Schedule B Form 1040 Internal Revenue Service Fill Out 2021

What is the Schedule B Form 1040?

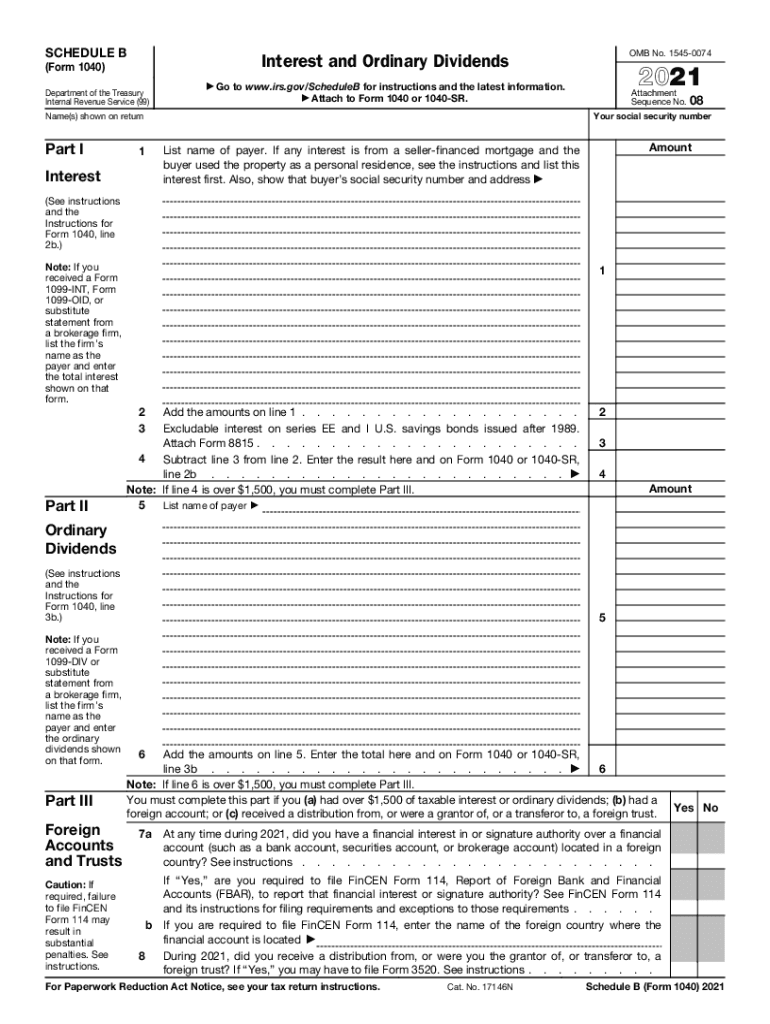

The Schedule B form is a crucial document for U.S. taxpayers who need to report interest and ordinary dividends. It is typically filed alongside the IRS Form 1040. This form helps the Internal Revenue Service (IRS) track income that is earned from various sources, which may include bank interest, dividends from stocks, or other investment income. Understanding the Schedule B is essential for ensuring accurate tax reporting and compliance with federal tax laws.

Steps to Complete the Schedule B Form 1040

Completing the Schedule B form involves several straightforward steps:

- Gather all necessary documentation, including bank statements and dividend reports.

- Enter your name and Social Security number at the top of the form.

- List each source of interest and dividends in the appropriate sections, ensuring to include the total amounts earned.

- If you have foreign accounts, complete the relevant section regarding foreign interest and dividends.

- Review the completed form for accuracy before submitting it with your Form 1040.

Legal Use of the Schedule B Form 1040

The Schedule B form is legally required for taxpayers who have received interest or dividends exceeding specific thresholds. Failing to report this income can lead to penalties and interest charges from the IRS. It is essential to ensure that all information provided on the Schedule B is accurate and complete to comply with tax laws. Utilizing digital tools for eSigning and submitting this form can enhance security and efficiency in the filing process.

Key Elements of the Schedule B Form 1040

Several key elements make up the Schedule B form:

- Interest Income: Report all interest earned from banks, savings accounts, and other financial institutions.

- Dividend Income: Include dividends received from stocks and mutual funds.

- Foreign Accounts: Disclose any foreign financial accounts if applicable, which may have additional reporting requirements.

- Signature: Ensure the form is signed and dated to validate the information provided.

IRS Guidelines for Schedule B Form 1040

The IRS provides specific guidelines for completing the Schedule B form. Taxpayers must adhere to these instructions to ensure compliance. Guidelines include:

- Understanding the thresholds for reporting interest and dividends.

- Familiarizing oneself with the definitions of interest and dividends as per IRS regulations.

- Being aware of the implications of foreign accounts and the need for additional disclosures.

Filing Deadlines for Schedule B Form 1040

The Schedule B form must be submitted by the same deadline as the Form 1040. Typically, this deadline is April 15 for most taxpayers. If additional time is needed, a taxpayer can file for an extension, but it is crucial to estimate and pay any owed taxes by the original deadline to avoid penalties. Keeping track of these deadlines is important for maintaining compliance with tax obligations.

Quick guide on how to complete schedule b form 1040 internal revenue service fill out

Complete Schedule B Form 1040 Internal Revenue Service Fill Out effortlessly on any gadget

Online document administration has gained popularity with enterprises and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, enabling you to locate the suitable form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Schedule B Form 1040 Internal Revenue Service Fill Out on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Schedule B Form 1040 Internal Revenue Service Fill Out effortlessly

- Obtain Schedule B Form 1040 Internal Revenue Service Fill Out and click Get Form to begin.

- Leverage the tools we provide to submit your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal impact as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, time-consuming form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign Schedule B Form 1040 Internal Revenue Service Fill Out to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b form 1040 internal revenue service fill out

Create this form in 5 minutes!

How to create an eSignature for the schedule b form 1040 internal revenue service fill out

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Schedule B in the context of airSlate SignNow?

Schedule B refers to the part of the form that captures additional information about the types of electronic signatures used in documents. With airSlate SignNow, businesses can seamlessly integrate Schedule B requirements into their documentation, ensuring compliance and accuracy in their eSigning processes.

-

How much does airSlate SignNow cost for using Schedule B features?

airSlate SignNow offers competitive pricing plans that include essential features for Managing Schedule B documents. Whether you're a small business or a large enterprise, the pricing is designed to accommodate various needs and budgets while providing robust eSigning capabilities.

-

What key features does airSlate SignNow offer for Schedule B documentation?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and the ability to collect eSignatures on Schedule B documents. These features streamline the process, making it easier for businesses to remain organized and efficient.

-

How can airSlate SignNow benefit my business when dealing with Schedule B forms?

Using airSlate SignNow for Schedule B forms helps businesses increase efficiency and compliance. Enhanced workflow processes allow for quicker turnaround times on documents while maintaining accuracy and legal validity in eSignatures.

-

Can I integrate airSlate SignNow with other tools for managing Schedule B?

Yes, airSlate SignNow integrates smoothly with various software solutions to help manage Schedule B processes. This includes CRM systems, cloud storage services, and project management tools, facilitating a seamless workflow throughout your organization.

-

Is it secure to eSign Schedule B documents with airSlate SignNow?

Absolutely! airSlate SignNow implements advanced security protocols, ensuring that all Schedule B documents are protected. With features like encryption and multi-factor authentication, your sensitive information remains safe throughout the eSigning process.

-

What type of customer support does airSlate SignNow offer for Schedule B inquiries?

airSlate SignNow provides comprehensive customer support, including live chat and email assistance for any Schedule B-related questions. The dedicated support team is ready to help users navigate the software and resolve any issues efficiently.

Get more for Schedule B Form 1040 Internal Revenue Service Fill Out

- Dc judgment form

- Letter from landlord to tenant as notice to remove wild animals in premises district of columbia form

- Letter landlord tenant 497301540 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497301541 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair district of columbia form

- Dc tenant landlord form

- Dc tenant landlord 497301544 form

- Dc tenant landlord 497301545 form

Find out other Schedule B Form 1040 Internal Revenue Service Fill Out

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document