Transferring Death Form

What is the transferring death?

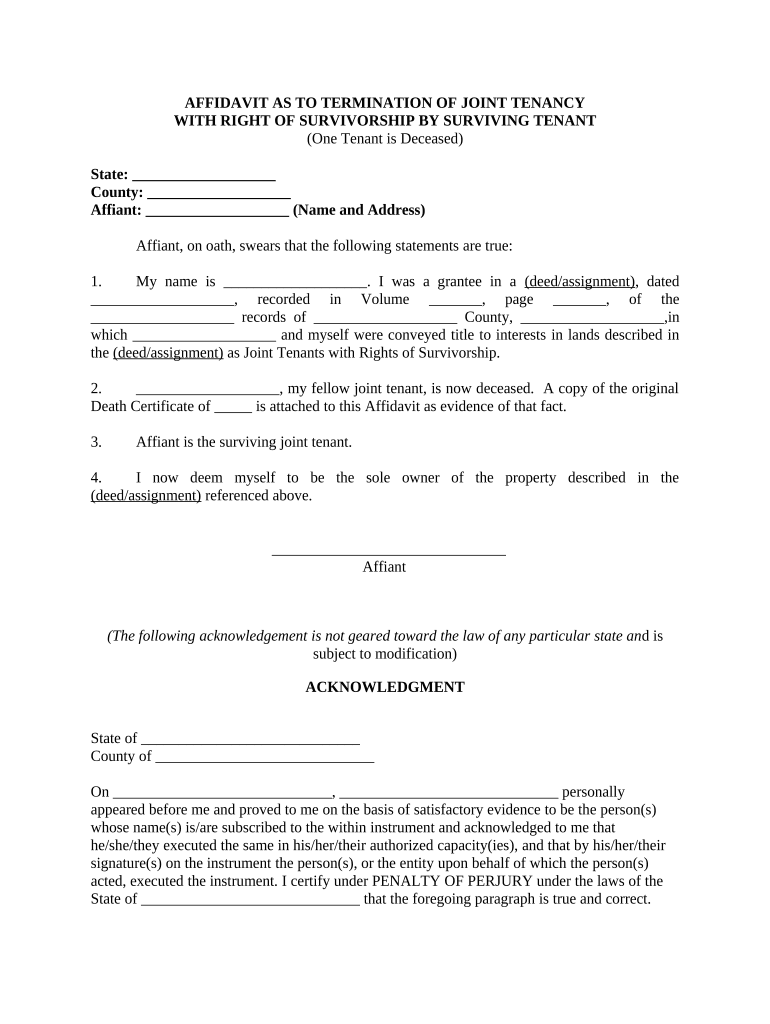

The transferring death form is a legal document used to facilitate the transfer of assets or property upon the death of an individual. This form is essential for ensuring that the deceased's wishes regarding asset distribution are honored and legally recognized. In the context of estate planning, the transferring death form may include details about beneficiaries, asset descriptions, and any stipulations related to the transfer. Understanding this form is crucial for both the executor of the estate and the beneficiaries to navigate the legal landscape effectively.

Steps to complete the transferring death

Completing the transferring death form involves several important steps to ensure accuracy and compliance with legal requirements. Here is a structured approach:

- Gather necessary information: Collect details about the deceased, including their full name, date of death, and a list of assets to be transferred.

- Identify beneficiaries: Clearly define who will receive the assets. This may include family members, friends, or organizations.

- Complete the form: Fill out the transferring death form with accurate information. Ensure all sections are completed to avoid delays.

- Obtain required signatures: Depending on state regulations, signatures from witnesses or notaries may be necessary to validate the document.

- Submit the form: File the completed form with the appropriate authority, such as the local probate court or relevant government agency.

Legal use of the transferring death

The transferring death form holds legal significance as it serves to formalize the transfer of assets after an individual's passing. For the form to be legally binding, it must comply with state laws regarding estate transfers. This includes adherence to any specific requirements for signatures, notarization, and submission timelines. Proper execution of the transferring death form can help prevent disputes among beneficiaries and ensure that the deceased's intentions are honored.

Required documents

To successfully complete the transferring death form, several documents may be required. These typically include:

- Death certificate: Official proof of the individual's passing, often required to initiate the transfer process.

- Will or trust documents: If applicable, these documents outline the deceased's wishes regarding asset distribution.

- Identification of beneficiaries: Personal identification for all beneficiaries may be necessary to validate their claims to the assets.

- Asset documentation: Any relevant paperwork related to the assets being transferred, such as titles or deeds.

Examples of using the transferring death

The transferring death form can be utilized in various scenarios, including:

- Real estate transfers: When a property owner passes away, the form can facilitate the transfer of the property title to the designated beneficiaries.

- Bank account access: Beneficiaries may need to complete the form to gain access to the deceased's bank accounts and funds.

- Investment accounts: The form may be necessary to transfer ownership of stocks, bonds, or other investment assets to heirs.

State-specific rules for the transferring death

Each state in the U.S. has its own regulations governing the transferring death form. It is essential to understand these specific rules, as they can affect the validity of the form and the overall transfer process. For instance, some states may require additional documentation or specific language to be included in the form. Familiarizing oneself with local laws can help ensure compliance and avoid potential legal complications.

Quick guide on how to complete transferring death

Effortlessly prepare Transferring Death on any device

Digital document management has gained popularity among organizations and individuals. It offers a superior eco-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Transferring Death on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Transferring Death seamlessly

- Locate Transferring Death and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Transferring Death and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process of transferring death documents using airSlate SignNow?

Transferring death documents with airSlate SignNow is a straightforward process. You can easily upload the necessary files, eSign them, and share them with relevant parties. This efficient workflow ensures all necessary documentation for transferring death is handled securely and promptly.

-

How much does it cost to use airSlate SignNow for transferring death documents?

airSlate SignNow offers a variety of pricing plans designed to suit different business needs when transferring death documents. Our plans are highly competitive and often provide signNow savings compared to traditional methods of document handling. You can choose a plan based on your document volume and required features.

-

What features does airSlate SignNow provide for transferring death documents?

airSlate SignNow offers several features ideal for transferring death documents, including document templates, customizable workflows, and secure eSigning. These features ensure that your document management process is both efficient and compliant with legal standards. Additionally, our built-in tracking allows you to monitor the status of your documents.

-

Are there any benefits to using airSlate SignNow for transferring death documents?

Yes, using airSlate SignNow for transferring death documents provides numerous benefits, including increased efficiency and reduced turnaround times. Our platform ensures that documents are securely signed and easily shared, reducing the hassle often associated with traditional methods. This leads to a smoother experience during a sensitive time.

-

Can I integrate airSlate SignNow with other tools for transferring death documents?

Absolutely! airSlate SignNow can be seamlessly integrated with various third-party applications to enhance your workflow when transferring death documents. Whether you require integration with CRM systems or cloud storage solutions, our platform supports multiple integrations to meet your specific needs.

-

Is airSlate SignNow user-friendly for transferring death documents?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to transfer death documents without prior experience. Our platform features an intuitive interface that guides you through the process of document uploading, signing, and sharing. This simplicity is particularly valuable during challenging times.

-

What security measures are in place for transferring death documents with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when transferring death documents. We utilize advanced encryption, secure data storage, and compliance with industry standards, ensuring that your documents remain confidential and protected throughout the entire process. You can trust us to handle sensitive information safely.

Get more for Transferring Death

- Wwwpdffillercom418028869 form 1095 a is2017 form irs 1095 a fill online printable fillable blank

- 2021 form 4868 application for automatic extension of time to file us individual income tax return

- 2016 2021 form irs 8379 fill online printable fillable

- Who must file schedule se irs tax formswho must file schedule se irs tax formswho must file schedule se irs tax forms

- 2021 form 990 ez short form return of organization exempt from income tax

- Press releasesus department of the treasury form

- 2021 instructions for form 1099 div internal revenue service

- Wwwirsgovpubirs pdf20 internal revenue service department of the treasury form

Find out other Transferring Death

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed