Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return 2021

What is the Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

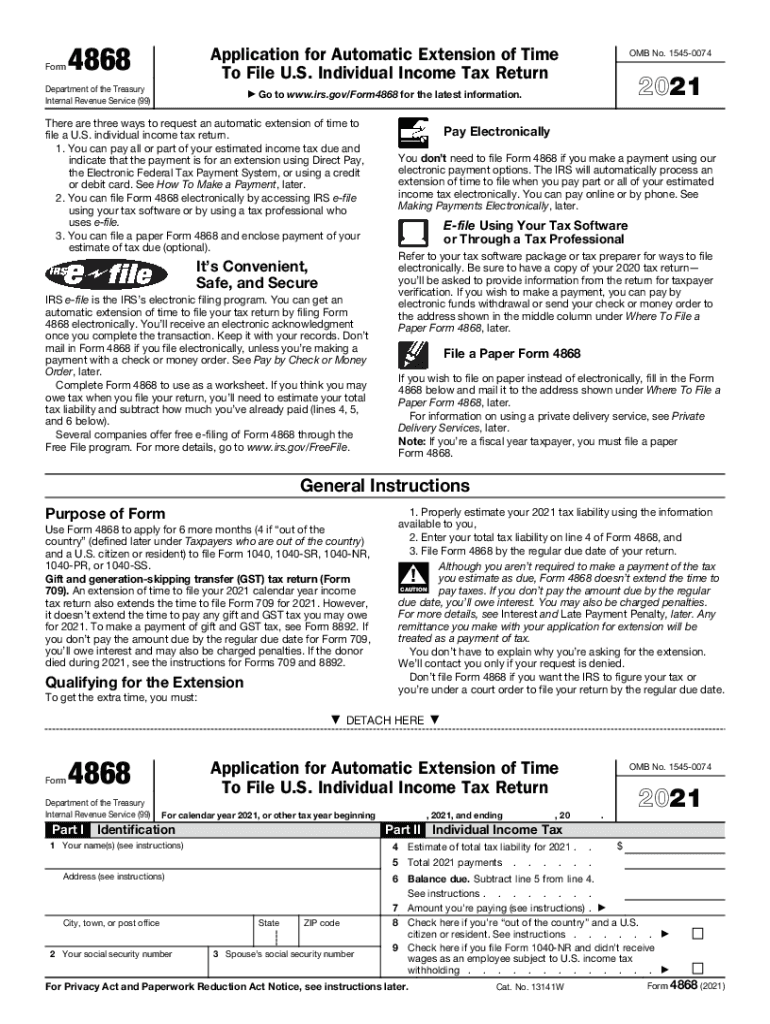

The Form 4868 is an official document used to request an automatic extension of time to file your U.S. individual income tax return. This form allows taxpayers to extend their filing deadline by six months, providing additional time to prepare their tax return without incurring penalties for late filing. It is important to note that while this form extends the time to file, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and pay any amount due by the original filing deadline to avoid interest and penalties.

Steps to Complete the Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

Completing the Form 4868 involves a few straightforward steps:

- Obtain the form: You can download the Form 4868 from the IRS website or access it through tax preparation software.

- Fill in your information: Provide your name, address, and Social Security number or Individual Taxpayer Identification Number.

- Estimate your tax liability: Calculate your expected tax due and enter this amount on the form.

- Determine your payment: If you owe taxes, include payment with your form to avoid penalties.

- Submit the form: File the completed form electronically or by mail before the original tax deadline.

Legal Use of the Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

The Form 4868 is legally recognized by the IRS as a valid request for an extension. To ensure compliance, taxpayers must follow the guidelines set forth by the IRS. This includes submitting the form on time and making any necessary payments. Failure to adhere to these requirements may result in penalties, including interest on unpaid taxes. It is essential to understand that the extension applies only to the filing of the tax return, not to the payment of taxes owed.

IRS Guidelines for Filing the Form 4868

The IRS provides specific guidelines for filing the Form 4868. Taxpayers should ensure that they:

- File the form by the original due date of their tax return.

- Provide accurate information to avoid delays in processing.

- Use the correct version of the form for the tax year in question.

- Keep a copy of the submitted form for their records.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the Form 4868 is crucial for compliance. The form must be filed by the regular tax return due date, which is typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline is extended to the next business day. The extended deadline to file your tax return, if the Form 4868 is approved, is usually October 15. Keeping track of these dates helps ensure that you remain compliant with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 4868:

- Online: Many tax preparation software programs allow for electronic filing of the Form 4868.

- By Mail: You can print the completed form and send it to the appropriate address based on your state of residence.

- In-Person: Some taxpayers may choose to deliver the form directly to their local IRS office, although this method is less common.

Quick guide on how to complete 2021 form 4868 application for automatic extension of time to file us individual income tax return

Complete Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without hindrances. Manage Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and electronically sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return with ease

- Find Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Decide how you wish to distribute your form, whether by email, SMS, sharing link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and electronically sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 4868 application for automatic extension of time to file us individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 4868 application for automatic extension of time to file us individual income tax return

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how can it help me file IRS documents?

airSlate SignNow is a powerful eSignature platform that allows businesses to send and sign documents securely. By using airSlate SignNow, you can easily file IRS documents electronically, ensuring compliance and speeding up the submission process.

-

Is there a cost associated with using airSlate SignNow to file IRS forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. The cost of using airSlate SignNow to file IRS forms is cost-effective compared to traditional methods, potentially saving you both time and money.

-

What features does airSlate SignNow offer for filing IRS documents?

airSlate SignNow provides various features such as customizable templates, document tracking, and secure eSigning, all of which facilitate the filing of IRS documents. These features help streamline your workflow, making it easier to manage taxes and compliance.

-

Can I integrate airSlate SignNow with other software when filing IRS forms?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Workspace, Salesforce, and Zapier, allowing you to create an efficient process for filing IRS forms. These integrations enhance productivity and help maintain all your tax-related documents in one place.

-

Is airSlate SignNow secure for filing sensitive IRS documents?

Yes, airSlate SignNow employs advanced security measures, including encryption and access controls, to protect your sensitive IRS documents. You can confidently file IRS forms knowing that your information is secure throughout the process.

-

How easy is it to use airSlate SignNow to file IRS documents?

Using airSlate SignNow to file IRS documents is incredibly user-friendly. With its intuitive interface, you can quickly prepare, send, and sign required forms, enabling you to focus on your core business activities without the hassle of complicated processes.

-

Are there any templates available for filing IRS forms in airSlate SignNow?

Yes, airSlate SignNow offers a variety of customizable templates specifically designed for filing IRS forms. These templates can help you save time and ensure you include all necessary information when preparing your submissions.

Get more for Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- Inventory and condition of leased premises for pre lease and post lease hawaii form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out hawaii form

- Property manager agreement hawaii form

- Agreement for delayed or partial rent payments hawaii form

- Tenants maintenance repair request form hawaii

- Guaranty attachment to lease for guarantor or cosigner hawaii form

- Hi lease 497304509 form

- Warning notice due to complaint from neighbors hawaii form

Find out other Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement