Www Irs Govpubirs Pdf20 Internal Revenue Service Department of the Treasury 2021

What is form 8867?

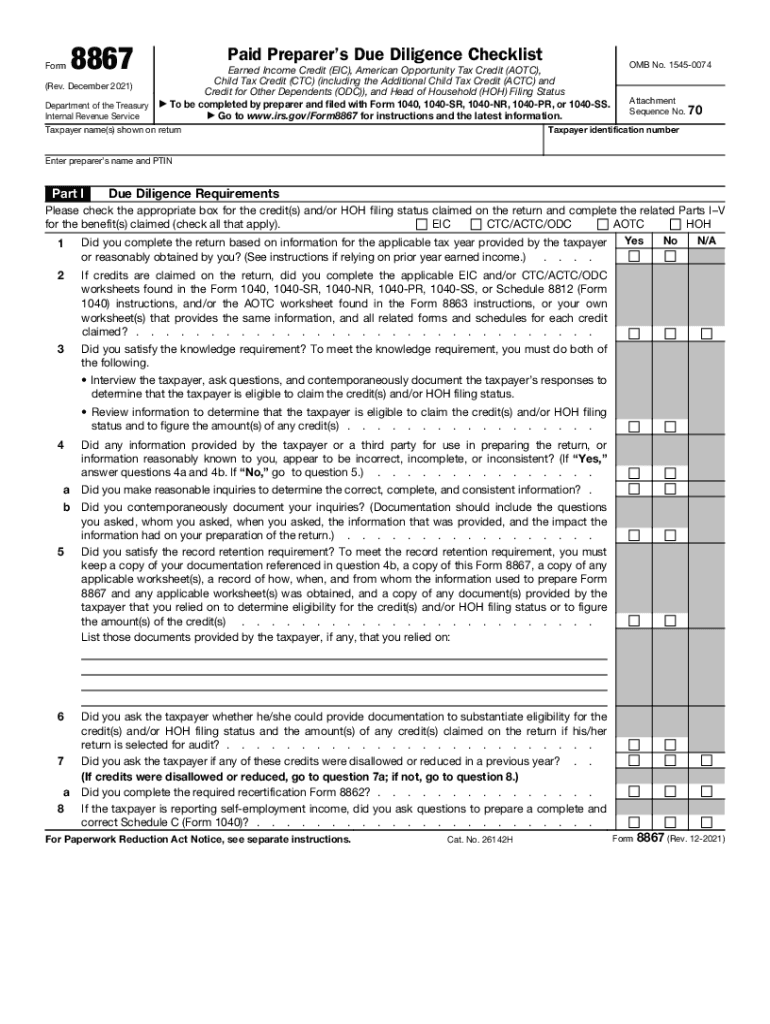

The IRS Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a crucial document used by tax professionals to ensure compliance when claiming the Earned Income Credit (EIC). This form is specifically designed to help preparers verify that the taxpayer meets all eligibility requirements for the EIC. By completing the 8867 form, tax preparers can demonstrate that they have conducted the necessary due diligence in assessing the taxpayer's qualifications for this valuable credit.

Eligibility criteria for the Earned Income Credit

To qualify for the Earned Income Credit, taxpayers must meet several criteria. These include having earned income from employment or self-employment, meeting specific income thresholds, and having a valid Social Security number. Additionally, taxpayers must be either a qualifying child or meet the age requirements if filing without a qualifying child. Understanding these eligibility criteria is essential for accurately filling out the form and ensuring compliance with IRS regulations.

Steps to complete the form 8867

Completing the form 8867 involves several key steps. First, the tax preparer must gather all relevant information from the taxpayer, including income details and Social Security numbers. Next, the preparer should review the taxpayer's eligibility for the Earned Income Credit by checking the requirements outlined in the IRS guidelines. After verifying eligibility, the preparer can fill out the form, ensuring that all sections are accurately completed. Finally, the form should be signed and submitted along with the taxpayer's tax return.

Legal use of form 8867

The legal use of form 8867 is essential for maintaining compliance with IRS regulations. Tax preparers are required to complete this form when claiming the Earned Income Credit to avoid penalties for non-compliance. Proper completion of the form not only protects the preparer but also ensures that the taxpayer receives the credits they are entitled to. Failure to use the form correctly can lead to audits and potential penalties, emphasizing the importance of understanding its legal implications.

Filing deadlines for form 8867

Filing deadlines for form 8867 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth, unless an extension is filed. It is important for tax preparers to be aware of these deadlines to ensure timely submission of the form along with the taxpayer's return. Missing these deadlines can result in delays in processing the return and potential penalties for both the preparer and the taxpayer.

Penalties for non-compliance

Tax preparers who fail to comply with the requirements of form 8867 may face significant penalties. The IRS imposes fines for each instance of non-compliance, which can accumulate quickly. Additionally, preparers may be subject to further scrutiny and audits, impacting their professional reputation. Understanding the potential penalties associated with improper use of form 8867 underscores the importance of diligence and accuracy in the tax preparation process.

Quick guide on how to complete wwwirsgovpubirs pdf20 internal revenue service department of the treasury

Prepare Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-conscious alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Handle Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury on any device with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury effortlessly

- Obtain Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf20 internal revenue service department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf20 internal revenue service department of the treasury

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

How to make an e-signature for a PDF on Android

People also ask

-

What is form 8867 and why is it important?

Form 8867 is the Earned Income Credit (EIC) eligibility checklist that tax preparers must complete to ensure compliance with IRS regulations. It's crucial for maximizing your client's refunds and avoiding penalties related to EIC claims.

-

How can airSlate SignNow assist with completing form 8867?

airSlate SignNow simplifies the process of preparing and signing form 8867 by providing intuitive tools for document management and eSignature collection. With our platform, you can easily share the form with clients for review and signature, ensuring compliance and accuracy.

-

Is airSlate SignNow cost-effective for small businesses handling form 8867?

Yes, airSlate SignNow offers a variety of pricing plans that cater to small businesses, providing an affordable solution for managing form 8867. Our plans ensure that you get the features needed without breaking your budget.

-

What features does airSlate SignNow offer for managing form 8867?

airSlate SignNow includes features like template creation, automated workflows, and real-time tracking that streamline the management of form 8867. These tools help save time and improve accuracy in the document submission process.

-

Can I integrate airSlate SignNow with other software for form 8867 processing?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your workflow for processing form 8867. This integration helps ensure all necessary forms are handled efficiently in one place.

-

What are the benefits of using airSlate SignNow for form 8867?

Using airSlate SignNow for form 8867 provides multiple benefits, including improved compliance, quicker turnaround times, and enhanced document security. Our platform ensures that all eSignatures are legally binding, giving you peace of mind.

-

What support does airSlate SignNow offer for form 8867 queries?

airSlate SignNow provides extensive support for users encountering questions about form 8867 and our services. Our knowledgeable customer service team is available to assist you with any inquiries, ensuring a smooth experience.

Get more for Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury

- Complex will with credit shelter marital trust for large estates hawaii form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497304555 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497304556 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497304557 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497304558 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective 497304559 form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497304560 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts where divorce 497304561 form

Find out other Www irs govpubirs pdf20 Internal Revenue Service Department Of The Treasury

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast