Vermont Executor Form

What is the Vermont Executor

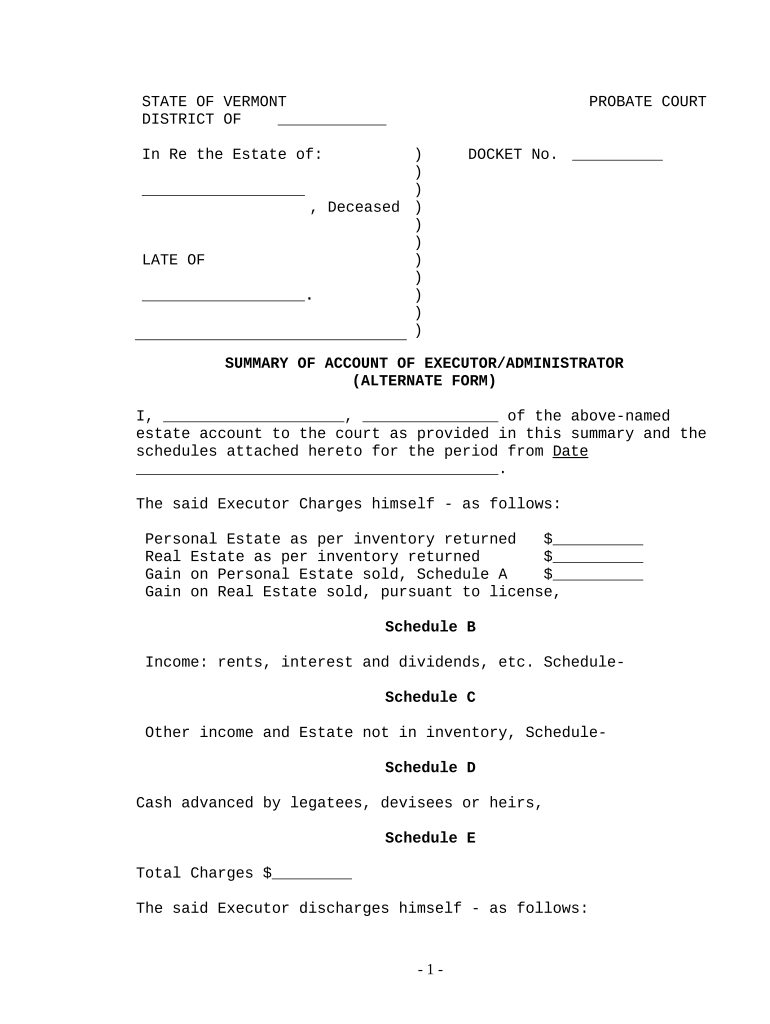

The Vermont executor is a legal document that designates an individual or entity responsible for managing the estate of a deceased person. This role includes settling debts, distributing assets, and ensuring that the decedent's wishes are honored as outlined in their will. The executor must navigate various legal obligations and may need to interact with the probate court to validate the will and initiate the estate settlement process.

How to use the Vermont Executor

Using the Vermont executor form involves several steps to ensure compliance with state laws. First, the designated executor must gather all necessary information about the deceased's assets and debts. Next, they should complete the executor form accurately, providing details such as the decedent's name, date of death, and information about the estate. Once completed, the form must be submitted to the appropriate probate court in Vermont for approval.

Steps to complete the Vermont Executor

Completing the Vermont executor form requires careful attention to detail. Here are the essential steps:

- Gather the decedent's financial documents, including bank statements, property deeds, and insurance policies.

- Fill out the executor form with accurate information about the decedent and their estate.

- Sign the form in the presence of a notary public to ensure its validity.

- Submit the completed form to the probate court along with any required supporting documents.

Legal use of the Vermont Executor

The legal use of the Vermont executor form is crucial for ensuring that the estate is handled according to the law. This document must comply with Vermont probate laws, which dictate how estates are managed and distributed. Proper execution of the form helps prevent disputes among beneficiaries and ensures that the executor can legally act on behalf of the estate.

Key elements of the Vermont Executor

Several key elements must be included in the Vermont executor form to make it legally binding. These elements typically include:

- The full name and address of the executor.

- The name of the deceased individual and their date of death.

- A statement of the executor's acceptance of the role.

- Details about the estate, including a list of assets and liabilities.

State-specific rules for the Vermont Executor

Vermont has specific rules governing the use of the executor form, which include deadlines for filing and requirements for notifying beneficiaries. Executors must adhere to these regulations to avoid penalties and ensure a smooth probate process. Understanding these state-specific rules is essential for anyone taking on the role of an executor in Vermont.

Quick guide on how to complete vermont executor

Accomplish Vermont Executor seamlessly on any device

Digital document handling has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without complications. Manage Vermont Executor on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Vermont Executor effortlessly

- Locate Vermont Executor and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to secure your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements with just a few clicks from any device you prefer. Alter and electronically sign Vermont Executor to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Vermont executor and what are their responsibilities?

A Vermont executor is an individual appointed to manage the estate of a deceased person. Their responsibilities include ensuring all debts are paid, assets are distributed according to the will, and necessary documents are filed with the Vermont probate court. Utilizing airSlate SignNow can streamline document signing for various responsibilities an executor faces.

-

How can airSlate SignNow assist a Vermont executor in document management?

airSlate SignNow offers a seamless platform for Vermont executors to manage and sign important legal documents securely. By enabling electronic signatures, it eliminates the hassle of paper-based processes, making it convenient for an executor to execute the last will or any estate-related documents efficiently.

-

What are the pricing options for airSlate SignNow for Vermont executors?

airSlate SignNow offers flexible pricing options tailored for different needs, including plans suitable for Vermont executors. These plans cater to varied budgets while ensuring you have access to essential features like document storage, collaboration, and eSignature capabilities, all designed to simplify the management of estate documentation.

-

Are there any integrations available for Vermont executors using airSlate SignNow?

Yes, airSlate SignNow provides various integrations that are highly beneficial for Vermont executors. You can easily integrate with popular applications like Google Drive, Dropbox, and others to streamline the document-sharing process. This flexibility allows executors to manage assets and relevant documentation more efficiently.

-

What are the key features of airSlate SignNow that benefit Vermont executors?

Key features of airSlate SignNow that benefit Vermont executors include secure electronic signatures, document templates, and cloud-based storage. These features help executors manage documents securely while ensuring compliance with legal standards. Furthermore, the platform simplifies collaboration with family members or legal advisors.

-

How does airSlate SignNow ensure the security of documents for Vermont executors?

AirSlate SignNow employs advanced security measures including encryption and two-factor authentication to protect documents for Vermont executors. These protocols ensure that sensitive information related to an estate is kept safe from unauthorized access, thus providing peace of mind during the probate process.

-

Can a Vermont executor use airSlate SignNow for multiple estate management?

Absolutely! A Vermont executor can utilize airSlate SignNow for managing multiple estates seamlessly. The platform allows for the creation and storage of various document templates, making it easier to handle different cases without confusion, enhancing overall efficiency in the estate management process.

Get more for Vermont Executor

Find out other Vermont Executor

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself