Form 1120 C U S Income Tax Return for Cooperative Associations 2021

What is the Form 1120 C U S Income Tax Return For Cooperative Associations

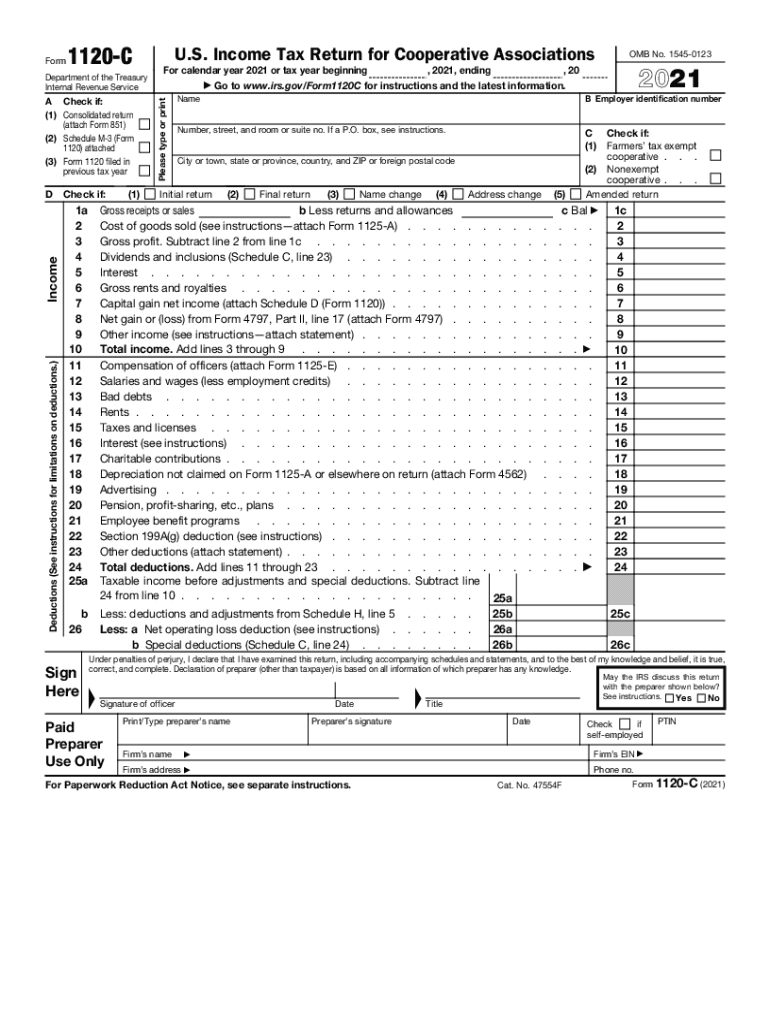

The Form 1120 C is specifically designed for cooperative associations to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for C corporations that operate as cooperatives, allowing them to declare their tax obligations accurately. Cooperative associations typically operate for the mutual benefit of their members, and the income generated is often distributed among those members. Understanding the purpose of Form 1120 C is crucial for compliance with federal tax regulations.

Steps to complete the Form 1120 C U S Income Tax Return For Cooperative Associations

Completing the Form 1120 C involves several key steps to ensure accurate reporting. Begin by gathering all necessary financial documents, including income statements, expense records, and any applicable deductions. Next, fill out the form by entering your cooperative's identifying information, such as name, address, and Employer Identification Number (EIN). Report your total income and allowable deductions in the appropriate sections. Finally, calculate your tax liability and ensure all information is accurate before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 C are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the cooperative's tax year. For cooperatives operating on a calendar year, this typically means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date extends to the next business day. It is important to stay aware of these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the filing requirements for Form 1120 C can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, inaccuracies on the form may lead to audits or further scrutiny from the IRS. Understanding these potential consequences emphasizes the importance of accurately completing and timely submitting the form to maintain compliance with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1120 C. These guidelines include detailed instructions on allowable deductions, credits, and reporting requirements. It is essential to refer to the latest IRS publications and instructions related to Form 1120 C to ensure compliance with current tax laws. Following these guidelines helps cooperative associations avoid errors and potential penalties.

Required Documents

To complete the Form 1120 C accurately, several documents are required. These typically include financial statements, such as profit and loss statements, balance sheets, and records of income and expenses. Additionally, any documentation supporting deductions, credits, or other tax-related claims should be gathered. Having these documents organized and accessible streamlines the filing process and ensures compliance with IRS requirements.

Who Issues the Form

The Form 1120 C is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides the necessary forms and instructions for taxpayers, including cooperative associations, to report their income and tax liabilities. It is vital for cooperatives to utilize the official IRS version of the form to ensure compliance with federal tax laws.

Quick guide on how to complete 2021 form 1120 c us income tax return for cooperative associations

Complete Form 1120 C U S Income Tax Return For Cooperative Associations seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1120 C U S Income Tax Return For Cooperative Associations on any device using airSlate SignNow's Android or iOS applications and enhance any documentation process today.

The easiest way to modify and electronically sign Form 1120 C U S Income Tax Return For Cooperative Associations effortlessly

- Locate Form 1120 C U S Income Tax Return For Cooperative Associations and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that require additional document copies to be printed. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Modify and electronically sign Form 1120 C U S Income Tax Return For Cooperative Associations and ensure clear communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1120 c us income tax return for cooperative associations

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1120 c us income tax return for cooperative associations

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are C corporation tax rates for small businesses?

C corporation tax rates apply to businesses that are incorporated as C corps. Generally, the tax rate is a flat 21% on profits, though small businesses may benefit from various deductions. Understanding these rates is crucial for financial planning and ensuring compliance with tax regulations.

-

How can airSlate SignNow help with managing C corporation tax rates?

While airSlate SignNow does not directly manage tax rates, it provides an efficient way to handle financial documents that relate to your C corporation. By streamlining the signing process for tax-related documents, it ensures you meet deadlines and maintain compliance, indirectly supporting better tax management.

-

Are there any discounts available for using airSlate SignNow for C corporations?

Yes, airSlate SignNow offers various pricing plans that can accommodate the needs of C corporations. By assessing the features included in each plan, businesses can choose an option that fits their budget while ensuring compliant handling of documents associated with C corporation tax rates.

-

What features does airSlate SignNow offer for C corporation document management?

airSlate SignNow provides features like eSigning, document templates, and secure cloud storage, which are essential for C corporations. These tools simplify workflows and help manage documents related to C corporation tax rates, making it easier to stay organized and compliant.

-

Can airSlate SignNow integrate with accounting software for C corporations?

Yes, airSlate SignNow integrates with various accounting and financial software programs. This integration is particularly beneficial for C corporations as it allows them to sync documents with their accounting records, aiding in accurate tracking of expenses related to C corporation tax rates.

-

Is airSlate SignNow secure for handling tax-related documents for C corporations?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and authentication, to protect your documents. This is vital when handling sensitive information about C corporation tax rates and ensuring your business remains compliant with regulations.

-

How does airSlate SignNow facilitate remote signing for C corporations?

airSlate SignNow enables remote signing through its user-friendly eSignature feature, making it ideal for C corporations. This capability allows multiple stakeholders to sign documents related to C corporation tax rates from any location, facilitating faster transactions and efficient document handling.

Get more for Form 1120 C U S Income Tax Return For Cooperative Associations

- Dc tenant form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497301563 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497301564 form

- Dc tenant in form

- Dc letter landlord 497301566 form

- Dc tenant in 497301567 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497301568 form

- Dc letter landlord 497301569 form

Find out other Form 1120 C U S Income Tax Return For Cooperative Associations

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free