Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms 2021

Who must file the self employed tax form?

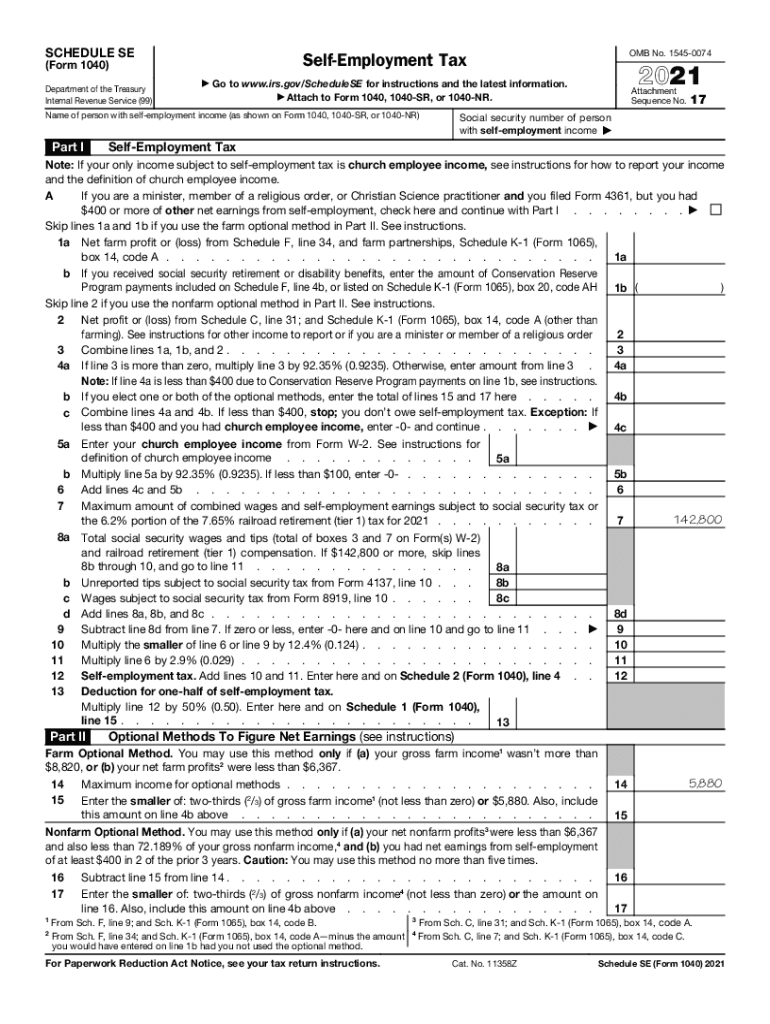

The self employed tax form, specifically the IRS Schedule SE, is designed for individuals who earn income from self-employment. This includes freelancers, independent contractors, and small business owners. If your net earnings from self-employment are $400 or more, you are required to file this form. Additionally, if you are a church employee or receive income from certain partnerships, you may also need to complete Schedule SE. Understanding who qualifies is crucial for compliance with IRS regulations.

Steps to complete the self employed tax form

Completing the self employed tax form involves several key steps:

- Gather your income information: Collect all records of your self-employment income, including invoices and receipts.

- Calculate your net earnings: Subtract your business expenses from your total income to determine your net earnings.

- Fill out Schedule SE: Enter your net earnings on the form, following the instructions carefully to ensure accuracy.

- Transfer information to your main tax return: The figures from Schedule SE will need to be reported on your Form 1040.

Completing these steps accurately is essential to avoid potential penalties and ensure proper reporting of your self-employment income.

Required documents for filing

When preparing to file the self employed tax form, you will need several important documents:

- Records of all self-employment income, including 1099 forms and invoices.

- Documentation of business expenses, such as receipts and bank statements.

- Previous year's tax return, which can provide useful reference information.

- Any relevant identification numbers, such as your Social Security Number or Employer Identification Number (EIN).

Having these documents organized will streamline the filing process and help ensure that you report your income accurately.

Filing deadlines for the self employed tax form

It is important to be aware of the filing deadlines associated with the self employed tax form. Typically, the deadline for filing your federal income tax return, including Schedule SE, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for non-compliance

Failing to file the self employed tax form or not paying the required taxes can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid tax for each month your return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes from the due date until the tax is paid in full. Understanding these potential penalties emphasizes the importance of timely and accurate filing.

Digital vs. paper version of the self employed tax form

When it comes to filing the self employed tax form, you have the option to submit it digitally or via paper. Filing electronically is often faster and more efficient, allowing for quicker processing and confirmation of receipt. Many tax software programs can guide you through the process and help ensure accuracy. On the other hand, if you prefer to file by mail, ensure that you send your forms to the correct address and consider using certified mail for tracking purposes. Both methods are valid, but choosing the right one depends on your personal preference and comfort level with technology.

Quick guide on how to complete who must file schedule se irs tax formswho must file schedule se irs tax formswho must file schedule se irs tax forms

Effortlessly Prepare Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms with Ease

- Locate Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct who must file schedule se irs tax formswho must file schedule se irs tax formswho must file schedule se irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the who must file schedule se irs tax formswho must file schedule se irs tax formswho must file schedule se irs tax forms

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a self employed tax form?

A self employed tax form is a specific document used by individuals who work for themselves to report their income and calculate taxes owed to the government. This form helps self-employed individuals accurately track their earnings and deductions, ensuring compliance with tax regulations.

-

How does airSlate SignNow help with self employed tax forms?

airSlate SignNow facilitates the process of completing and signing self employed tax forms digitally. With our platform, you can easily upload, edit, and securely eSign your tax documents, which streamlines your filing process and saves time.

-

What features does SignNow offer for self employed individuals?

SignNow offers features tailored for self employed individuals, such as document templates, collaborative editing, and secure cloud storage. These features ensure that your self employed tax forms are easily accessible and can be completed efficiently with minimal hassle.

-

Is there a cost associated with using SignNow for self employed tax forms?

Yes, there is a cost to using SignNow, but it is designed to be a cost-effective solution for self employed individuals. Various pricing plans are available, allowing you to choose one that best suits your needs and budget while ensuring you can manage your self employed tax forms effectively.

-

Can I store my self employed tax forms in SignNow?

Absolutely! SignNow provides a secure cloud storage solution for your self employed tax forms and other important documents. This means you can easily access and manage your files from anywhere, helping you stay organized and prepared during tax season.

-

Does SignNow integrate with accounting software for self employed tax forms?

Yes, SignNow integrates with various accounting software platforms, making it easier for self employed individuals to manage their finances. By linking your accounting tools with SignNow, you can streamline the process of handling self employed tax forms and ensure accurate record-keeping.

-

What are the benefits of using SignNow for my self employed tax form?

Using SignNow for your self employed tax form offers several benefits, including time savings, improved organization, and enhanced security. The platform allows for quick eSigning and document management, making the tax filing process smoother and more efficient for self employed individuals.

Get more for Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms

- Residential rental lease agreement hawaii form

- Hawaii tenant 497304520 form

- Warning of default on commercial lease hawaii form

- Warning of default on residential lease hawaii form

- Landlord tenant closing statement to reconcile security deposit hawaii form

- Hi name change form

- Name change notification form hawaii

- Commercial building or space lease hawaii form

Find out other Who Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax FormsWho Must File Schedule SE IRS Tax Forms

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later