Schedule K 1, Form N 20, Rev , Partner's Share of Income 2020

Understanding Schedule K-1, Form N-20

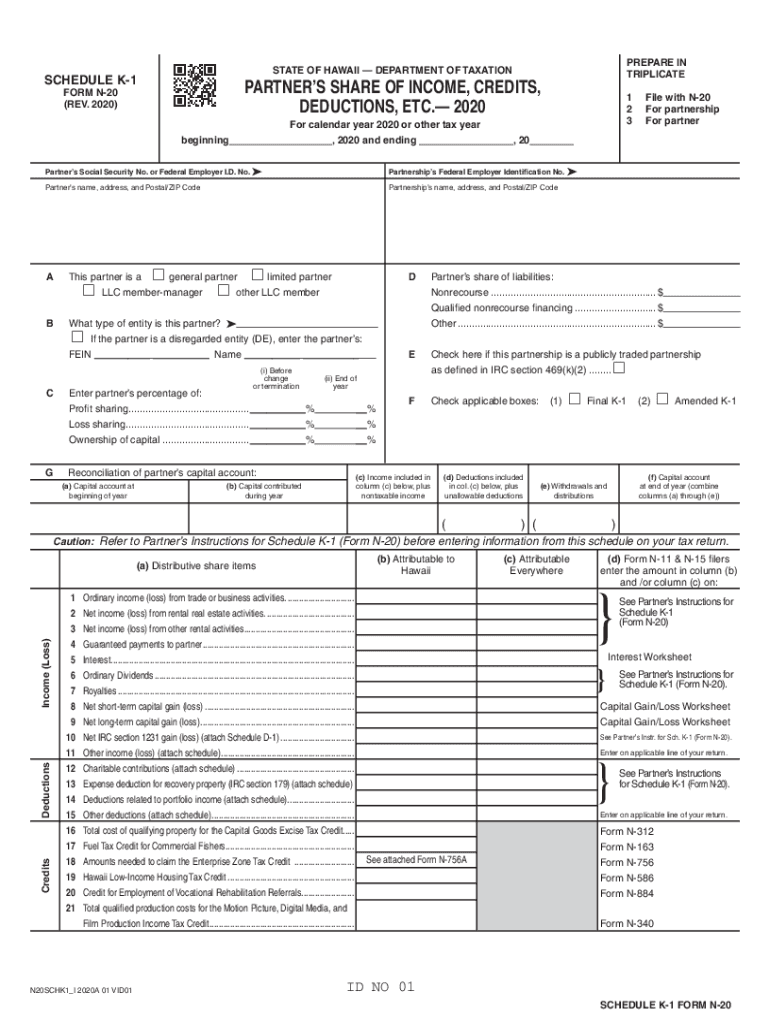

Schedule K-1, Form N-20 is a crucial document for partners in partnerships and certain limited liability companies in Hawaii. This form reports each partner's share of income, deductions, and credits from the partnership. It is essential for accurately filing personal income tax returns, as it provides detailed information on how much income is allocated to each partner based on their ownership percentage.

This form is particularly important for tax compliance, as it ensures that all partners report their share of the partnership's income to the IRS and the state of Hawaii. Understanding the components of this form can help partners avoid potential tax issues and penalties.

Steps to Complete Schedule K-1, Form N-20

Completing Schedule K-1, Form N-20 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information from the partnership, including income, deductions, and credits. Next, accurately fill out each section of the form, which includes identifying information for both the partnership and the partner, as well as the financial details of the partner's share.

It is important to double-check all entries for accuracy, as errors can lead to complications during tax filing. Once completed, the form should be distributed to each partner for their records and included with their individual tax returns. Utilizing digital platforms can streamline this process, making it easier to fill out and share the form securely.

Legal Use of Schedule K-1, Form N-20

The legal validity of Schedule K-1, Form N-20 is grounded in compliance with IRS regulations and state tax laws. This form serves as an official record of income distribution among partners and is critical for substantiating income claims on personal tax returns. Proper completion and submission of this form help partners meet their tax obligations and avoid potential audits or penalties.

When using this form, it is essential to ensure that all information is accurate and that the form is filed within the appropriate deadlines. Adhering to these legal requirements protects both the partnership and its partners from tax-related issues.

Who Issues Schedule K-1, Form N-20

Schedule K-1, Form N-20 is issued by partnerships and certain limited liability companies operating in Hawaii. The partnership is responsible for preparing and distributing this form to each partner, typically after the end of the tax year. The information contained in the form is derived from the partnership's financial statements and tax returns.

Each partner should receive their K-1 in a timely manner to ensure they can accurately report their income on their personal tax returns. It is advisable for partners to keep a copy of this form for their records, as it may be needed for future reference or audits.

Filing Deadlines for Schedule K-1, Form N-20

Filing deadlines for Schedule K-1, Form N-20 align with the overall tax filing deadlines for partnerships in Hawaii. Typically, partnerships must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For most partnerships operating on a calendar year, this means the deadline is April 15.

It is important for partnerships to ensure that K-1 forms are provided to partners by this deadline so that partners can meet their individual tax filing obligations. Failure to meet these deadlines can result in penalties for both the partnership and the partners involved.

Key Elements of Schedule K-1, Form N-20

Schedule K-1, Form N-20 includes several key elements that are essential for accurate tax reporting. These elements typically consist of the partner's name, address, and taxpayer identification number, as well as the partnership's information. Additionally, the form details the partner's share of income, deductions, and credits, which are critical for calculating taxable income.

Understanding these key components ensures that partners can accurately report their income and comply with tax regulations. Each section of the form plays a vital role in providing a complete picture of the partner's financial involvement in the partnership.

Quick guide on how to complete schedule k 1 form n 20 rev 2020 partners share of income

Complete Schedule K 1, Form N 20, Rev , Partner's Share Of Income effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documentation, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Schedule K 1, Form N 20, Rev , Partner's Share Of Income on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign Schedule K 1, Form N 20, Rev , Partner's Share Of Income with ease

- Obtain Schedule K 1, Form N 20, Rev , Partner's Share Of Income and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign Schedule K 1, Form N 20, Rev , Partner's Share Of Income and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 20 rev 2020 partners share of income

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 20 rev 2020 partners share of income

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Hawaii Form N-20?

The Hawaii Form N-20 is a tax return form specifically used by corporations operating in Hawaii. It reports income, deductions, and tax liability to the state. Completing the Hawaii Form N-20 correctly is essential for compliance with state tax regulations.

-

How can airSlate SignNow help with filing the Hawaii Form N-20?

airSlate SignNow streamlines the process of signing and sending your Hawaii Form N-20 electronically. This solution allows for quick document preparation and ensures secure eSigning, making it easier to meet filing deadlines. Use SignNow to simplify your tax documentation needs.

-

Is there a fee for using airSlate SignNow to manage the Hawaii Form N-20?

airSlate SignNow offers various pricing plans based on your business needs, making it a cost-effective solution. Users can choose from multiple tiers depending on feature requirements. Investing in this platform can save both time and money in managing your Hawaii Form N-20.

-

What features does airSlate SignNow provide for the Hawaii Form N-20?

airSlate SignNow offers features like customizable templates, electronic signatures, and document tracking for the Hawaii Form N-20. These tools enhance the efficiency of the signing process and ensure that all necessary steps are followed. The platform is designed to make tax documentation seamless.

-

Can I integrate airSlate SignNow with other software to manage the Hawaii Form N-20?

Yes, airSlate SignNow easily integrates with various applications to streamline workflows related to the Hawaii Form N-20. Popular integrations include cloud storage, CRM systems, and productivity tools that enhance document management. These integrations can signNowly improve your tax filing efficiency.

-

What are the benefits of using airSlate SignNow for the Hawaii Form N-20?

Using airSlate SignNow for the Hawaii Form N-20 provides several benefits, including faster processing times and enhanced security. The electronic signature feature allows for quick approval, ensuring timely submission. Additionally, the platform offers compliance support to navigate Hawaii tax regulations.

-

Is airSlate SignNow secure for handling the Hawaii Form N-20?

Absolutely, airSlate SignNow prioritizes security and compliance, which is crucial for sensitive documents like the Hawaii Form N-20. The platform employs encryption and security protocols to safeguard your data. You can confidently manage your tax documentation with peace of mind.

Get more for Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- Springing general and durable power of attorney district of columbia form

- District of columbia company search form

- Dc notice 497301526 form

- Deed of distribution personal representative to an individual district of columbia form

- District of columbia llc form

- Demand for notice of satisfaction individual district of columbia form

- Dc corporation search form

- Dc law case form

Find out other Schedule K 1, Form N 20, Rev , Partner's Share Of Income

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament