the agreement: Once finalized, both parties should sign the document to make it legally binding.

Legal use of the underwriting agreement sample

The legal use of an underwriting agreement sample hinges on its compliance with relevant laws and regulations. In the United States, the agreement must adhere to the Securities Act of 1933 and other applicable securities laws. This ensures that the underwriting process is conducted transparently and fairly. Moreover, the agreement should include provisions that protect both parties, such as indemnification clauses and representations regarding the issuer's financial status. By following legal guidelines, businesses can mitigate risks associated with securities offerings.

Examples of using the underwriting agreement sample

There are various scenarios where an underwriting agreement sample can be utilized effectively. For instance, a company planning to go public may use the sample to outline the terms of its initial public offering (IPO). Similarly, a corporation looking to issue bonds may reference the sample to draft an agreement with an underwriter. These examples illustrate how the underwriting agreement serves as a foundational document in diverse financial transactions, facilitating clear communication and mutual understanding between parties.

Quick guide on how to complete underwriting agreement sample

Complete Underwriting Agreement Sample effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Underwriting Agreement Sample on any device using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and electronically sign Underwriting Agreement Sample with ease

- Obtain Underwriting Agreement Sample and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the data and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Underwriting Agreement Sample to guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an underwriting agreement?

An underwriting agreement is a legal contract between a company and underwriters to issue and sell a specific number of shares or bonds. It outlines the terms and conditions under which the underwriters agree to manage the offering and the responsibility for selling the securities to investors.

-

How does airSlate SignNow simplify the eSigning process for underwriting agreements?

airSlate SignNow streamlines the eSigning process for underwriting agreements by allowing users to send documents directly to multiple signers, track the status in real-time, and secure signatures with legally binding authentication measures. This ensures that the entire process is efficient and compliant with legal standards.

-

What are the pricing options for airSlate SignNow for managing underwriting agreements?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including features for handling underwriting agreements. Businesses can choose from monthly or annual subscriptions with different tiers to access advanced features such as custom branding, integration options, and additional storage.

-

Can I integrate airSlate SignNow with existing software for managing underwriting agreements?

Yes, airSlate SignNow provides seamless integrations with popular business tools and software. This allows you to manage underwriting agreements effectively by connecting with CRMs, document management systems, and other applications, ensuring that your workflow remains uninterrupted.

-

What security features does airSlate SignNow provide for underwriting agreements?

airSlate SignNow prioritizes the security of your documents, including underwriting agreements, by employing advanced encryption and authentication protocols. This ensures that all documents are protected during transmission and storage, giving users peace of mind that their sensitive information is safe.

-

How can airSlate SignNow enhance collaboration on underwriting agreements?

AirSlate SignNow enhances collaboration on underwriting agreements by allowing multiple stakeholders to review, comment, and sign documents in one place. The platform supports real-time notifications and updates, making it easier for teams to work together and finalize agreements swiftly.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with underwriting agreements?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises, looking to manage underwriting agreements efficiently. Its scalability ensures that as your business grows, the solution can adapt to your increasing document needs without compromising functionality.

Get more for Underwriting Agreement Sample

Find out other Underwriting Agreement Sample

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation