Form 990 EZ Short Form Return of Organization Exempt from Income Tax 2021

What is the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

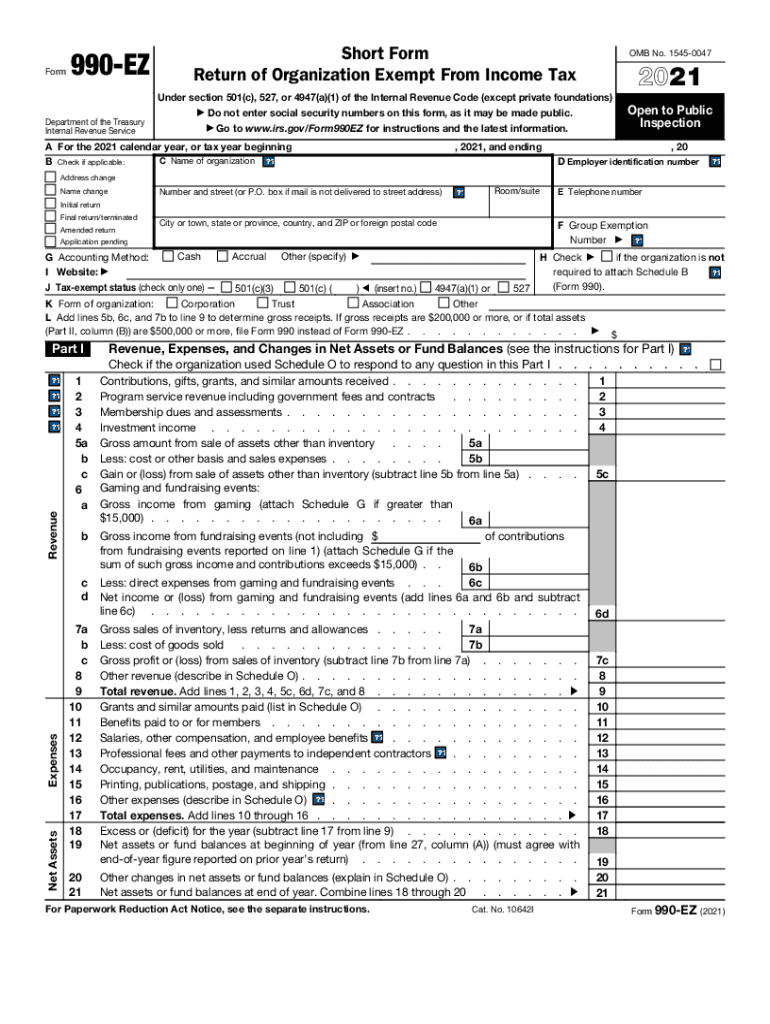

The Form 990 EZ is a simplified version of the standard Form 990, designed for organizations that are exempt from income tax under section 501(c) of the Internal Revenue Code. This form is primarily used by small to mid-sized tax-exempt organizations, such as charities and nonprofits, to report their financial information to the IRS. By using Form 990 EZ, organizations can provide essential details about their revenue, expenses, and activities while benefiting from a streamlined reporting process.

Key elements of the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

The Form 990 EZ includes several critical components that organizations must complete to ensure compliance with IRS requirements. Key elements include:

- Basic Information: This section captures the organization's name, address, and Employer Identification Number (EIN).

- Financial Data: Organizations must report their total revenue, expenses, and changes in net assets, providing a clear picture of their financial health.

- Program Service Accomplishments: This section highlights the organization's mission and significant activities, demonstrating how funds are utilized to further their objectives.

- Governance: Organizations must disclose information about their governing body and policies, ensuring transparency and accountability.

Steps to complete the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

Completing the Form 990 EZ involves several straightforward steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and expense reports.

- Fill Out the Form: Carefully complete each section of the form, ensuring accuracy in reporting financial data and organizational activities.

- Review for Accuracy: Double-check all entries for errors or omissions, as inaccuracies can lead to penalties or compliance issues.

- Submit the Form: File the completed Form 990 EZ with the IRS by the designated deadline, either electronically or via mail.

Legal use of the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

The Form 990 EZ serves as a legally binding document that provides transparency and accountability for tax-exempt organizations. It must be filed annually to maintain tax-exempt status and comply with federal regulations. Organizations that fail to file this form may face penalties, including loss of tax-exempt status. It is essential for organizations to understand the legal implications of their reporting and ensure compliance with all IRS guidelines.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Form 990 EZ to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if an organization's fiscal year ends on December thirty-first, the Form 990 EZ must be filed by May fifteenth of the following year. Organizations can apply for an extension if necessary, but they must ensure that any extension request is submitted on time to avoid late filing penalties.

Eligibility Criteria

To use the Form 990 EZ, organizations must meet certain eligibility criteria. Primarily, the organization must have gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars at the end of the tax year. Additionally, organizations must be classified as tax-exempt under section 501(c) of the Internal Revenue Code. Nonprofits that exceed these thresholds are required to file the standard Form 990 instead.

Quick guide on how to complete 2021 form 990 ez short form return of organization exempt from income tax

Complete Form 990 EZ Short Form Return Of Organization Exempt From Income Tax effortlessly on any device

Digital document management has become widely embraced by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 990 EZ Short Form Return Of Organization Exempt From Income Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax with ease

- Obtain Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 990 ez short form return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 990 ez short form return of organization exempt from income tax

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the 990 ez form, and how can airSlate SignNow help me with it?

The 990 ez form is a simplified version of the IRS Form 990, designed for smaller tax-exempt organizations. With airSlate SignNow, you can easily eSign and send your 990 ez form securely, ensuring compliance and saving time in your filing process.

-

What features does airSlate SignNow offer for managing the 990 ez form?

airSlate SignNow offers features like document templates, eSigning, and secure storage specifically for forms like the 990 ez. These tools streamline the process, allowing you to focus on completing your filings without hassle.

-

How much does airSlate SignNow cost for filing a 990 ez?

airSlate SignNow offers competitive pricing plans tailored to suit various needs, including the filing of the 990 ez form. By subscribing to one of our plans, you gain access to unlimited eSigning, templates, and secure document management.

-

Is using airSlate SignNow for the 990 ez form secure?

Yes, airSlate SignNow prioritizes security with features like encryption and secure cloud storage for your documents, including the 990 ez form. We comply with industry standards to keep your sensitive information protected.

-

Can I integrate airSlate SignNow with other applications to handle my 990 ez efficiently?

Absolutely! airSlate SignNow offers integrations with various business applications that can help streamline your processes for managing the 990 ez form. Whether it’s syncing with your accounting software or CRM, we make it easy to incorporate eSigning into your workflow.

-

What are the benefits of using airSlate SignNow for my 990 ez filing?

Using airSlate SignNow for your 990 ez filing provides a user-friendly experience, saves time with easy eSigning, and ensures compliance. This cost-effective solution allows you to handle paperwork efficiently, facilitated by powerful automation tools.

-

Can I access my signed 990 ez form anytime with airSlate SignNow?

Yes, once you sign the 990 ez form using airSlate SignNow, it is stored securely in your account. You can access it anytime, giving you flexibility and peace of mind regarding your important documents.

Get more for Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- Hawaii relative caretaker legal documents package hawaii form

- Hawaii standby temporary guardian legal documents package hawaii form

- Affidavit of surviving spouse or joint survivor hawaii form

- Hawaii bankruptcy form

- Bill of sale with warranty by individual seller hawaii form

- Bill of sale with warranty for corporate seller hawaii form

- Bill of sale without warranty by individual seller hawaii form

- Bill of sale without warranty by corporate seller hawaii form

Find out other Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist