Accounting Agreement Self Employed Independent Contractor Form

What is the Accounting Agreement Self Employed Independent Contractor

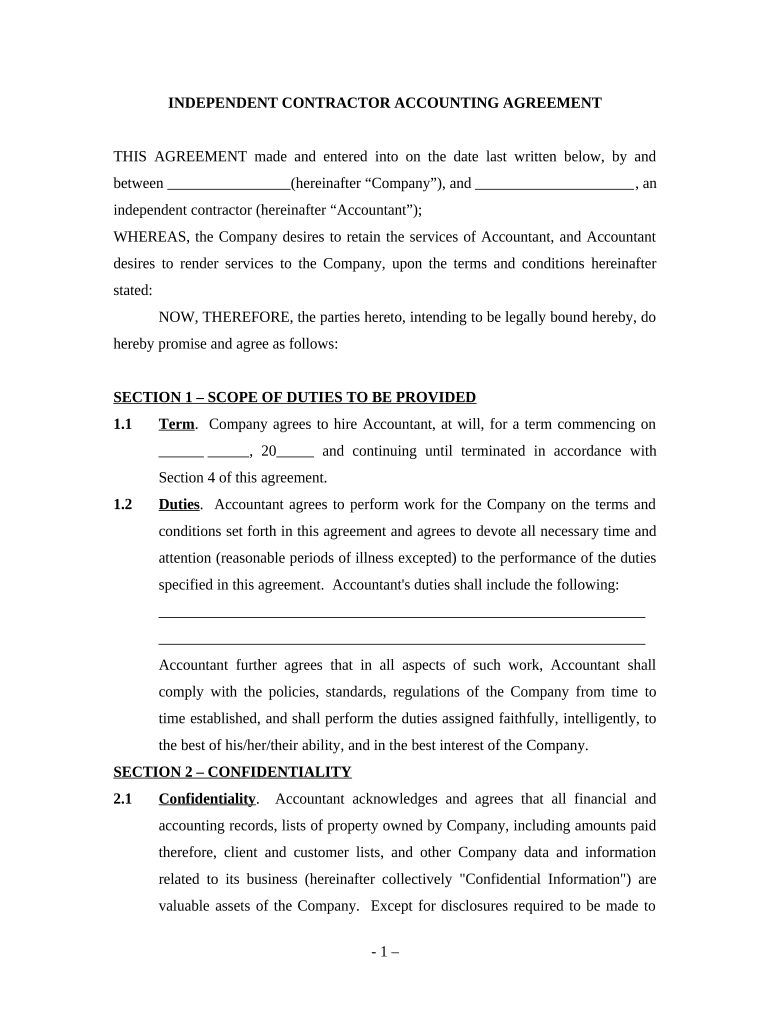

The Accounting Agreement for Self Employed Independent Contractors is a legal document that outlines the terms and conditions between a contractor and a client. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. It serves to protect the interests of both the contractor and the client, ensuring clarity and mutual understanding. By formalizing the relationship, this document helps to prevent disputes and misunderstandings that may arise during the course of the project.

Key Elements of the Accounting Agreement Self Employed Independent Contractor

Several key elements are essential in the Accounting Agreement for Self Employed Independent Contractors. These include:

- Scope of Work: A detailed description of the services to be provided by the contractor.

- Payment Terms: Clear information on how and when payments will be made, including rates and invoicing procedures.

- Duration of Agreement: The start date and end date of the contract, along with any conditions for renewal.

- Confidentiality Clause: Provisions to protect sensitive information shared during the contract period.

- Termination Conditions: Guidelines on how either party can terminate the agreement, including notice requirements.

Steps to Complete the Accounting Agreement Self Employed Independent Contractor

Completing the Accounting Agreement for Self Employed Independent Contractors involves several straightforward steps:

- Draft the Agreement: Use a template or create a document that includes all necessary elements outlined above.

- Review the Terms: Both parties should review the agreement to ensure that all details are accurate and acceptable.

- Sign the Agreement: Use a trusted electronic signature platform to sign the document, ensuring it is legally binding.

- Distribute Copies: Provide copies of the signed agreement to all parties involved for their records.

Legal Use of the Accounting Agreement Self Employed Independent Contractor

The legal use of the Accounting Agreement for Self Employed Independent Contractors is governed by various laws and regulations in the United States. To ensure that the agreement is enforceable, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and ensure that agreements can be executed digitally, provided that both parties consent to this method of signing.

Examples of Using the Accounting Agreement Self Employed Independent Contractor

Examples of scenarios where an Accounting Agreement for Self Employed Independent Contractors is used include:

- A freelance graphic designer entering into a contract with a marketing agency to create promotional materials.

- A consultant providing strategic business advice to a small business owner.

- A software developer working on a project for a tech startup on a contract basis.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for independent contractors, including tax obligations and reporting requirements. Contractors must report their income using Form 1099-NEC if they earn $600 or more from a single client. Additionally, self-employed individuals must pay self-employment taxes, which cover Social Security and Medicare contributions. Understanding these guidelines is crucial for compliance and financial planning.

Quick guide on how to complete accounting agreement self employed independent contractor

Complete Accounting Agreement Self Employed Independent Contractor effortlessly on any device

Digital document management has gained traction among organizations and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents swiftly without any setbacks. Handle Accounting Agreement Self Employed Independent Contractor on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Accounting Agreement Self Employed Independent Contractor with ease

- Obtain Accounting Agreement Self Employed Independent Contractor and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Accounting Agreement Self Employed Independent Contractor and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Accounting Agreement for Self Employed Independent Contractors?

An Accounting Agreement for Self Employed Independent Contractors outlines the terms under which services will be provided and the payment structure. This document helps clarify expectations between the contractor and client, ensuring that both parties are on the same page regarding their responsibilities. Using airSlate SignNow to create and eSign this agreement simplifies the process and enhances professionalism.

-

How can airSlate SignNow assist in creating an Accounting Agreement for Self Employed Independent Contractors?

airSlate SignNow provides an easy-to-use platform for creating tailored Accounting Agreements for Self Employed Independent Contractors. With customizable templates and drag-and-drop functionality, you can quickly design your agreement to meet specific needs. This process saves time and enhances accuracy, allowing you to focus on your self-employed work.

-

What features does airSlate SignNow offer for managing Accounting Agreements?

With airSlate SignNow, you can efficiently manage your Accounting Agreements for Self Employed Independent Contractors through features such as eSigning, document tracking, and cloud storage. The platform allows for real-time collaboration and updates, ensuring that everyone involved has the most current version of the agreement. This reduces miscommunication and streamlines the workflow.

-

Is there a pricing plan for using airSlate SignNow for Accounting Agreements?

airSlate SignNow offers flexible pricing plans to accommodate the needs of self-employed independent contractors requiring an Accounting Agreement. Each plan includes essential features for creating, signing, and storing your agreements securely. By choosing the right plan, you can effectively manage costs while utilizing the full capabilities of the platform.

-

What are the benefits of using airSlate SignNow for my Accounting Agreements?

Using airSlate SignNow for your Accounting Agreements provides numerous benefits, including increased efficiency through digital signings and the elimination of paper clutter. The platform offers a high level of security for your sensitive documents, ensuring compliance with industry standards. Additionally, the ease of use encourages faster turnaround times, allowing you to focus on your projects.

-

Can I integrate airSlate SignNow with other business tools for my Accounting Agreements?

Yes, airSlate SignNow offers integrations with a variety of business tools that can enhance the management of your Accounting Agreements for Self Employed Independent Contractors. These integrations streamline workflows by connecting with platforms such as CRM systems and accounting software. This allows for a more holistic approach in managing your contracts and finances.

-

How secure are my Accounting Agreements on airSlate SignNow?

Your Accounting Agreements on airSlate SignNow are highly secure, incorporating encryption and secure cloud storage to protect your documents. The platform complies with industry standards to ensure that your sensitive information remains confidential. Additionally, access controls and audit trails provide transparency and security throughout the signing process.

Get more for Accounting Agreement Self Employed Independent Contractor

- Grease trap maintenance log form

- Cg exempt form

- Horse bill of sale california form

- Enter the complete name of the limited liability company llc exactly as it appears in the records of the form

- Standard quotation and specification form virginia

- Withholding tax forms wv state tax department

- Wv form cd 1np 2014

- Cd 1np form

Find out other Accounting Agreement Self Employed Independent Contractor

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now