Form U 6, Rev , Public Service Company Tax Return Forms Fillable 2021

What is the Form U-6, Rev, Public Service Company Tax Return?

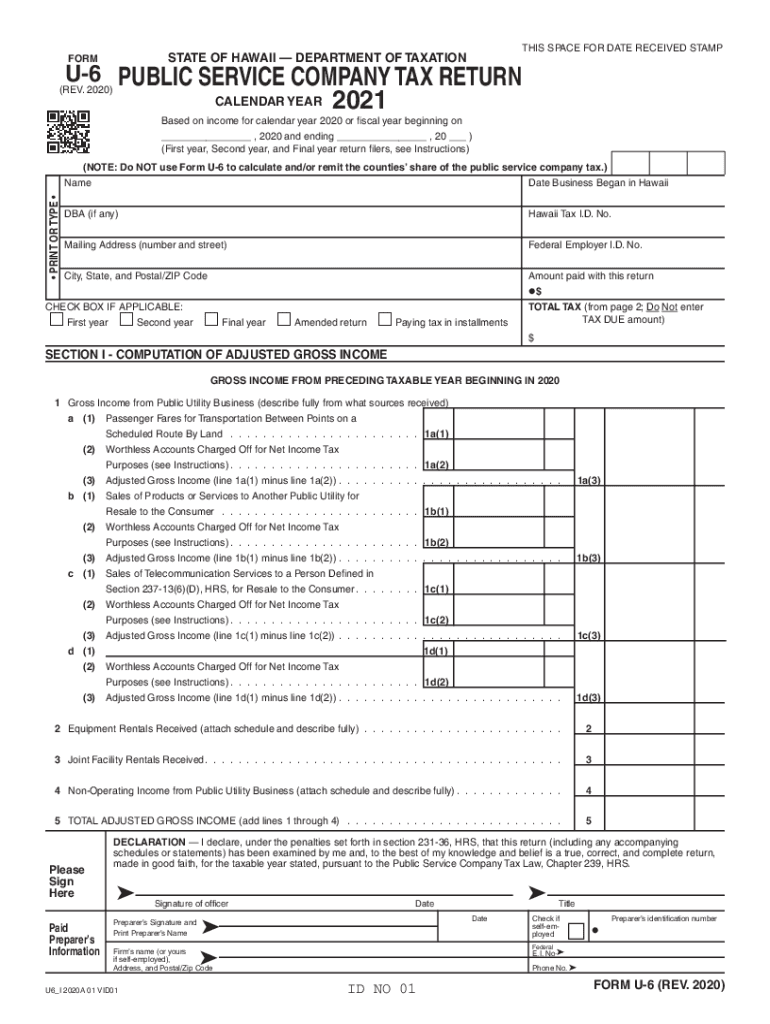

The Form U-6, Rev, is a tax return specifically designed for public service companies operating in Hawaii. This form is essential for reporting income and calculating the appropriate public service company tax owed to the state. It is tailored for businesses that provide utility services, such as electricity, water, and telecommunications. Understanding the purpose and requirements of this form is crucial for compliance with state tax laws.

Steps to Complete the Form U-6, Rev

Completing the Form U-6, Rev, involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including revenue statements and expense reports. Follow these steps:

- Provide your company’s identifying information, including name, address, and federal tax identification number.

- Report total gross income from public service operations for the tax year.

- Deduct any allowable expenses to arrive at the net taxable income.

- Calculate the tax liability based on the applicable tax rate for public service companies.

- Sign and date the form to certify its accuracy before submission.

Legal Use of the Form U-6, Rev

The Form U-6, Rev, serves a legal purpose in the context of state tax compliance. It is recognized by the Hawaii Department of Taxation as the official document for reporting public service company income. Filing this form accurately and on time is essential to avoid penalties and ensure that your business meets its tax obligations. The form must be signed by an authorized representative of the company to be considered valid.

Filing Deadlines for the Form U-6, Rev

Timely filing of the Form U-6, Rev, is critical to avoid late fees and penalties. The filing deadline typically aligns with the end of the fiscal year for public service companies. It is advisable to check the Hawaii Department of Taxation for any updates or changes to the filing schedule. Generally, forms are due on or before the last day of the month following the close of the fiscal year.

Required Documents for Filing the Form U-6, Rev

When preparing to file the Form U-6, Rev, certain documents are required to support the information reported. These documents include:

- Financial statements detailing gross income and expenses.

- Previous year’s tax returns, if applicable.

- Any supporting documentation for deductions claimed.

- Proof of payment for any estimated taxes made during the year.

Form Submission Methods for the U-6, Rev

The Form U-6, Rev, can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission through the Hawaii Department of Taxation's e-filing portal.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

State-Specific Rules for the Form U-6, Rev

Each state has unique regulations governing tax forms, and the Form U-6, Rev, is no exception. In Hawaii, specific rules may apply regarding the calculation of taxable income, allowable deductions, and tax rates for public service companies. It is essential to stay informed about any state-specific amendments or guidelines that may affect the completion and submission of this form.

Quick guide on how to complete form u 6 rev 2020 public service company tax return forms 2020 fillable

Prepare Form U 6, Rev , Public Service Company Tax Return Forms Fillable effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form U 6, Rev , Public Service Company Tax Return Forms Fillable on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable with ease

- Find Form U 6, Rev , Public Service Company Tax Return Forms Fillable and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would prefer to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Alter and eSign Form U 6, Rev , Public Service Company Tax Return Forms Fillable and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev 2020 public service company tax return forms 2020 fillable

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev 2020 public service company tax return forms 2020 fillable

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the form u 6, and how can airSlate SignNow help with it?

The form u 6 is a document used for specific administrative purposes within various organizations. airSlate SignNow streamlines the signing process, allowing you to send, sign, and manage your form u 6 electronically, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for managing form u 6?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs, including those specifically for managing form u 6. You can choose a plan that suits your budget and required features without compromising on quality.

-

What features does airSlate SignNow offer for the form u 6?

airSlate SignNow provides a range of features for handling form u 6, including customizable templates, automatic reminders, and secure cloud storage. These features simplify the entire signing process, making it user-friendly and efficient.

-

Is airSlate SignNow compliant with regulations for signing form u 6?

Yes, airSlate SignNow adheres to industry standards and regulations, ensuring that signing the form u 6 is legally binding and secure. Our platform offers advanced encryption and authentication methods to protect your sensitive data.

-

Can I integrate airSlate SignNow with other software while managing form u 6?

Absolutely! airSlate SignNow supports integrations with various popular software applications, allowing you to seamlessly incorporate the signing process of form u 6 into your existing workflows. This flexibility enhances productivity and saves time.

-

How can airSlate SignNow improve the efficiency of handling form u 6?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of handling form u 6. The platform automates many manual processes, reduces turnaround times for signatures, and helps manage documents in one central location.

-

Are there any mobile options for signing form u 6 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to sign form u 6 on the go. This ensures that you can handle important documents anytime, anywhere, without being tied to a desk.

Get more for Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- Letter from tenant to landlord about illegal entry by landlord district of columbia form

- Letter from landlord to tenant about time of intent to enter premises district of columbia form

- Letter notice rent form

- Letter from tenant to landlord about sexual harassment district of columbia form

- District of columbia family form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure district form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497301560 form

- Dc letter landlord form

Find out other Form U 6, Rev , Public Service Company Tax Return Forms Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors