Agreement Self Employed Form

What is the Agreement Self Employed

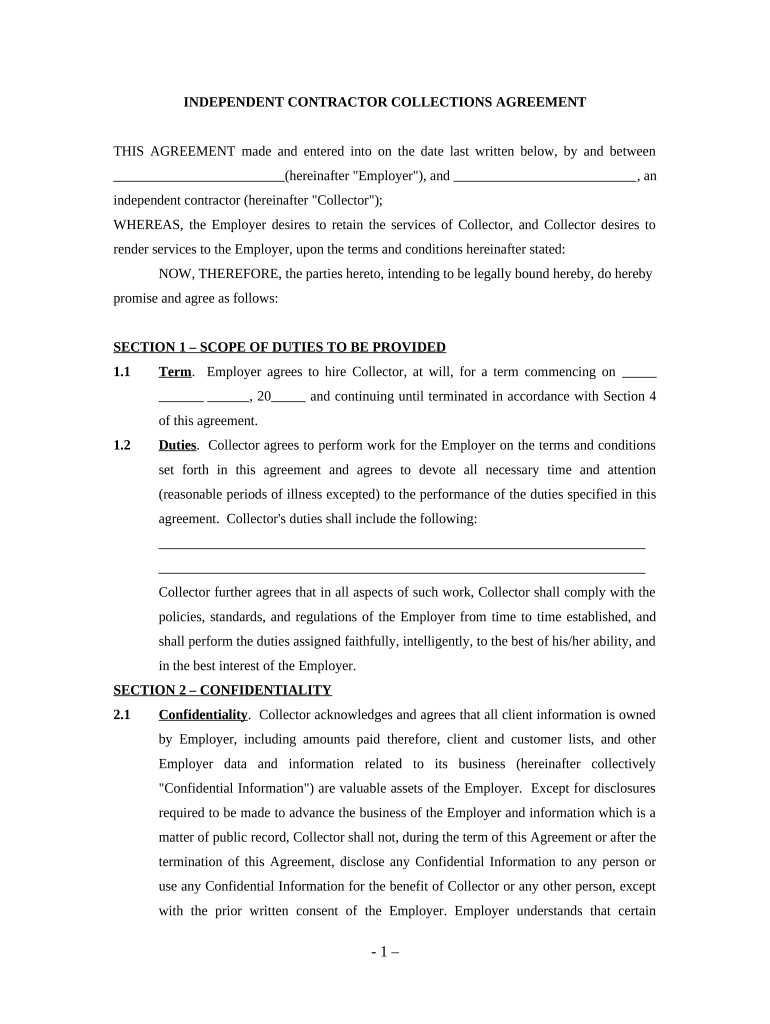

The agreement self employed is a legal document that outlines the terms and conditions between a self-employed individual and their clients or employers. This form serves to clarify the expectations of both parties, including payment terms, deliverables, and timelines. It is essential for establishing a professional relationship and protecting the rights of both the self-employed individual and the client.

How to use the Agreement Self Employed

To effectively use the agreement self employed, begin by clearly defining the scope of work. This includes specifying the services to be provided, deadlines, and payment details. Both parties should review the document for accuracy and completeness. Once agreed upon, the form should be signed electronically to ensure it is legally binding. Utilizing a reliable eSignature platform can streamline this process and maintain compliance with legal standards.

Steps to complete the Agreement Self Employed

Completing the agreement self employed involves several key steps:

- Gather necessary information about the parties involved, including names, addresses, and contact details.

- Define the services to be rendered, including any specific requirements or deliverables.

- Include payment terms, specifying rates, payment methods, and due dates.

- Outline the duration of the agreement and conditions for termination.

- Review the document with all parties to ensure clarity and mutual understanding.

- Sign the agreement electronically to finalize the contract.

Legal use of the Agreement Self Employed

The legal use of the agreement self employed is governed by various laws that ensure its enforceability. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that both parties consent to use electronic means for signing. It is crucial to ensure that the agreement complies with these legal frameworks to be considered valid in a court of law.

Key elements of the Agreement Self Employed

Several key elements must be included in the agreement self employed to ensure its effectiveness:

- Identification of Parties: Clearly state the names and addresses of the self-employed individual and the client.

- Scope of Work: Detail the services to be provided, including any specific tasks and deliverables.

- Payment Terms: Specify the payment amount, schedule, and method of payment.

- Duration: Indicate the start and end dates of the agreement.

- Termination Clause: Outline the conditions under which either party can terminate the agreement.

Quick guide on how to complete agreement self employed 497337203

Finish Agreement Self Employed effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Agreement Self Employed on any device using airSlate SignNow applications for Android or iOS and enhance any document-focused task today.

How to modify and eSign Agreement Self Employed smoothly

- Obtain Agreement Self Employed and then click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Mark important sections of your documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Verify the details and then click on the Done button to record your adjustments.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Agreement Self Employed and guarantee outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement self employed document?

An agreement self employed document is a legal contract that outlines the terms and conditions between a self-employed individual and a client. This type of agreement helps protect the interests of both parties by clearly defining responsibilities, payment terms, and deliverables.

-

How can airSlate SignNow help with creating an agreement self employed?

airSlate SignNow offers tools to easily create, customize, and manage your agreement self employed documents. With its user-friendly interface, you can quickly generate professional contracts and ensure they are eSigned by all parties, streamlining the process.

-

What are the pricing options for airSlate SignNow when creating an agreement self employed?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs. You can start with a free trial and explore premium plans that offer additional features for creating and managing your agreement self employed documents at competitive prices.

-

What features does airSlate SignNow offer for agreement self employed documents?

airSlate SignNow includes features like templated document creation, reminders for signers, and customizable workflows specifically for agreement self employed situations. These features enhance efficiency and ensure timely execution of contracts.

-

Can I integrate airSlate SignNow with other tools for my agreement self employed needs?

Yes, airSlate SignNow offers seamless integrations with numerous applications such as Google Drive, Dropbox, and Microsoft Office. This capability allows you to manage your agreement self employed documents alongside your other business tools effectively.

-

What benefits does using airSlate SignNow provide for self-employed professionals?

Using airSlate SignNow empowers self-employed professionals to manage their agreement self employed documents effortlessly. The platform not only ensures that contracts are signed quickly and securely but also provides a streamlined way to store and access these important documents.

-

How does airSlate SignNow ensure the security of my agreement self employed documents?

airSlate SignNow prioritizes security with features such as SSL encryption, two-factor authentication, and compliance with global security standards. This guarantees that your agreement self employed documents remain confidential and protected throughout the signing process.

Get more for Agreement Self Employed

- Y1 form

- Thank you for your interest in partnering with the department of animal services form

- One day alcohol beverage permit request form

- Rescue partner information and application

- Rescue partner information and application animal services

- Oewd form 118 verbal employment education verification oewd

- County of los angeles residential plan general notes 2017 form

- Residential plan form

Find out other Agreement Self Employed

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple