Qualified Written Request Form

What is the Qualified Written Request

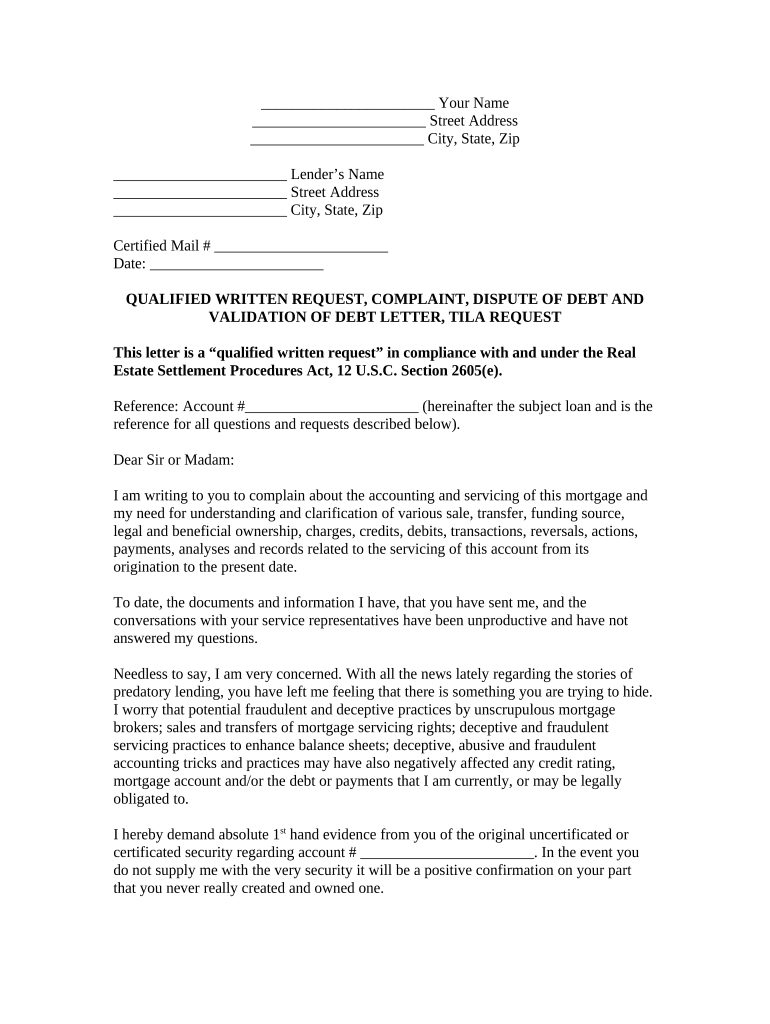

A Qualified Written Request (QWR) is a formal communication sent by a borrower to a loan servicer, typically regarding issues related to the servicing of a mortgage loan. Under the Real Estate Settlement Procedures Act (RESPA), a QWR allows borrowers to request information or dispute the accuracy of loan servicing. This request must be in writing and clearly state the reasons for the inquiry or dispute. The servicer is obligated to respond within a specific timeframe, ensuring that borrowers receive timely assistance regarding their mortgage concerns.

Key elements of the Qualified Written Request

When drafting a Qualified Written Request, it is essential to include specific elements to ensure its validity. Key components include:

- Borrower Information: Full name, address, and account number associated with the mortgage.

- Specific Inquiry: A clear and concise statement of the information requested or the issue being disputed.

- Supporting Documentation: Any relevant documents that support the request or dispute.

- Date of Submission: The date the request is sent to the loan servicer.

Including these elements helps facilitate a smooth response process from the loan servicer.

Steps to complete the Qualified Written Request

Completing a Qualified Written Request involves several important steps:

- Identify the Issue: Determine the specific concern or information needed regarding your mortgage.

- Gather Documentation: Collect any necessary documents that support your request.

- Draft the Request: Write your QWR, ensuring it includes all required elements.

- Send the Request: Submit the QWR to the appropriate address provided by your loan servicer, ensuring it is sent via a method that provides proof of delivery.

- Follow Up: Keep track of the response time and follow up if you do not receive a timely reply.

Following these steps can help ensure that your request is handled efficiently.

Legal use of the Qualified Written Request

The Qualified Written Request serves as a legal tool for borrowers to address issues with their mortgage servicers. Under RESPA, servicers are required to acknowledge receipt of a QWR within five days and respond within thirty days, providing the necessary information or addressing the dispute. This legal framework protects borrowers by ensuring they have a formal avenue to seek resolution and receive accurate information regarding their loans.

Examples of using the Qualified Written Request

Examples of situations where a Qualified Written Request may be utilized include:

- Requesting clarification on loan terms or payment history.

- Disputing errors in account statements or payment applications.

- Inquiring about the status of a loan modification or foreclosure process.

- Seeking information regarding escrow accounts or insurance payments.

Using a QWR in these scenarios helps ensure that borrowers receive the necessary information to manage their loans effectively.

Form Submission Methods (Online / Mail / In-Person)

Submitting a Qualified Written Request can be done through various methods, depending on the preferences of the borrower and the requirements of the loan servicer. Common submission methods include:

- Mail: Sending the QWR via certified mail provides proof of delivery and is often the most secure method.

- Email: Some servicers may accept QWRs via email, but it is essential to verify this option and ensure all documentation is attached.

- Online Portals: If the loan servicer has an online portal, borrowers may be able to submit their requests directly through this platform.

Choosing the appropriate submission method can help ensure that the request is received and processed in a timely manner.

Quick guide on how to complete qualified written request

Effortlessly Prepare Qualified Written Request on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Qualified Written Request on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Qualified Written Request with Ease

- Find Qualified Written Request and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Qualified Written Request to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a qualified written request sample?

A qualified written request sample is a formal document used to communicate specific information or requests to a company, ensuring that it meets legal standards. This type of request typically concerns issues like billing disputes or service changes. By using a well-crafted qualified written request sample, you can ensure your concerns are handled promptly and legally.

-

How can airSlate SignNow help me create a qualified written request sample?

airSlate SignNow provides intuitive tools that allow you to easily draft and customize a qualified written request sample. With our eSign capabilities, you can ensure your document is not only well-formulated but also legally binding. This streamlines the communication process with your service providers.

-

Is airSlate SignNow cost-effective for businesses looking to create qualified written request samples?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes. Our subscription plans provide access to essential features that help you create, send, and eSign documents, including qualified written request samples, without breaking the bank. You can choose a plan that best suits your organization's needs.

-

What features does airSlate SignNow offer for eSigning qualified written request samples?

airSlate SignNow includes a variety of features specifically designed for eSigning qualified written request samples. Our platform allows you to add multiple signers, track document status, and send reminders. These features ensure that your requests are signed and processed efficiently.

-

Can I integrate airSlate SignNow with other tools to manage qualified written request samples?

Absolutely! airSlate SignNow offers numerous integration options with popular tools like Google Workspace, Microsoft Office, and CRM systems. This enables you to streamline your workflow when managing qualified written request samples, ensuring that you can easily access and use the information across different platforms.

-

What are the benefits of using a qualified written request sample for my business?

Using a qualified written request sample can signNowly enhance your business communications by ensuring clarity and compliance. It establishes a formal record of your requests, which can expedite processes and prevent misunderstandings. Additionally, it demonstrates professionalism, which helps in maintaining good relationships with your service providers.

-

How do I ensure my qualified written request sample is compliant with legal standards?

To ensure that your qualified written request sample complies with legal standards, it's essential to include specific elements such as your account details, date, and a clear statement of the issue. AirSlate SignNow provides templates that are designed to adhere to these requirements, making it easier for you to create compliant documents. Always review your request before sending to ensure complete accuracy.

Get more for Qualified Written Request

- Osa disability verification form sacred heart university

- Date student interview request form thank you for considering planned parenthood for your upcoming school project

- Application for candidate corresponding form

- Commonwealth challenge application part one and part two form

- Commonwealth challenge application form

- June 2015 loyola university chicago form

- Orientation week administrative personnel and telephone ssom luc form

- Letterpre matriculation information stritch school of medicine stritch luc

Find out other Qualified Written Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors