Financial Records Form

What is the Financial Records

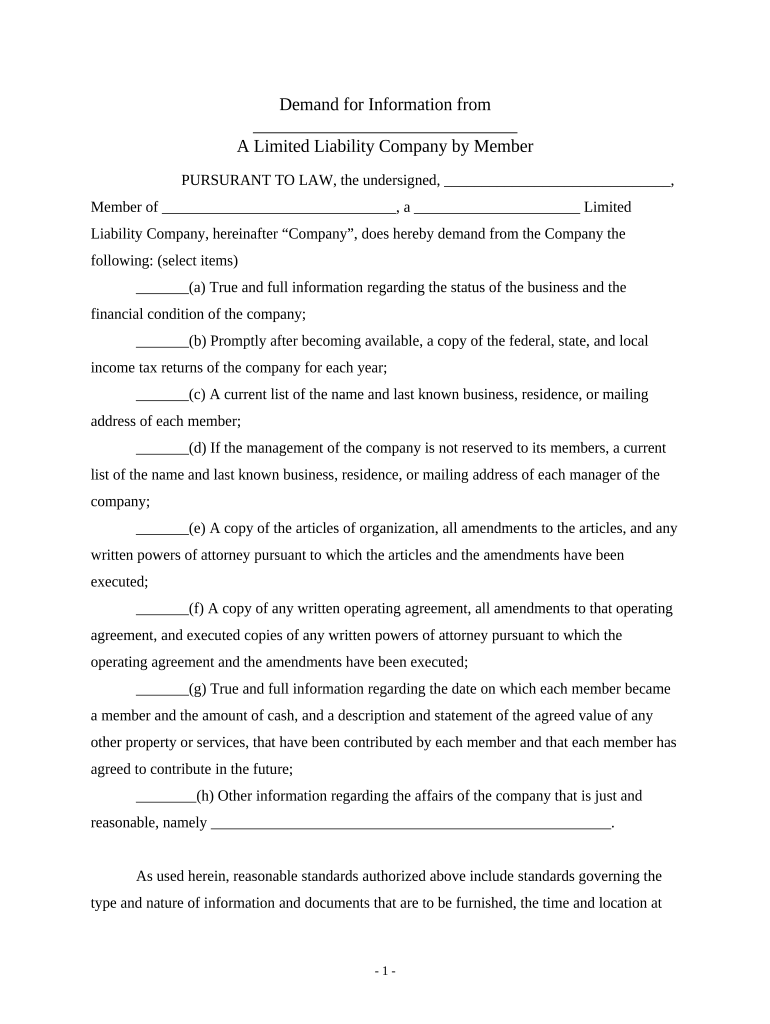

The financial records form is a crucial document that outlines the financial activities of a business entity, specifically for Limited Liability Companies (LLCs). This form serves to provide a comprehensive overview of the income, expenses, assets, and liabilities of the LLC, ensuring compliance with both state and federal regulations. Properly maintained financial records are essential for tax reporting, securing loans, and making informed business decisions.

How to use the Financial Records

Utilizing the financial records form involves systematic documentation of all financial transactions related to the LLC. This includes tracking income from sales, expenses for operational costs, and any investments or loans. By accurately filling out this form, business owners can create a clear financial picture that aids in budgeting and forecasting. Regular updates to the financial records also help in preparing for tax season and ensuring that the LLC meets all regulatory requirements.

Steps to complete the Financial Records

Completing the financial records form involves several key steps:

- Gather all financial documents, including receipts, invoices, and bank statements.

- Organize the information by categorizing income and expenses.

- Input the data into the financial records form, ensuring accuracy in all entries.

- Review the completed form for any discrepancies or missing information.

- File the form according to state and federal guidelines, ensuring compliance with all deadlines.

Legal use of the Financial Records

The legal use of financial records is paramount for LLCs, as these documents serve as evidence of the company's financial health and compliance with tax laws. Accurate financial records protect the LLC from potential audits and legal disputes. They must be maintained in accordance with the Internal Revenue Service (IRS) guidelines and relevant state regulations to ensure that the LLC remains in good standing and avoids penalties.

Key elements of the Financial Records

Key elements of the financial records form include:

- Income Statement: A summary of revenues and expenses over a specific period.

- Balance Sheet: A snapshot of the LLC’s assets, liabilities, and equity at a given time.

- Cash Flow Statement: An overview of cash inflows and outflows, highlighting liquidity.

- Supporting Documentation: Receipts and invoices that validate the entries made in the financial records.

IRS Guidelines

The IRS provides specific guidelines for maintaining and submitting financial records for LLCs. These guidelines outline the types of records that must be kept, the duration for which they should be retained, and the format in which they should be presented. Adhering to these guidelines is essential for accurate tax reporting and minimizing the risk of audits. LLCs should familiarize themselves with IRS Publication 583, which details the requirements for maintaining business records.

Quick guide on how to complete financial records

Complete Financial Records effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents rapidly, without any delays. Manage Financial Records on any platform utilizing airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Financial Records effortlessly

- Find Financial Records and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Financial Records and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for airSlate SignNow regarding LLC financial documents?

airSlate SignNow offers flexible pricing plans for businesses managing LLC financial documents. Our pricing is designed to fit various budgets, providing features that cater specifically to LLC financial workflows. You can choose a plan that best suits your needs, including essential tools for efficient document management.

-

How can airSlate SignNow help streamline LLC financial processes?

With airSlate SignNow, you can streamline your LLC financial processes by digitizing your documents and facilitating electronic signatures. This not only accelerates the signing process but also ensures compliance and reduces the risk of errors. The platform's user-friendly interface makes it easy to manage LLC financial documents from anywhere.

-

Does airSlate SignNow integrate with accounting software for LLC financial management?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing your LLC financial management capabilities. This integration allows for better tracking of financial transactions and document handling. You can easily connect your preferred accounting tools to streamline your workflow.

-

What features does airSlate SignNow offer for managing LLC financial agreements?

airSlate SignNow offers robust features for managing LLC financial agreements, including customizable templates, automated workflows, and secure storage. These features are designed to simplify the process of creating, signing, and storing important LLC financial documents. You can create templates that align with your specific business needs.

-

Is airSlate SignNow secure for handling sensitive LLC financial information?

Absolutely, airSlate SignNow prioritizes the security of your LLC financial information. We utilize advanced encryption protocols and comply with industry regulations to protect your data. You can trust that your sensitive LLC financial documents will be handled with the utmost care and security.

-

Can I use airSlate SignNow on mobile devices for LLC financial tasks?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage your LLC financial tasks on the go. Whether you need to send documents for e-signature or access your files, our mobile app provides the functionality you need. This flexibility makes it easier to stay on top of your LLC financial responsibilities.

-

What benefits can I expect from using airSlate SignNow for my LLC financial operations?

Using airSlate SignNow for your LLC financial operations offers numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy in document handling. Our solution helps you stay organized and enhances collaboration within your team, ultimately leading to better management of your LLC financial transactions.

Get more for Financial Records

- Schedule k 1 form n 20 rev 2020 partners share of income

- Schedule b form 1040 internal revenue service fill out

- Wwwirsgovforms pubsabout form w 8 eciabout form w 8 eci certificate of foreign persons claim

- Form u 6 rev 2020 public service company tax return forms 2020 fillable

- 2021 form 1120 c us income tax return for cooperative associations

- One stop forms ampamp templates download pdffiller

- Fillable form bb 1 basic business application printable

- Form 940 employers annual federal unemployment futa tax

Find out other Financial Records

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple